CLIFFS NATURAL RESOURCES

2012 ANALYST AND INVESTOR DAY

Exhibit 99.1 |

CLIFFS NATURAL RESOURCES

2012 ANALYST AND INVESTOR DAY

Exhibit 99.1 |

2012 Analyst & Investor Day

“SAFE HARBOR”

STATEMENT UNDER THE PRIVATE SECURITIES LITIGATION

REFORM ACT OF 1995

2

This presentation and accompanying oral remarks contain statements that constitute

“forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-

looking statements may be identified by the use of predictive, future-tense or forward-looking

terminology, such as “believes,” “anticipates,” “expects,” “estimates,” “intends,” “may,” “will” or similar terms. These

statements speak only as of the date of this presentation and we undertake no ongoing obligation, other

than that imposed by law, to update these statements. These statements appear in a number of places

in this presentation and relate to our intent, belief or current expectations of our directors or our

officers with respect to: our future financial condition, results of operations or prospects; estimates of our

economic iron ore and coal reserves; our business and growth strategies; and our financing plans and

forecasts. You are cautioned that any such forward-looking statements are not guarantees of future

performance and involve significant risks and uncertainties, and that actual results may differ

materially from those contained in or implied by the forward-looking statements as a result of various factors, some

of which are unknown, including, without limitation:

• the ability to successfully integrate acquired companies into our operations;

• uncertainty or weaknesses in global and/or market economic conditions, including any

related impact on prices; • trends affecting our financial condition, results of operations or future prospects;

• the ability to reach agreement with our iron ore customers regarding modifications

to sales contract pricing escalation provisions to reflect a shorter-term or spot-base pricing mechanism;

• the outcome of any contractual disputes with our customers or significant energy,

material or service providers; • the outcome of any arbitration or litigation;

• changes in sales volume or mix;

• the impact of price-adjustment factors on our sales contracts;

• the ability of our customers to meet their obligations to us on a timely basis or at

all; • our actual economic ore reserves or reductions in current resource estimates;

• the success of our business and growth strategies;

• our ability to successfully identify and consummate any strategic investments;

• our ability to achieve post-acquisition synergies;

• events or circumstances that could impair or adversely impact the viability of a

mine and the carrying value of associated assets; • the results of pre-feasibility and feasibility studies in relation to projects;

• impacts of increasing governmental regulation including failure to receive or

maintain required environmental permits, approvals, modifications or other authorization of, or from, any governmental

or regulatory entity;

• adverse changes in currency values, currency exchange rates and interest rates;

• the success of our cost-savings efforts;

• our ability to maintain adequate liquidity and successfully implement our financing

plans; • our ability to maintain appropriate relations with unions and employees;

• uncertainties associated with unanticipated geological conditions, natural

disasters, weather conditions, supply and price of energy, equipment failures and other unexpected events;

• risks related to international operations;

• the potential existence of significant deficiencies or material weakness in our

internal control over financial reporting; and • the risk factors referred to or described in the “Risk Factors” section of

our documents filed with the Securities and Exchange Commission.

Reference is made to the detailed explanation of the many factors and risks that may cause such

predictive statements to turn out differently, set forth in the Company's Annual Report and Reports on Form

10-K, Form 10-Q and previous documents filed with the Securities and Exchange Commission, which

are publicly available on Cliffs Natural Resources Inc.’s website. The information contained in this

document speaks as of today and may be superseded by subsequent events.

We caution you that the foregoing list of important factors is not exclusive. In addition, in light of

these risks and uncertainties, the matters referred to in our forward-looking statements may not occur. We

undertake no obligation to publicly update or revise any forward-looking statement as a result of

new information, future events or otherwise, except as may be required by law. We also strongly urge you to not

rely on any single financial measure to evaluate our business.

|

2012 Analyst & Investor Day

1:00pm –

1:20pm

Macro Overview and Cliffs in Canada

J. Carrabba

1:20pm –

1:50pm

Total Shareholder Return and Bloom Lake Financials

L. Brlas

1:50pm –

2:10pm

Bloom Lake Optimization and Operations

D. Blake

2:10pm –

2:35pm

Q&A and Break

2:35pm –

2:50pm

Global Exploration

C. Smith

2:50pm –

3:30pm

Building a World Class Chrome Business

B. Boor

3:30pm –

4:00pm

Closing and Q&A

J. Carrabba

TODAY’S AGENDA

3 |

CLIFFS NATURAL RESOURCES

JOE CARRABBA |

2012 Analyst & Investor Day

5

5

Building scale through diversification

•

Multiple Revenue Streams

•

Product Diversification

•

Geographic Presence

Operational excellence

•

Safety

•

Technical Competencies

•

Operating Efficiencies

Global execution

•

Competencies of the Firm

•

Outlook of Personnel

•

Global Scalability

Shareholder returns

•

Shareholder Value

•

Risk Management

•

“Earning the Right to Grow”

OUR STRATEGIC IMPERATIVES REMAIN THE SAME |

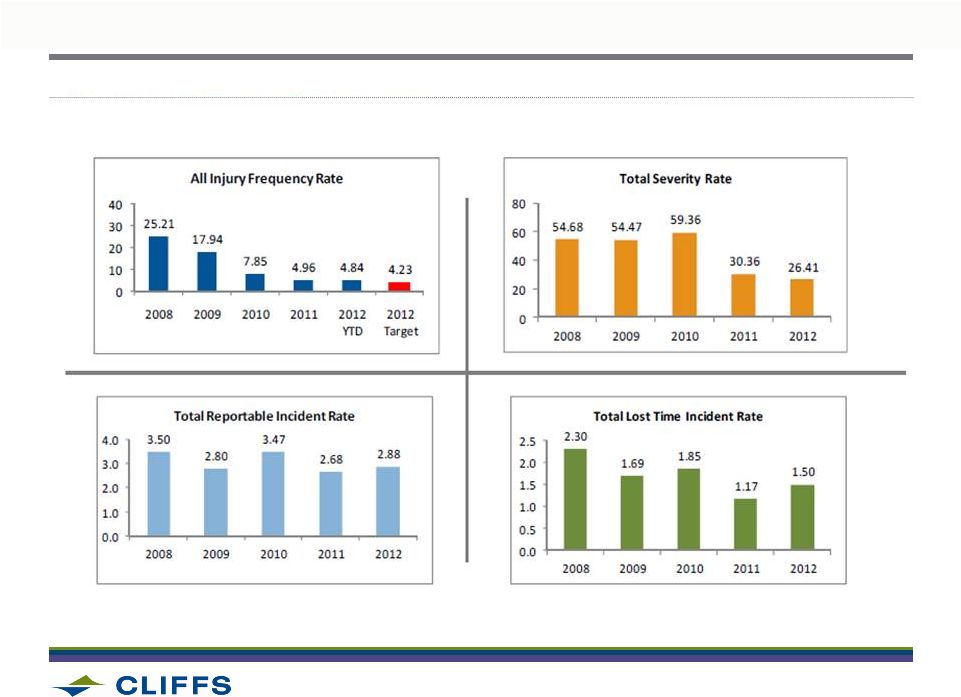

2012 Analyst & Investor Day

SAFETY

6 |

2012 Analyst & Investor Day

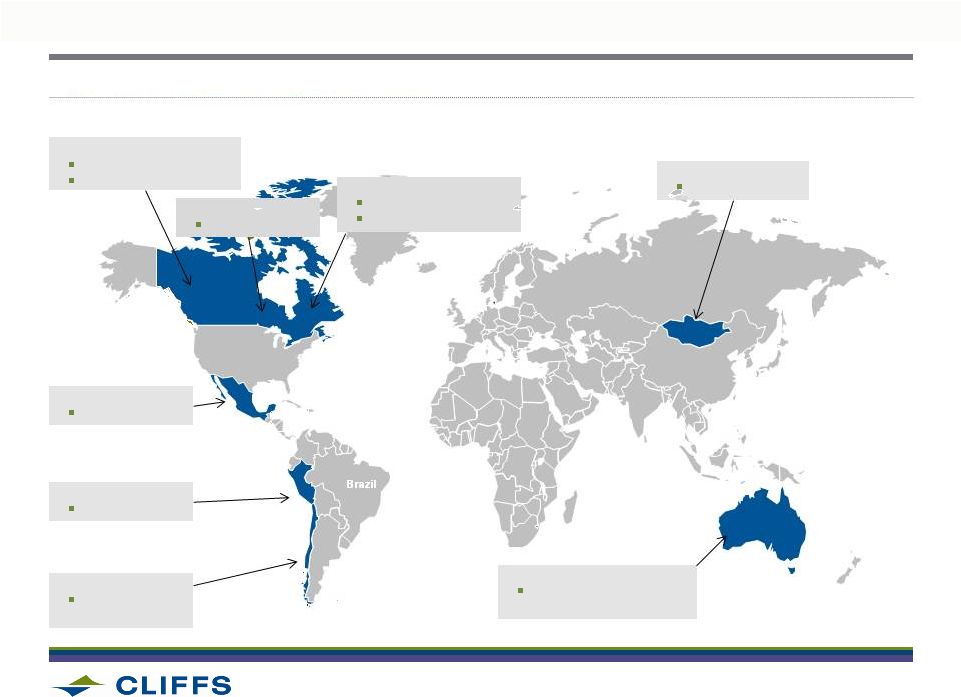

CLIFFS IS A MORE MATURE, DYNAMIC AND SOPHISTICATED COMPANY IN 2012

•

International mining and natural resources company, member of

the S&P 500

•

Diverse, global footprint with major operations in the Upper Midwest and

Appalachian United States, Eastern Canada and Western Australia

•

Developing an advanced pipeline of organic growth opportunities

•

Information, Human Capital and Talent Management systems consistent

with S&P 500-level organization

•

Transitioning to more rigorous and methodical economic value-based

management

7 |

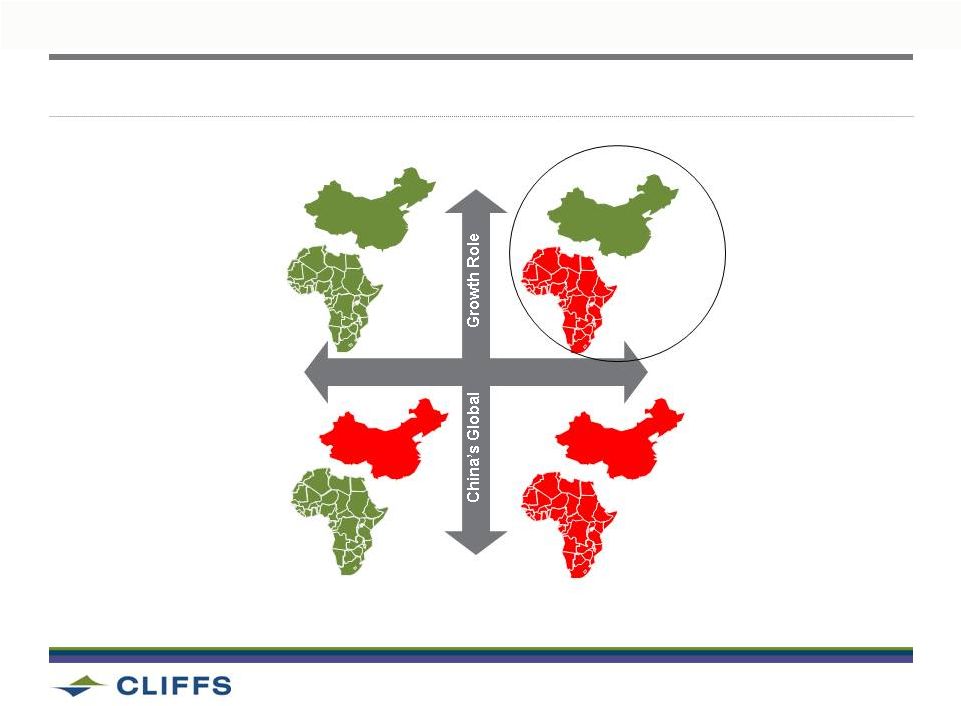

MEGATRENDS: CHINA WILL KEEP GROWING, AFRICAN SUPPLY WILL CONTINUE

TO FACE BARRIERS

INCREMENTAL CHANGE

New

Sources Of Supply

STRUCTURAL SHIFT

SMOOTH

TRANSITION

VOLATILE

EVOLUTION

8

2012 Analyst & Investor Day |

2012 Analyst & Investor Day

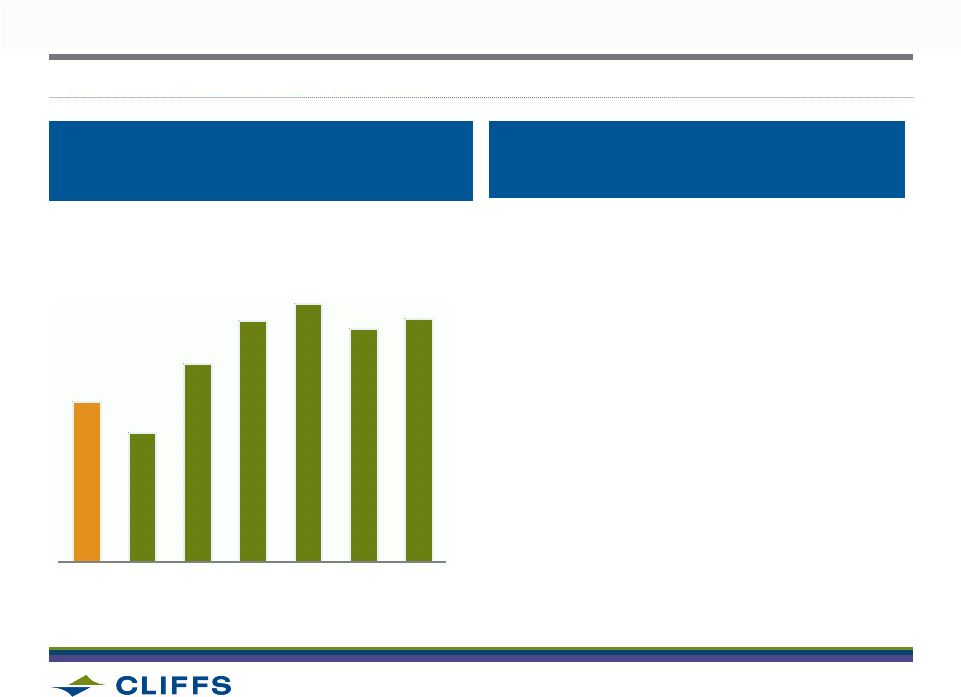

2012 CHINA CRUDE STEEL PRODUCTION GROWING BUT VOLATILE

ANNUALIZED 2012 CHINESE STEEL

PRODUCTION

BY MONTH (MILLION METRIC TONS)

JANUARY

Slow Construction Sector in China Weighs

on Steel Demand

FEBRUARY

Global Steel Production up in February

as China Switches On

MAY

Crude Steel Output Drops in May

JUNE

China’s $23 Billion Steel Push Seen

Igniting Iron Ore

SAMPLE OF CORRESPONDING MEDIA

HEADLINES

(JANUARY

–

JUNE)

Source: Cliffs, National Bureau of Statistics, Bloomberg

9

683

667

703

725

734

721

726

2011

Actual

January

February

March

April

May

June |

2012 Analyst & Investor Day

ENVIRONMENT IN CHINA IS DYNAMIC, FULL OF CONTRADICTION

•

Fundamentals remain strong; property market

crackdown now a year old –

inflation in check

•

The People’s Bank of China reserve requirement

and interest rate cuts positioning economy for

accelerated second half growth

•

China Iron and Steel Association (CISA),

representing 80 State-owned enterprise mills,

continues to message negatively…

•

…

while 2 mills with 10 million tons of capacity

approved (Baosteel and Wuhan) in Southern China

10 |

2012 Analyst & Investor Day

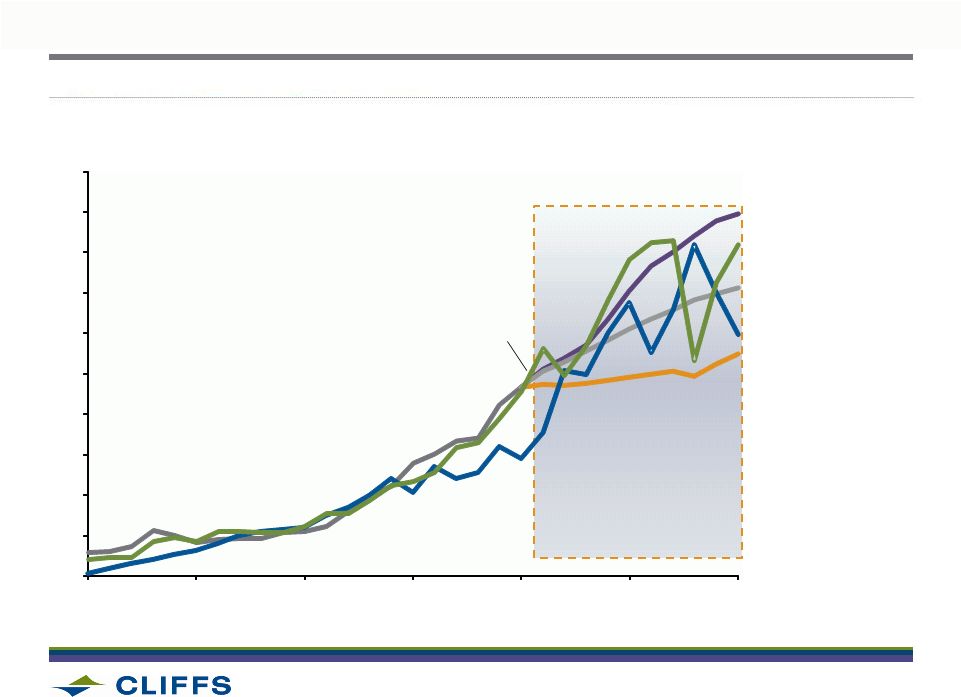

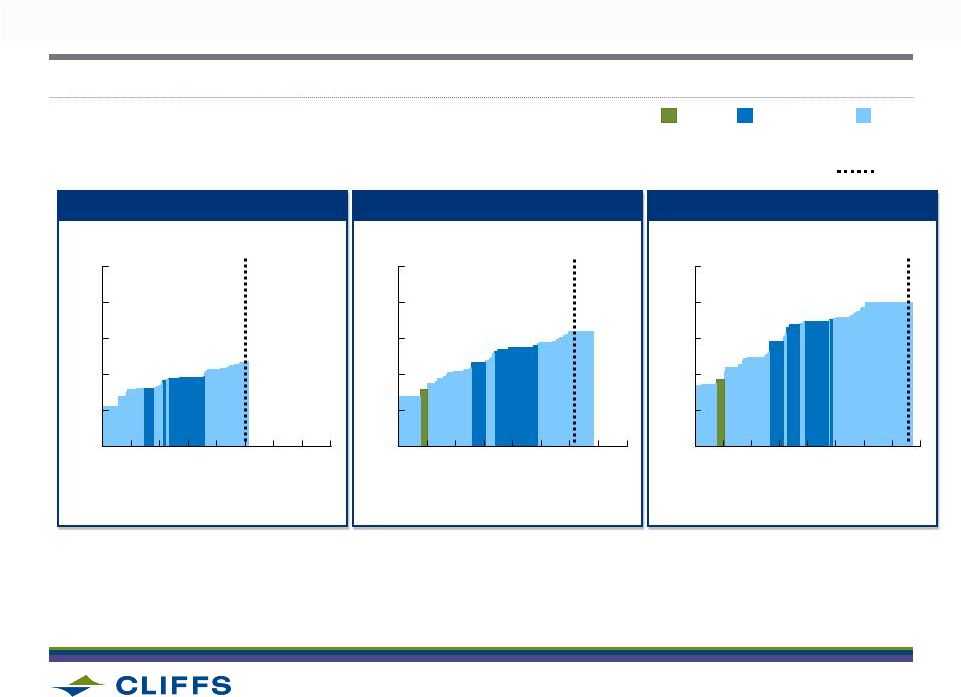

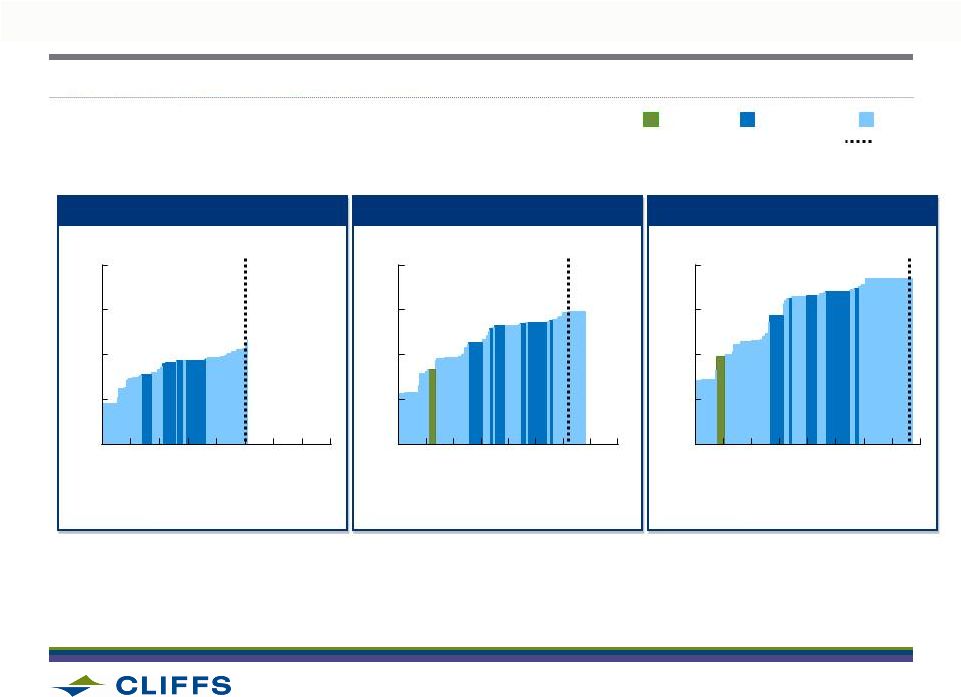

PAST INDUSTRIALIZATION PATTERNS SHOWS CHINA VOLATILITY IMMINENT

Source: The World Bank; Global Insights; National Bureau of Statistics China; ISI

Emerging Markets; Japanese Statistics Bureau Japan (1945-1985)

China –

Base Case

China –

Low Scenario

China –

High Scenario

South Korea (1970-2006)

China actual

FOCUS OF

CLIFFS’

STRATEGY

11

0

100

200

300

400

500

600

700

800

900

1,000

1990

1995

2000

2005

2010

2015

2020

STEEL

CONSUMPTION

PER

PERSON

(kg) |

2012 Analyst & Investor Day

OVERVIEW –

GLOBAL IRON ORE SUPPLY

•

The Big 4 are committed to short-term, large scale expansions of about 500mtpa

in total •

In addition, they are close to decisions on further expansions of over 500mtpa in

total •

Miners outside of the Big 4 have matched the Big 4’s expansion rates to date,

but may struggle in the future due to capital, industry and quality

constraints •

Structural issues will make it very difficult for China to expand production

domestically •

India’s near-term impact on the global iron ore market will likely be

small •

Significant growth of West African exports is contingent upon the construction of

high- capacity deep water ports and uncertainty of capital and sovereign

risk Note:

India’s

impact

of

seaborne

market

expected

to

be

+/-

60mtpa

i.e.

a

smaller

impact

than

a

single

major

project

for

any

one

of

the

‘Big

4’

12 |

2012 Analyst & Investor Day

OPPOSING FORCES IMPACTING SUPPLY EXPANSIONS

FORCES SUPPORTING

SUPPLY RESPONSE

•

Window of high prices encourages

accelerated expansions and

new entrants

FORCES HINDERING

SUPPLY RESPONSE

•

Government approvals more stringent

and more time intensive

•

Investors and boards pressure to return

capital as cycle wanes

•

Operations are becoming increasingly

complex, and necessary logistics and

skills availability is tight

•

As scale increases, capacity

replenishment increasingly difficult

13 |

2012 Analyst & Investor Day

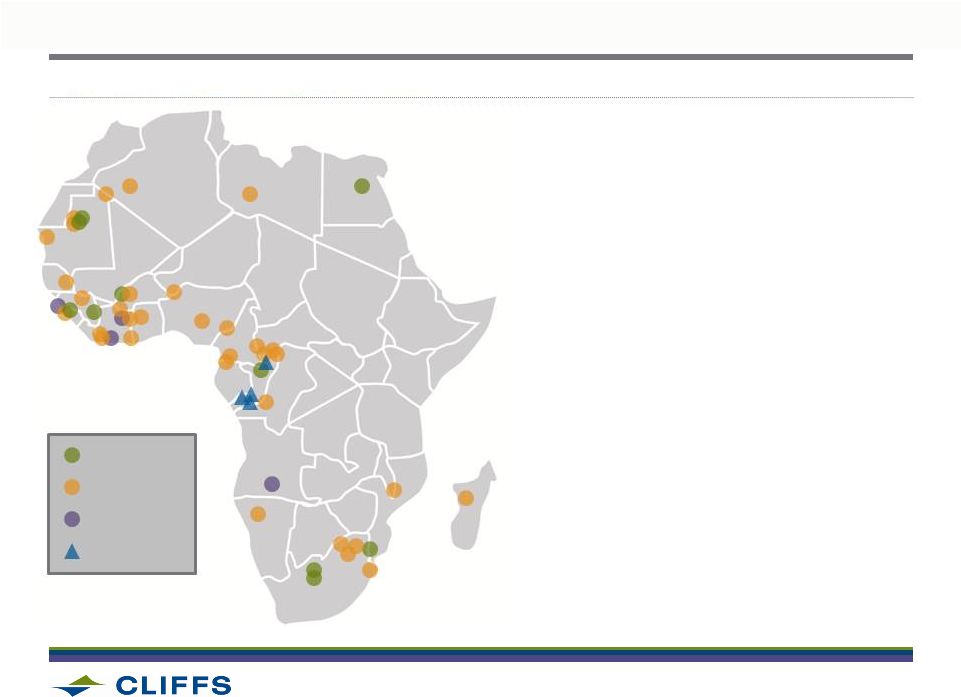

MONITORING MINING DEVELOPMENTS IN AFRICA

Source:

Global

Iron

Ore

-

Intierra,

AME

Iron

Ore

Outlook

•

Many deposits and prospects but little

meaningful supply online

•

Lack of deep water ports, rail or required

stability of political environments

•

Most likely project, Simandou, would have

first production in 2015

•

In 2011, Africa only produced about

80 million tons of iron ore

14

Active Mine

Deposit

Project

Closed Mine |

2012 Analyst & Investor Day

Other 3%

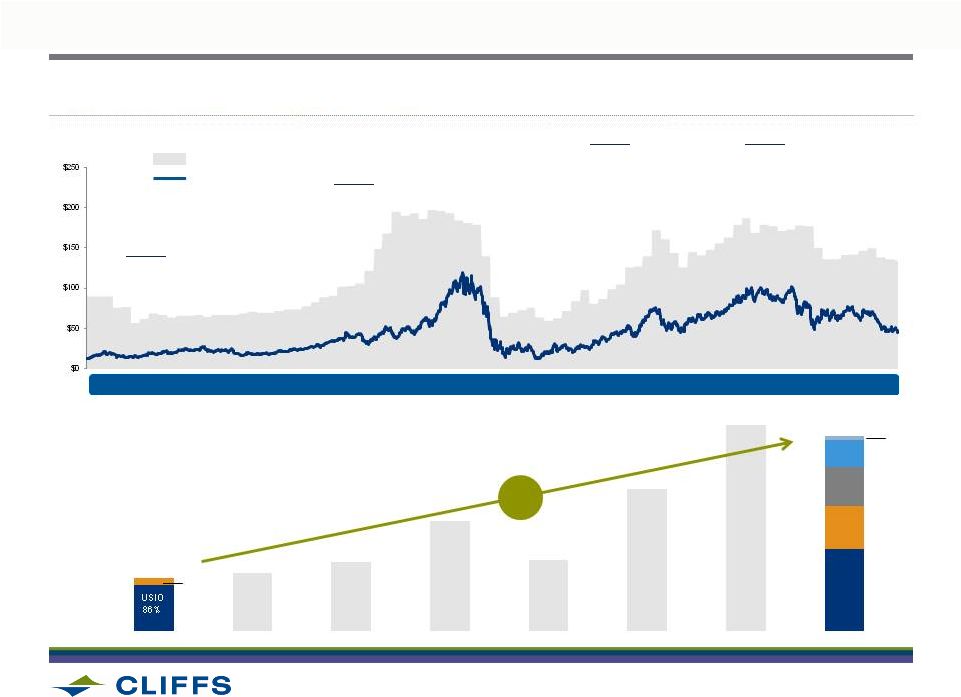

SINCE 2005 WE HAVE MAINTAINED OUR LONG-TERM STRATEGY THROUGH TIMES

OF PRICING VOLATILITY AND UNCERTAINTY

APIO

14%

USIO

42%

APIO

21%

ECIO

20%

$1.7B

$6.4B

SALES

2005

2007

2010

2011

PRICE

2005

2012F

21%

CAGR

Iron Ore Price

Share Price

NAC

14%

1

Share Price and Iron Ore Price data provided up until July 15, 2012

15

•

Acquired 80% of

Portman Limited

•

Entered low-volatile

met coal market

•

Acquired world-class

chromite assets in

Ontario, Canada

•

Acquired INR Energy,

high-volatile met and

thermal coal

•

Acquired Bloom Lake mine, an

emerging world-class iron ore

operation in Eastern Canada

1 |

2012 Analyst & Investor Day

16

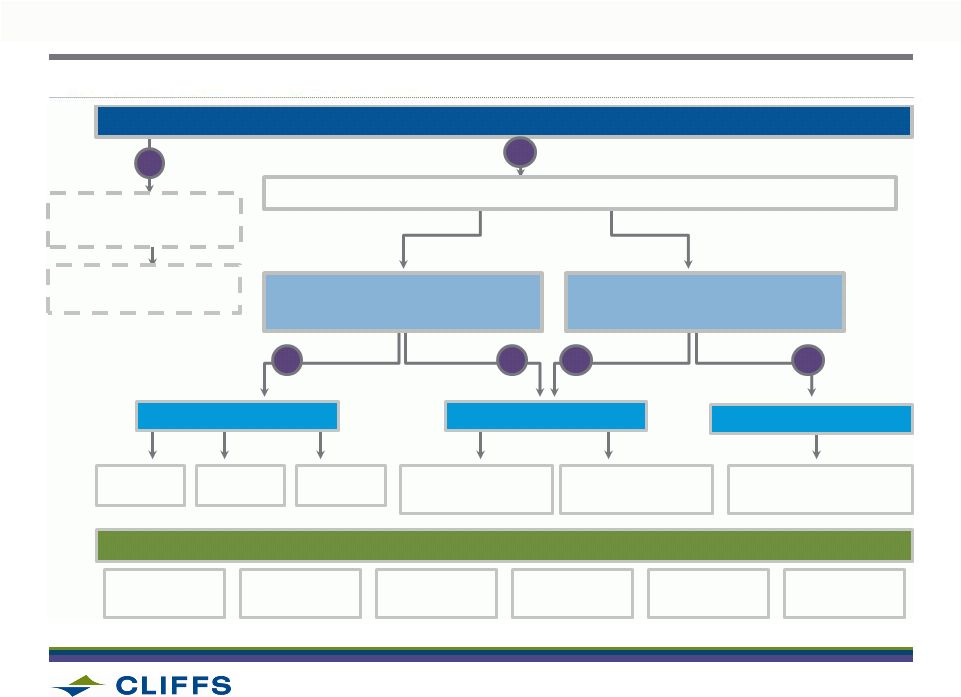

DEPLOY CLIFFS WIDE

2

ENGAGE TSR AS

MANAGEMENT TOOL

1

INTEGRATE TSR INTO

CONTROL SYSTEMS

3

DESCRIPTION

ADOPTION OF TSR WILL ENHANCE THE ABILITY TO OPTIMALLY

MANAGE TRADE OFFS AND MAXIMIZE SHAREHOLDER VALUE

•

Align goals with top-quartile relative TSR against our peers

•

Ensure discipline and prioritization in all processes, from

target setting to incentives

•

Launched as planning and target setting tool at corporate level

•

Roll-out training to employees

•

Link capital allocation, incentive and other systems

•

Reshaped portfolio and capital prioritization

•

Long-term incentive plan based 100% on relative TSR

16

DEVELOPING A VALUE-BASED MANAGEMENT SYSTEM TO DRIVE TOTAL

SHAREHOLDER RETURN |

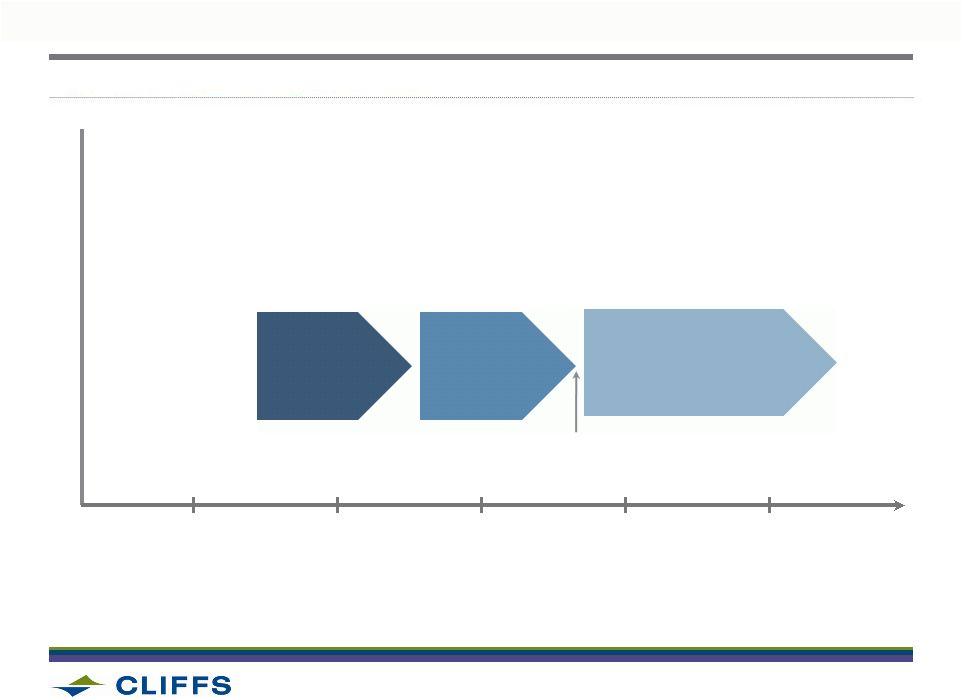

2012 Analyst & Investor Day

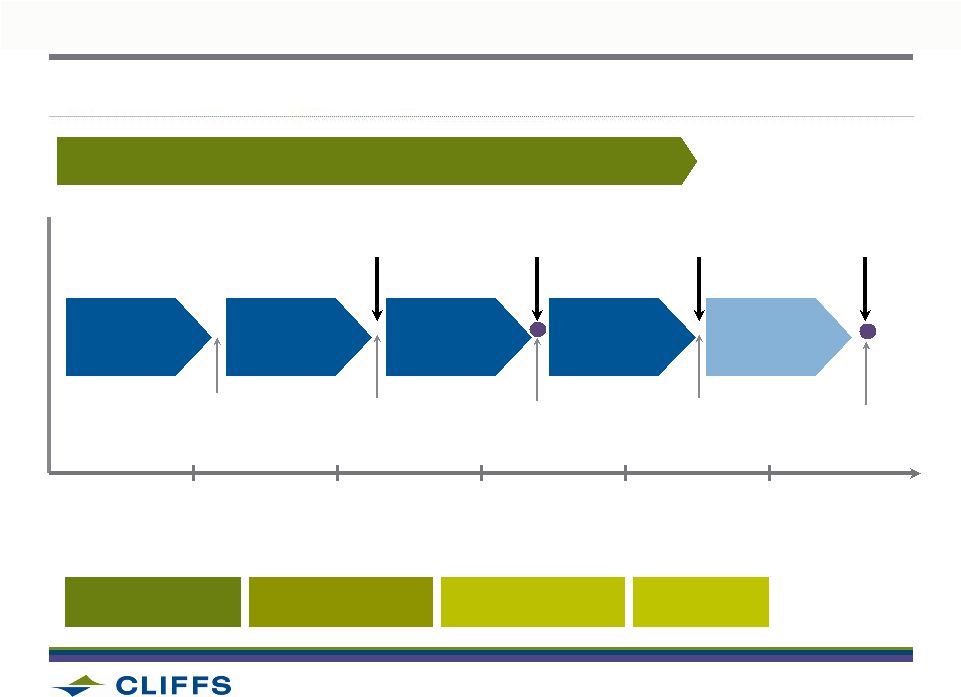

ENTIRE CAPITAL INVESTMENT SYSTEM (CIS) OCCURS WITHIN TYPICAL

APPROVAL TIMELINES

17

TYPICAL ENVIRONMENTAL PERMITTING AND APPROVALS

PROCESS…

4½

-

5 YEARS

SCOPING

STUDY

PREFEASIBILITY

STUDY (PFS)

FEASIBILITY

STUDY (FS)

EARLY

COMMITMENT

PHASE

Stage

Approval

Stage

Approval

Board

Commitment

Final

Investment

Decision

Independent Peer

Review 1

Independent Peer

Review 2

Independent Peer

Review 3

Y1

Y2

Y3

Y4

Y5

2 years post

ramp-up

Independent Peer

Review 4

TYPICAL BUDGET DISTRIBUTION ACROSS STUDIES…

GEOLOGY ~ 60%

METALLURGY ~15%

OTHER ~ 10%

ENGINEERING ~ 15%

CONSTRUCTION

PHASE |

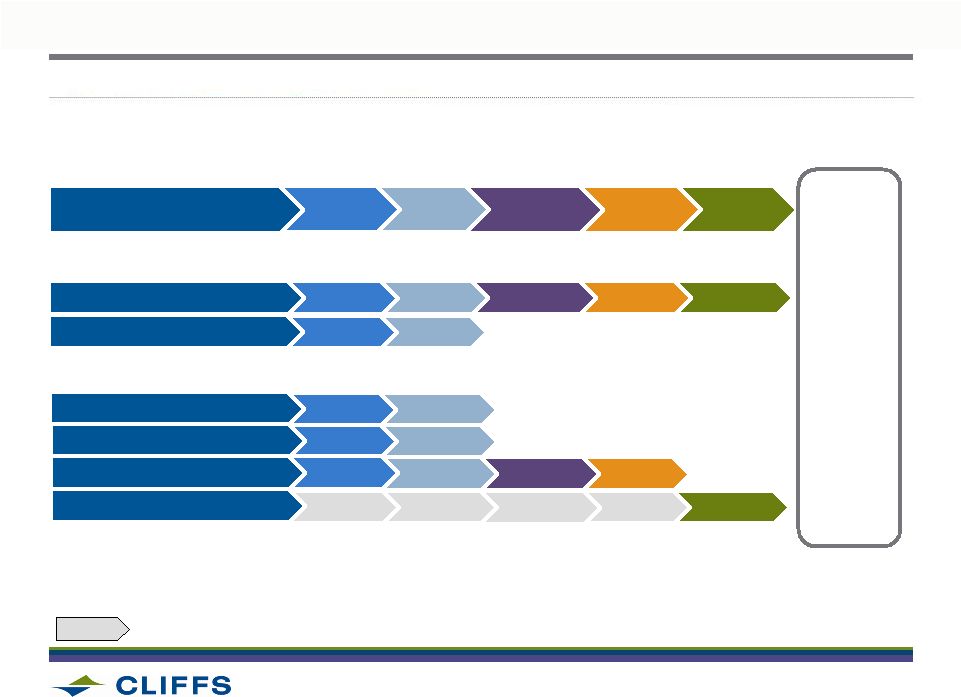

2012 Analyst & Investor Day

CIS PROJECTS BY STUDY PHASE

EXPECTED

NEXT IPR

Q1, 2013

Q3, 2012

Q2, 2013

IN PROGRESS

COMPLETE

CANADA

ASIA PACIFIC

CONCEPT

SCOPING

PREFEASBILITY

FEASIBILITY

EXECUTION

DECAR

BLOOM LAKE III

BLOOM LAKE II

KOOLYANOBBING EXPANSION

Indicates project did not complete all stage-gates of CIS process due to

timing of acquisition PROJECT

18

•

CIS is a deliberate and disciplined process to ensure effective deployment of

capital in a project setting.

PROJECT GUNNEL

Q4, 2012

FERROALLOYS

|

2012 Analyst & Investor Day

SUMMARY

•

Megatrends intact and Cliffs’

strategic direction positioning company

to capitalize on Eastern Canada and Australia expansions

•

While volatile, Cliffs’

view is China continues as engine of demand

for steelmaking raw materials, incumbent producers will benefit

•

Marginal cost producers will continue providing floor for pricing

•

West African and other supply response will be delayed by capital/investor

uncertainty, cost inflation and approvals/execution delays

•

Cliffs’

strategic levers include quality products, financial flexibility

and strength of legacy operations’

market positions

19 |

CLIFFS NATURAL RESOURCES

LAURIE BRLAS |

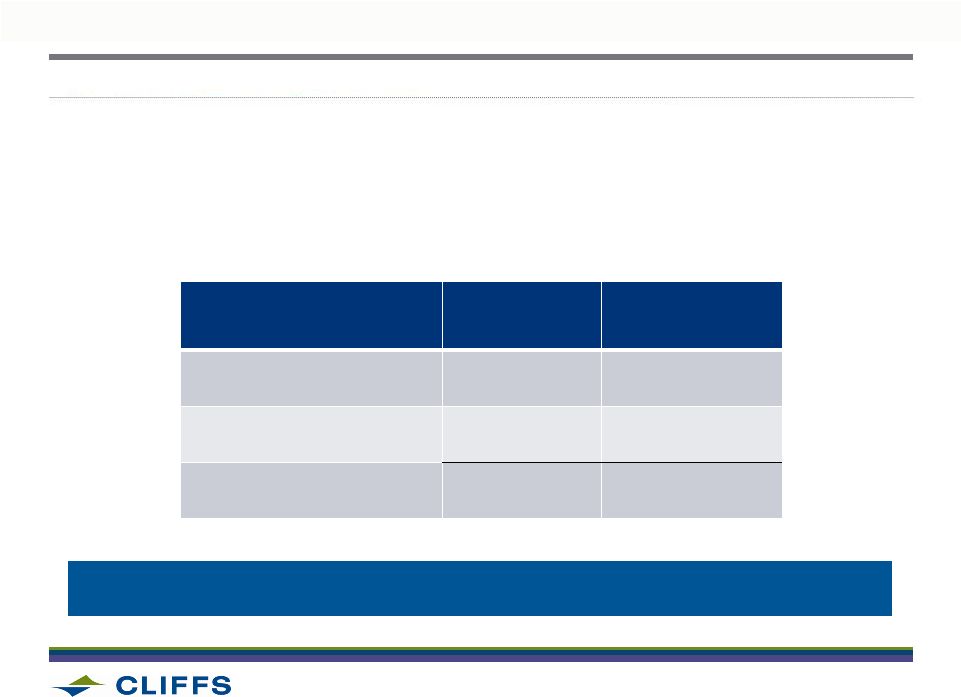

2012 Analyst & Investor Day

SINCE THE SECOND HALF OF 2011, WE HAVE BEEN ASSESSING HOW WE COULD

USE OUR CASH TO MAXIMIZE SHAREHOLDER VALUE

Potential Uses

Market Context

Sustainability

•

Assessed current

project pipeline

•

Analyzed drivers of relative

valuation for Cliffs vs. peers

•

Reviewed potentially available

M&A opportunities

•

Analyzed relative impact from

buybacks vs. dividends

•

Captured feedback from our

largest investors on

shareholder value creation,

strategy and capital allocation

•

Validated quantitative results

of historical multiple drivers

•

Scenario pressure-testing

•

Analyzed impact on liquidity

and TSR of various options

•

Analyzed current debt level

and paydown schedule

•

Assessed potential rating

agency responses to uses

of cash

21

from

2006

–

2011 |

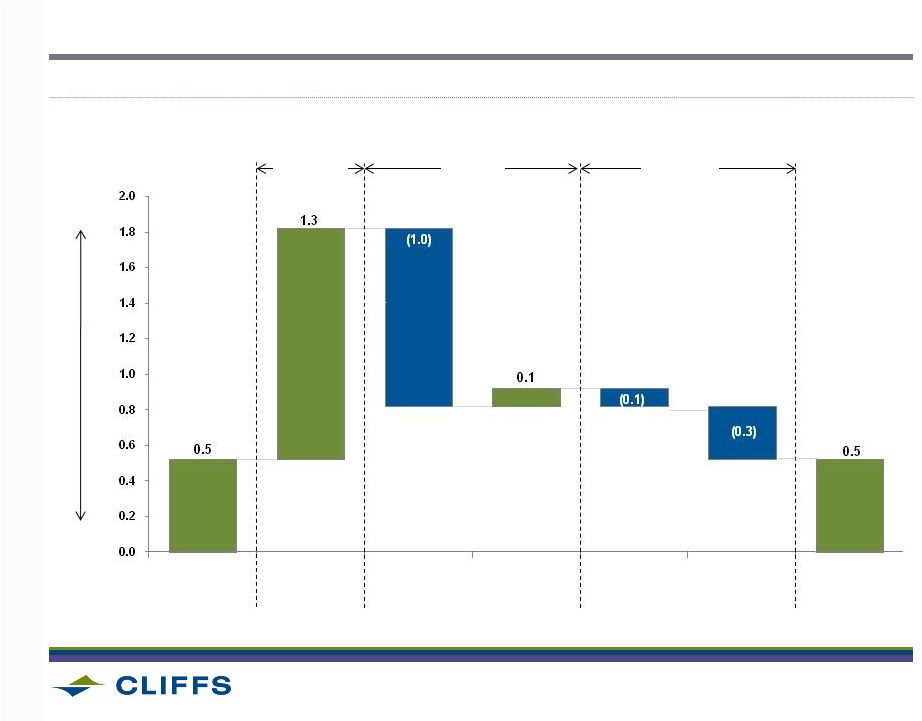

2012 Analyst & Investor Day

FREE CASH FLOW

22

SOURCES AND USES OF CASH IN 2012 ($B)

Dividends

Debt Issuance/

(Repayment) &

Other Financing

CAPEX

Operations

Cash on Hand

12/31/11

Expected Cash on

Hand 12/31/12

Operating

Financing

Cash

generated

Cash

consumed

1.Operating cash flow includes effect of non-cash operating activities,

including but not limited to, those related to deferred taxes, hedge contracts and equity investments.

Investing

Sonoma Sale |

2012 Analyst & Investor Day

CAPITAL ALLOCATION STRATEGY PRIORITIZES ORGANIC GROWTH AND DIVIDENDS

PRIORITY

MOVING FORWARD, CAPITAL ALLOCATION TO BE DETERMINED

BY CONTRIBUTION TO TOTAL SHAREHOLDER RETURNS

ORGANIC

GROWTH

DIVIDENDS

DEBT

REDUCTION

M&A

BUYBACKS

•

Support

and

reinforce

Cliffs’

profitable

organic

growth

potential

•

Ability to fund organic growth and still have significant cash available

•

Continue significant debt reductions

•

Maintain investment-grade rating

•

Reward investors and reinforce capital allocation discipline

•

Commit to pay dividend regularly, grow it based on future performance

•

Focus on execution and organic growth pipeline

•

Select TSR-accretive M&A as conditions warrant

•

Secondary to dividends as means of returning cash to shareholders

•

Selective buybacks at attractive valuations

23 |

2012 Analyst & Investor Day

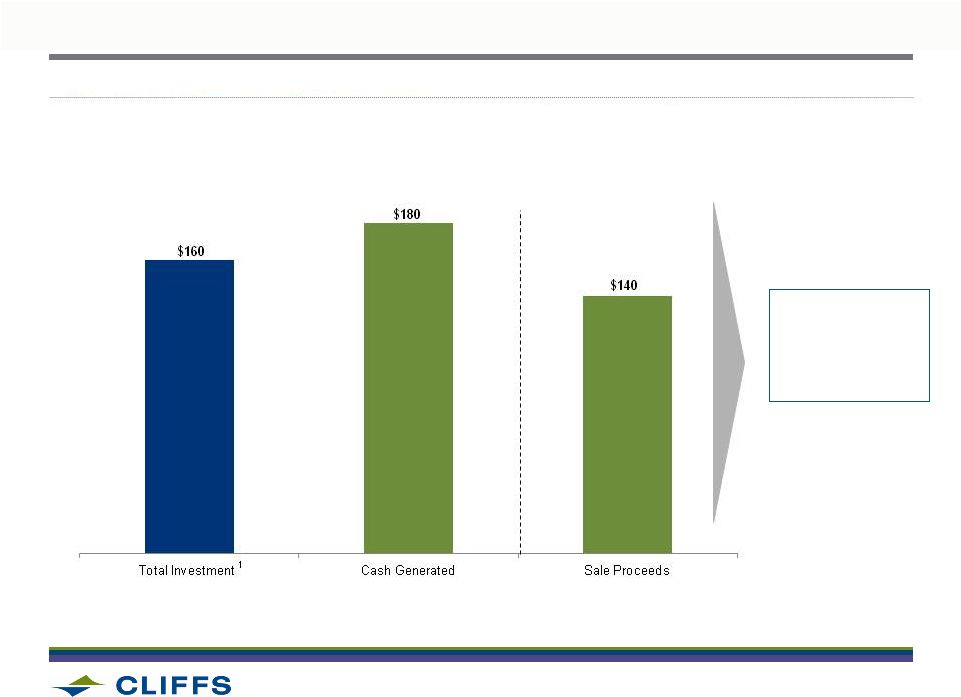

DRIVING SHAREHOLDER VALUE WITH SALE OF SONOMA

24

DRIVING SHAREHOLDER VALUE WITH SALE OF SONOMA

24

Total

Investment

IRR of 26%

SONOMA INVESTMENT (US$M)

2007 -

2012

1

Total investment includes initial investment and capital expenses

|

2012 Analyst & Investor Day

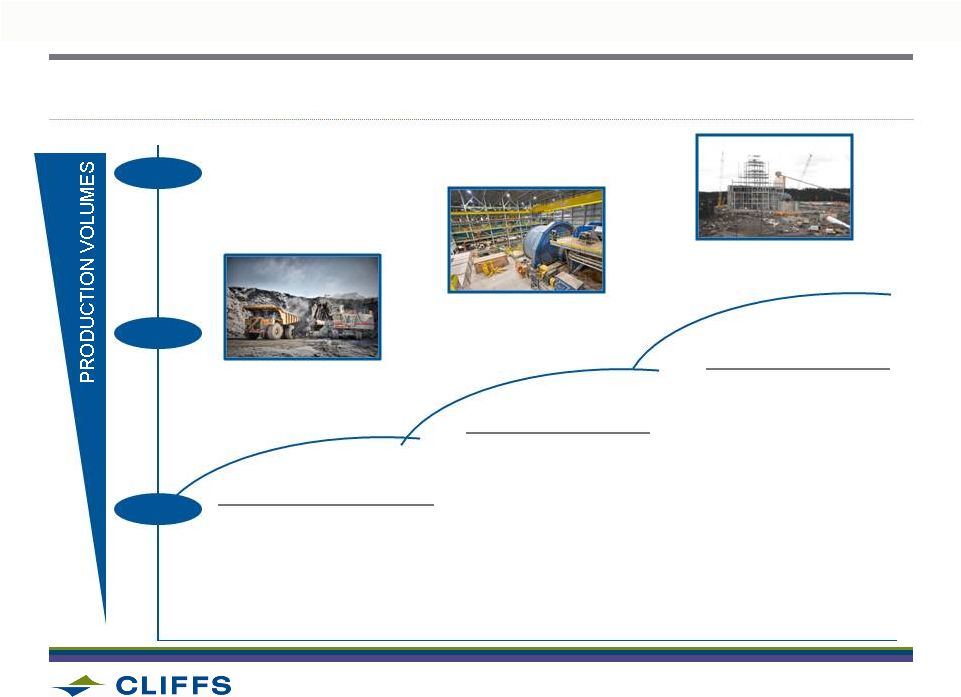

EASTERN CANADA POSITIONED TO BECOME OUR LARGEST BUSINESS SEGMENT

PHASE

II

–

GROWTH

TO

14.5

MTPA

FUTURE GROWTH BEYOND 22 MTPA

A

B

•

Phase

I

“process

learnings”

and

incorporated

into Phase II startup

•

Overland conveyor investment

•

Mine development and tailings basin

expansion by 2012/2013

•

First-half 2013 start-up

•

Resource within current mining location

•

Currently in CIS-approved scoping phase,

prefeasibility by 2012

•

Anticipated lower spending by leveraging

existing Phase I & II infrastructure

•

Targeting 2016 production

Metric tons (m)

By 2016,

Bloom Lake will

produce more than

entire U.S. Iron Ore

with 1/3 workforce

25

3.3

5.6

6.0

14.5

22.0

20.0

0.0

5.0

10.0

15.0

20.0

25.0

2010

2011

2012F

end of 2013

Next Phase

USIO 2016

A

B |

2012 Analyst &

Investor Day PREVIOUS MARKETING AND SALES STRATEGY FOR BLOOM LAKE CONCENTRATE

•

Wisco (steelmaker)

•

WorldLink (trader)

•

SK Group (trader)

•

Junior miner had

limited market reach

•

Lacked seaborne

end-consumer network

•

Acquired 25% of Bloom Lake, 20%

stake in Consolidated Thompson

•

Agreed to 50% off-take

agreement for Phase I

•

Annual option for up to 60%

of all future production

3

26

PRIOR TO CLIFFS’

CONTROL, MARKET STRATEGY

DRIVEN BY FINANCIAL NECESSITY

Wisco introduced

to help meet

capital needs

1

2

Initial marketing

approach to use

commodity traders

Three customers

acquired with

CT acquisition |

2012 Analyst & Investor Day

CLIFFS STRATEGY: ACHIEVE CUSTOMER AND GEOGRAPHICAL DIVERSITY

Identify ‘priority’

customers

beyond Wisco base tons

Technical evaluation of

Bloom Lake concentrates

Industrial plant trials

with priority customers

Alternative markets and

other opportunities

•

Promoting high Fe content and low impurities

•

Exploiting opportunities due to declining competitor ore grades

•

Conduct technical sinter test work

•

Collaborating with Wisco on use of Bloom Lake in sinter plants

•

Trial cargoes arranged this year, with plant data results

expected in late 2012 / early 2013

•

Customers include Nippon Steel, Posco, China Steel

and mills in Europe

•

Explore other products for Bloom Lake concentrate

•

Micro-pelletizing, cold briquetting

27 |

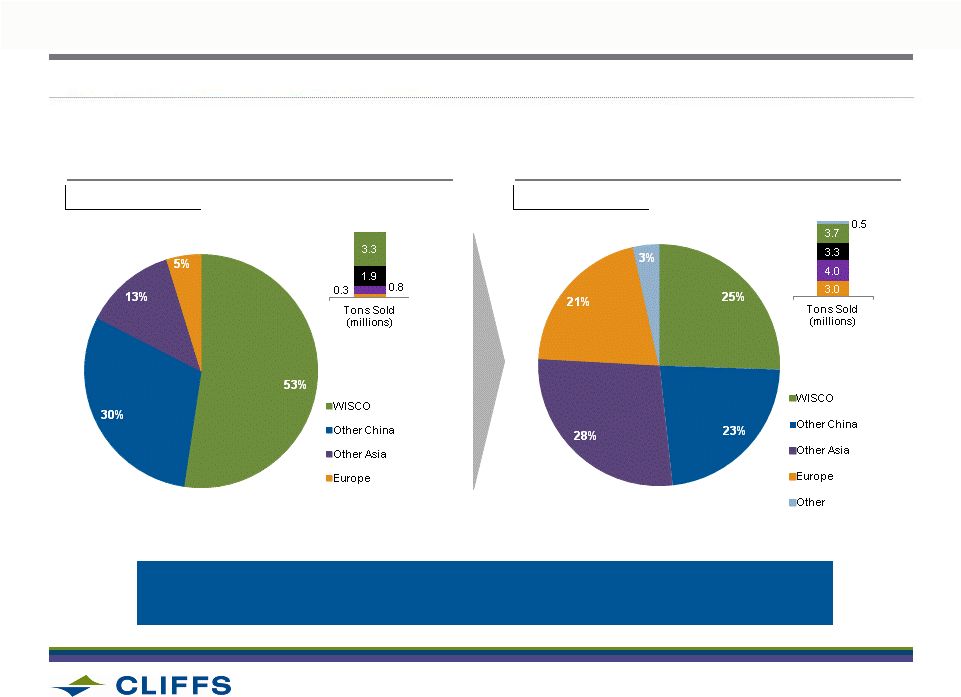

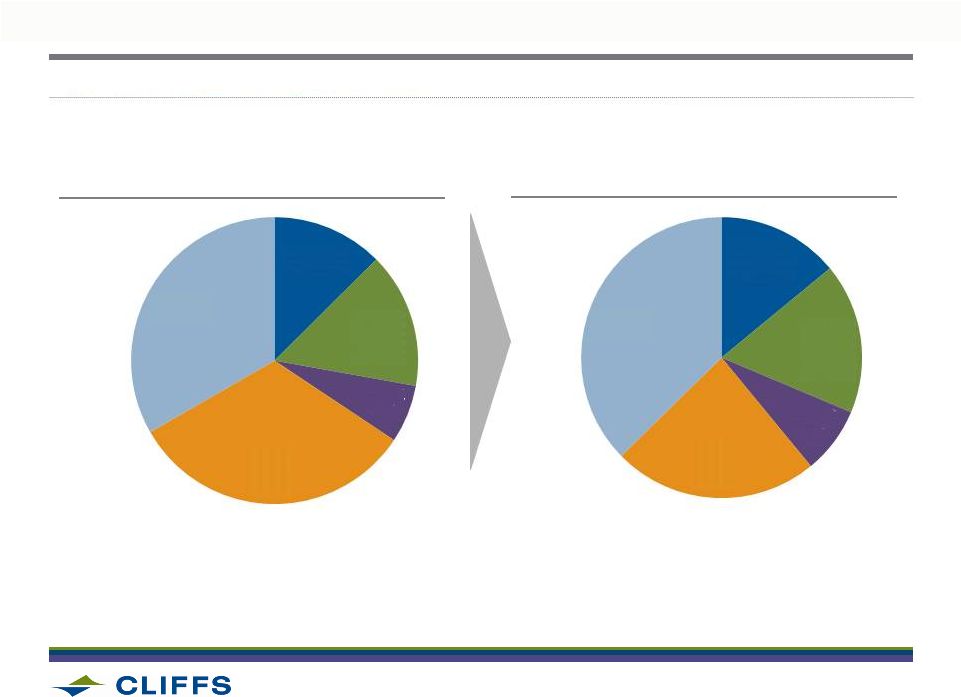

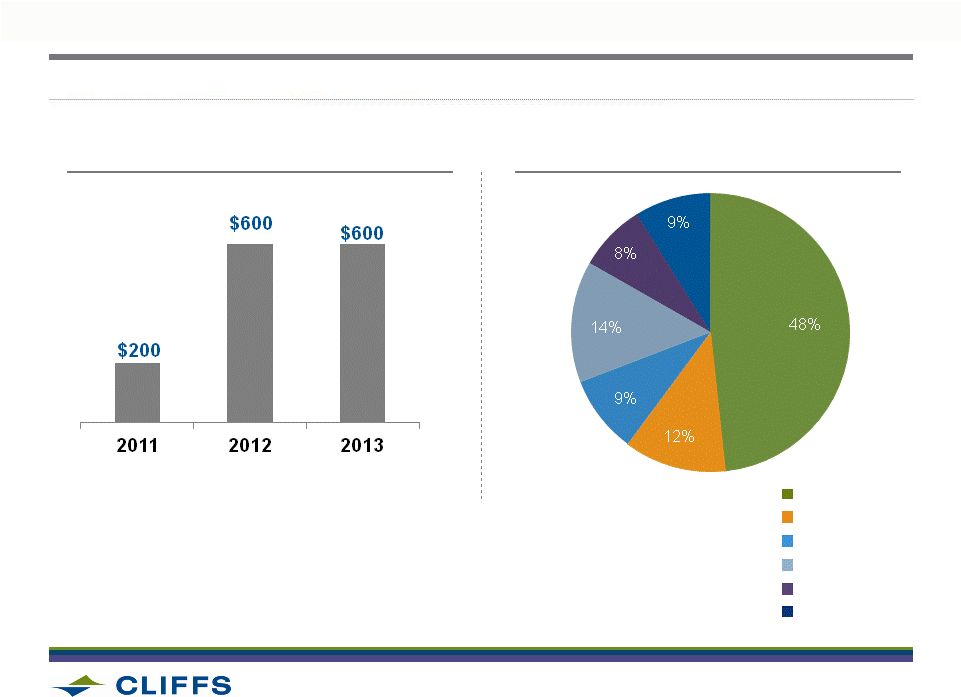

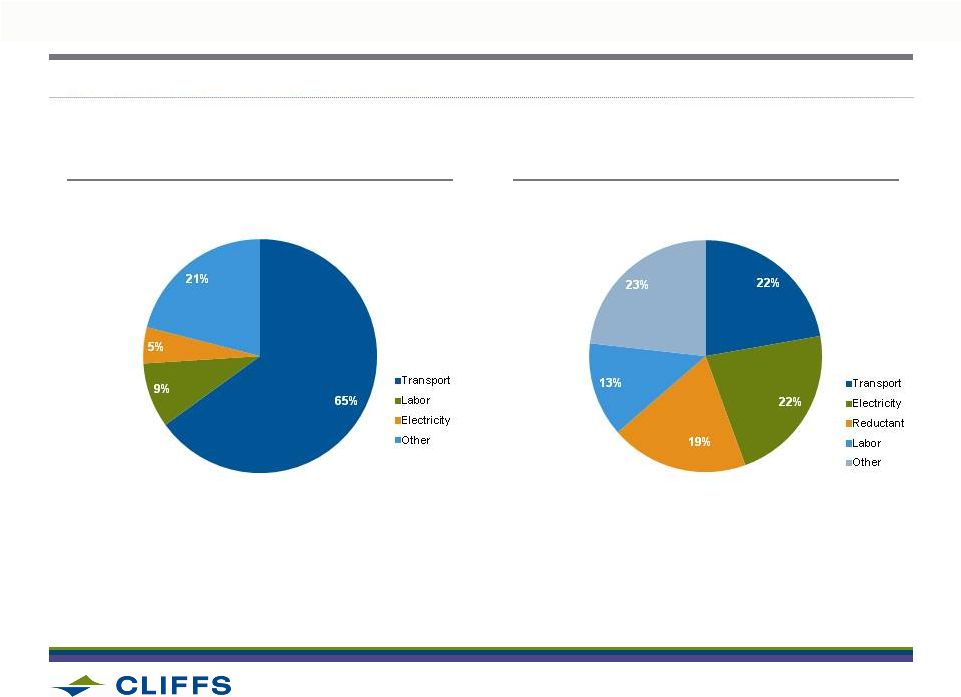

2012 Analyst & Investor Day

FUTURE SALES DIVERSIFICATION TARGETS

2012 CURRENT ESTIMATE

(PHASE I)

TARGETED ANNUAL SALES

(PHASE I & II)

Sales Tons by Region

Sales Tons by Region

6.3

14.5

BOTH CUSTOMER AND GEOGRAPHIC DIVERSIFICATION

ACHIEVABLE FOR BLOOM LAKE CONCENTRATE PRODUCT

28 |

2012 Analyst & Investor Day

DIVERSIFICATION WILL RESULT IN HIGHER FOB PRICES AND CASH MARGINS

$ / t

Note: For FOB China sales assumes $135/ton for 66% Fe and 5.5% SiO2 with $60 cash

costs. For FOB Other Asia and FOB Europe assumes $9/ton Pricing Premium to $144/ton for

66% Fe and 4.5% SiO2 with $65 cash costs. Freight assumptions are $25/ton

into China, $20/ton into Other Asia and $10/ton into Europe. 29

$135

$144

$144

$50

$59

$69

$0

$50

$100

$150

FOB China

FOB Other Asia

FOB Europe

Revenue Rate

Cash Margin |

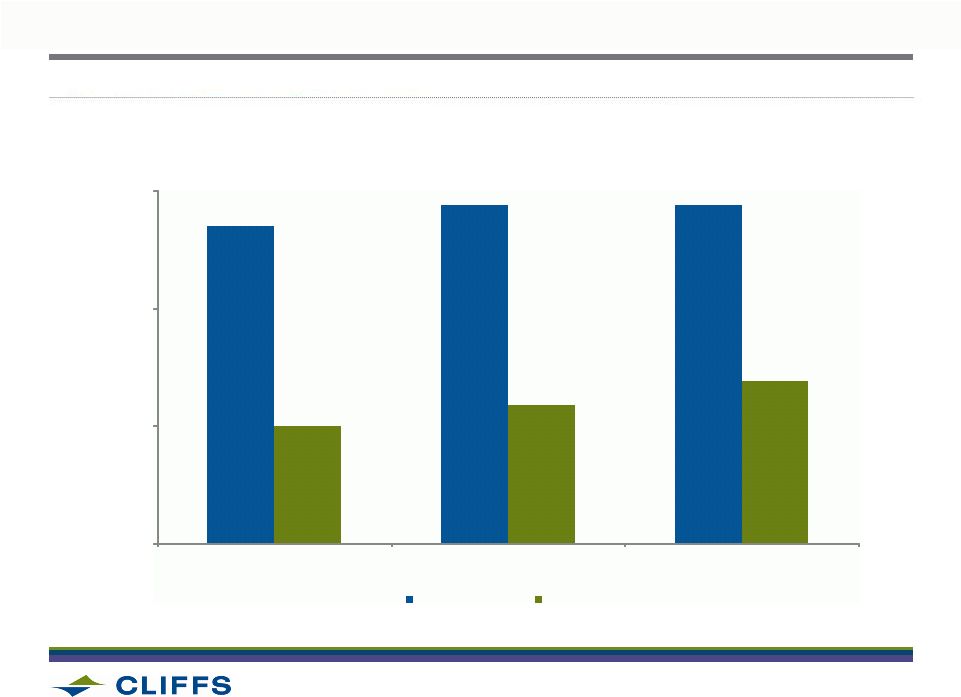

ANTICIPATED SALES MARGIN CONTRIBUTION FROM BLOOM LAKE WITH

EXECUTED MARKETING AND OPERATIONAL PLANS

(millions)

Revenue

EBITDA

PHASE

I –

7.2

MILLION

TONS

@ 4.5% SILICA

(millions)

Revenue

EBITDA

PHASE

I

&

II

–

14.5

MILLION

TONS

@ 4.5% SILICA

30

$900

$400

$0

$500

$1,000

$1,500

$2,000

$1,800

$900

$0

$500

$1,000

$1,500

$2,000

2012 Analyst & Investor Day

Note: Assumes $135/ton CIF China index price, $25/ton freight to China, $20/ton for Other Asia and

$10/ton for Asia. Also assumes $9/ton Pricing Premium for non-China sales and $62.50/ton

cash costs. |

2012 Analyst & Investor Day

Platts 62% Fe Price:

Weighted Average Freight:

Value in Use/Fe Premium for

66% Fe Bloom Concentrate:

Cash Costs:

BLOOM LAKE HAS SIGNIFICANT EBITDA GENERATION POTENTIAL

BULL CASE

BASE CASE

BEAR CASE

EBITDA

14.5 Mpta RUN RATE

$150/ton

$20/ton

$16

$60/ton

$135/ton

$20/ton

$10

$62.5/ton

$110/ton

$20/ton

$7

$65/ton

$1.2B

$900M

$460M

31 |

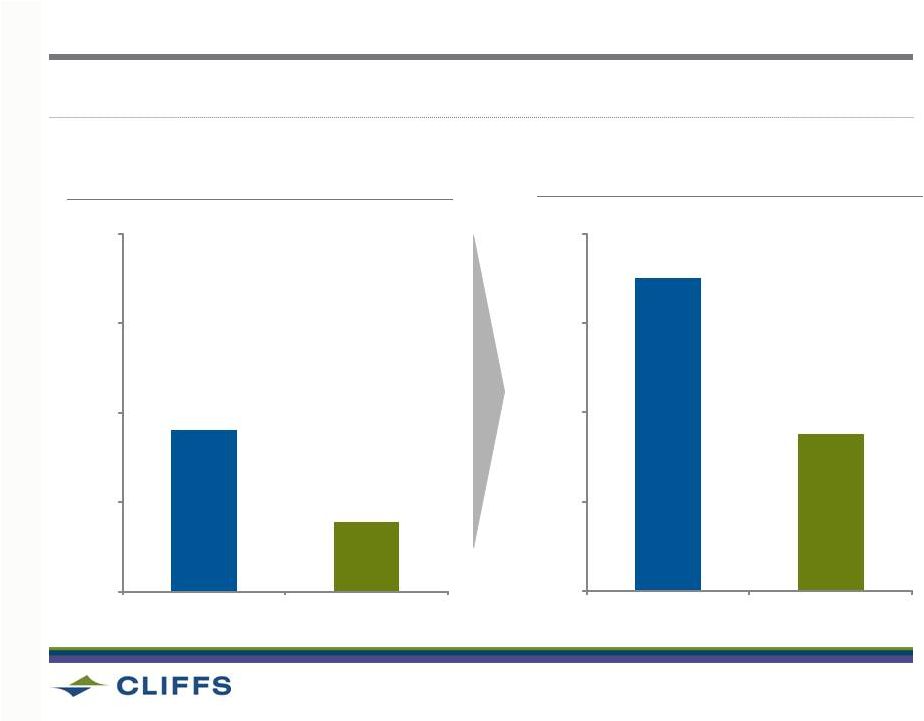

2012 Analyst & Investor Day

OPPORTUNITY LIES IN DELIVERING BLOOM LAKE MINE’S CASH COSTS

PRODUCTION ESCALATION TO 7.2 MT

RUN RATE BY DECEMBER, 2012

32

CASH COST PROGRESSION

3.3

5.6

5.7

7.2

2.0

3.0

4.0

5.0

6.0

7.0

8.0

2009

2010

2011

2012F

Dec

2012

$95

$63

$18

$7

$4

$3

Current Cash

Costs

Volume

Contractor

Spend

Tailings

Management

Transhipping

Estimated

Cash Cost |

2012 Analyst & Investor Day

OPPORTUNITY LIES IN DELIVERING BLOOM LAKE MINE’S CASH COSTS (CONT.)

CURRENT

STATE -

$95/TON

LONG-TERM

ESTIMATE

-

$63/TON

33

Supplies &

Materials

14%

Labor

17%

Energy

8%

Mining

24%

Logistics

37%

Supplies &

Materials

13%

Labor

15%

Energy

7%

Mining

32%

Logistics

33% |

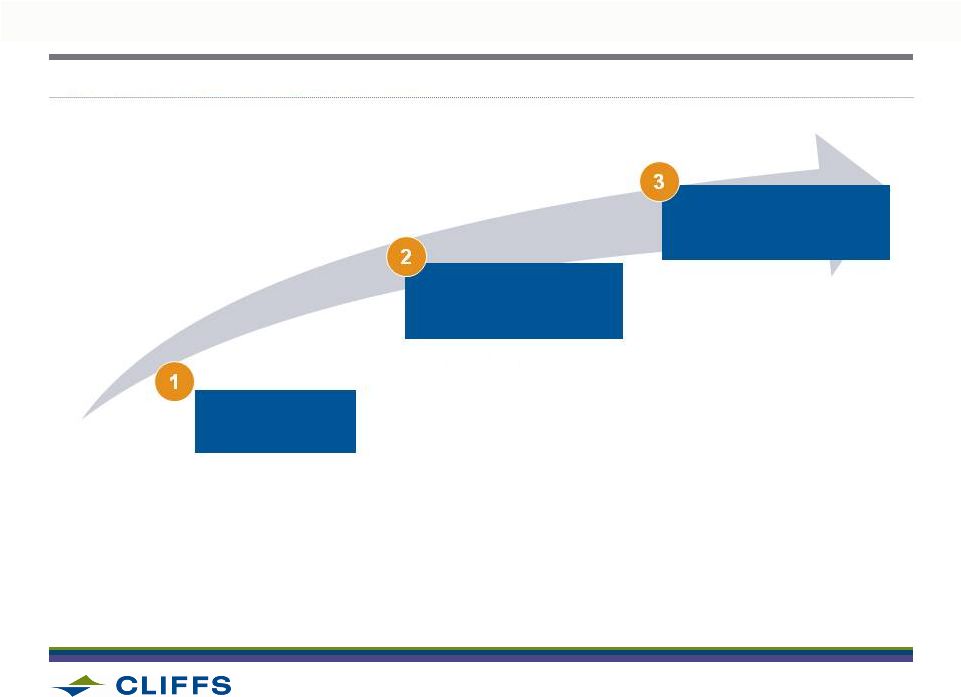

2012 Analyst & Investor Day

CRITICAL NEXT STEPS

•

Transition from contract to

permanent labor force

•

Fly-in, Fly-out roster

•

Housing Management

•

Ore Characterization

•

Tailings

•

Logistics

•

Capitalize on lessons learned

•

Construction of

Phase II Concentrator

•

Continued to enhance

logistics network

34

Achieve targeted

production volumes

and scale

Human

Resources

Phase II preparations |

CLIFFS NATURAL RESOURCES

DAVE BLAKE |

2012 Analyst & Investor Day

SIGNIFICANT LONG-TERM VALUE CREATION POTENTIAL FOR BLOOM LAKE

36

One Billion tons of resources

Operating concentrator

Rail and port facilities

Phase II project to double

production by end of 2013 |

2012 Analyst & Investor Day

INCREASE

IN

RESOURCE

BASE

POSITIONS

BLOOM

LAKE

FOR

FUTURE

EXPANSION

Future Expansions

•

Leverage Phase I & II infrastructure

•

No third crusher required ($50 million)

•

Mature mine development, tailings basin

and logistics base

37

580

1,051

0

300

600

900

1,200

Acquisition Model Resource

2011 Resource Estimate

2008 LOM Resource Limit

2011 LOM Resource Limit

Total Ore

(million metric tonnes) |

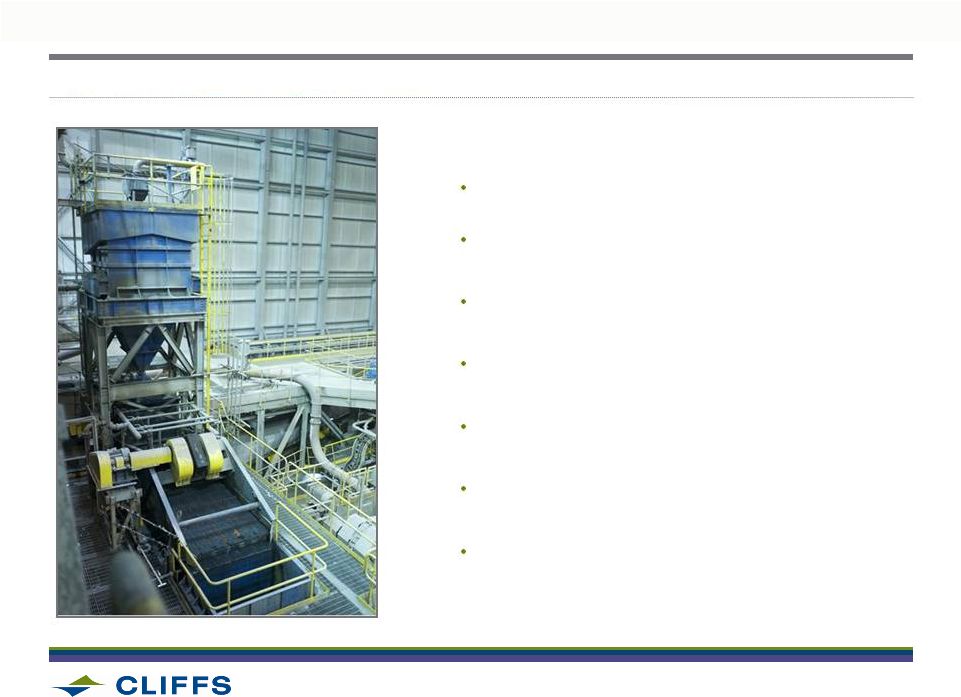

2012 Analyst & Investor Day

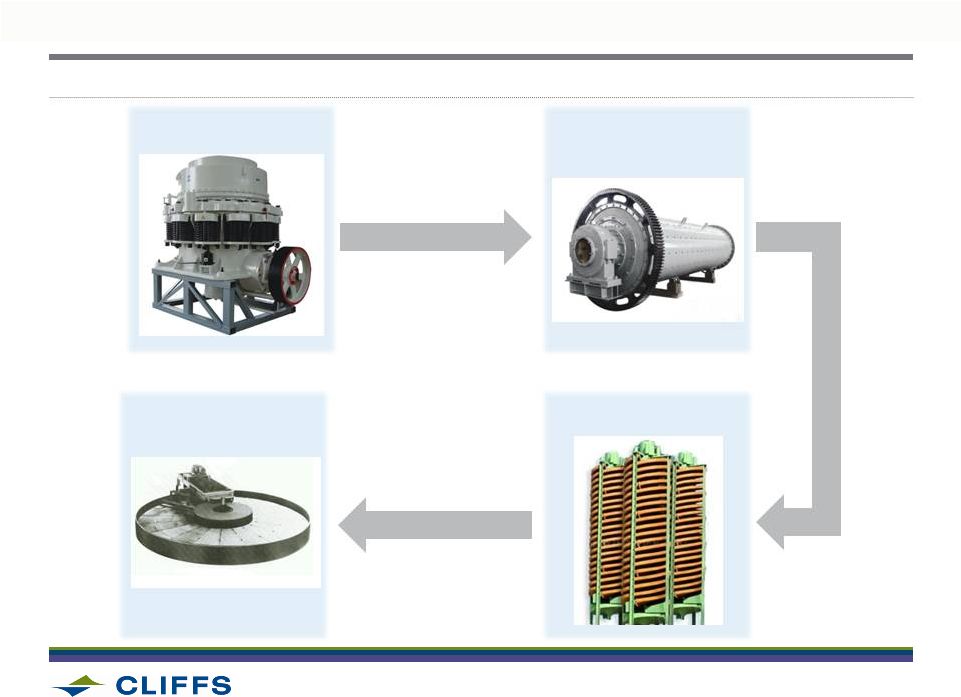

BLOOM LAKE CONCENTRATOR FLOW SHEET

38

CRUSHING

MILLING

FILTRATION

SPIRAL SEPARATION |

2012 Analyst & Investor Day

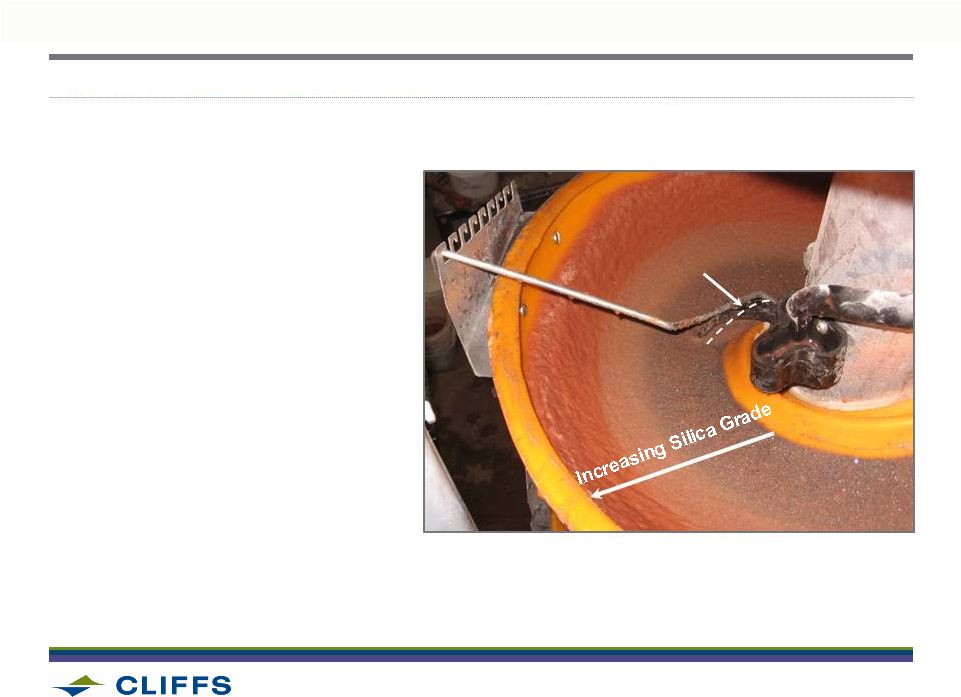

PRODUCING A LOWER SILICA PRODUCT AT BLOOM LAKE

39

Cutter Closing Decreases

Silica in Concentrate

•

Ore

Control

–

Mine

plan

is

sequenced to optimize plant

feed targets over time

•

Grind

Control

–

Circuit

optimized to increase

silica liberation

•

Spiral

Classifiers

–

Cutter

bar position, water addition

and SPC/Lab analysis

response plans

•

Grade increases toward

outer periphery of spiral |

2012 Analyst & Investor Day

PHASE I KEY STABILIZATION STEPS

TAILINGS BASIN

ORE

CHARACTERIZATION

LOGISTICS

•

Develop and implement Mature Development Block process

•

Focus on consistent concentrator feed to improve quality

and lower costs

•

Expand tailings basin to support future growth

•

Lower operating costs through lower headcount/eliminating

manual tailings movement

•

Improve operations and maintenance practices

•

Deliver significant synergies

40 |

2012 Analyst & Investor Day

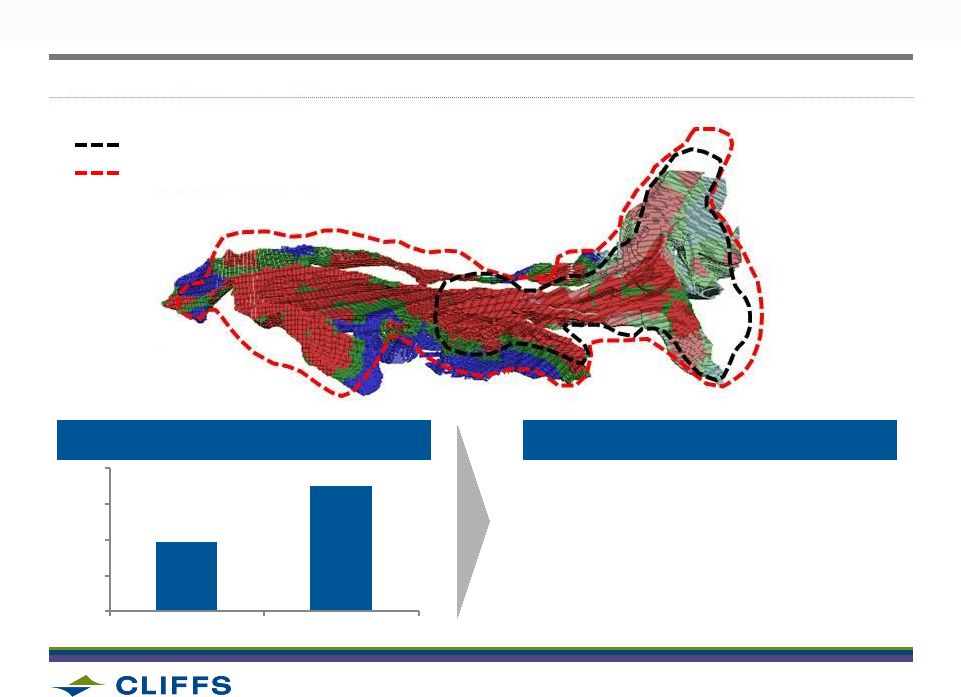

UNDERSTANDING ORE CHARACTERIZATION

DEVELOP MATURE

OPERATIONAL BLOCK MODEL

DATA ANALYSIS &

INTERPRETATION

PREDICTABILITY AND

UNDERSTANDING

•

Test work on drill core

•

Chemical and

metallurgical testing

•

Real-time mine to mill

analysis of crude to

concentrate behaviors

•

Improve consistency of

concentrator feed

•

Provide process KPIs on:

•

Facilitates proper mine

planning

•

Provides sound input for

expected plant performance

41

•

Mill throughput rates

•

Iron recovery

•

Concentrate silica

•

Trace minerals |

2012 Analyst & Investor Day

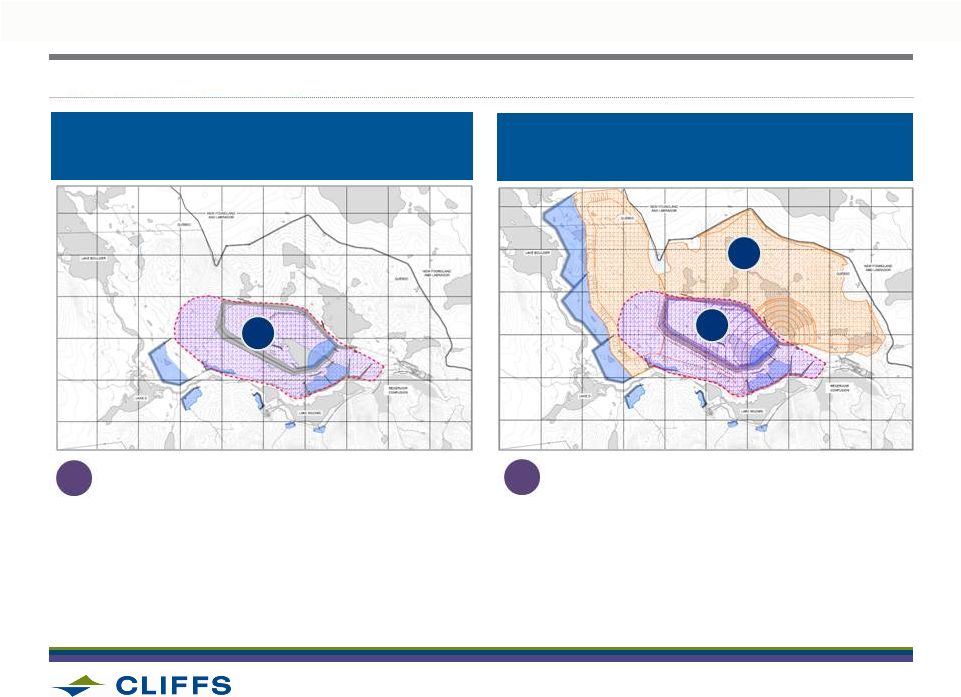

REDESIGN OF TAILINGS BASIN SUPPORTS 30-YEARS OF OPERATIONS

A

Original design (2011)

A

Re-designed

(2012

–

2014)

B

•

Undersized and insufficient storage for

future expansions

•

Footprint adequate only through mid 2013

ORIGINAL TAILINGS BASIN DESIGN

LIMITED LONG-TERM GROWTH

REDESIGNED TAILINGS BASIN WILL

SUPPORT GROWTH PLANS

A

B

•

Will allow sufficient storage for expansion

•

Meets permission to operate requirement

•

Reduce operating costs through elimination

of headcount and manual tailings management

42 |

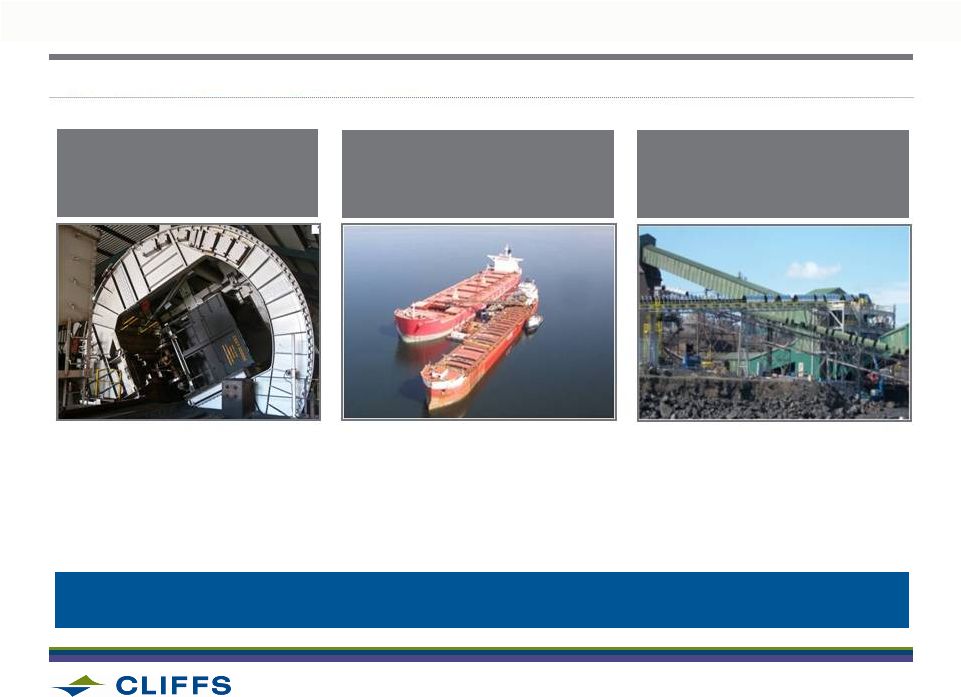

2012 Analyst & Investor Day

SYNERGIES BEING ACHIEVED FROM ORIGINAL BUSINESS PLAN

DOCK TO VESSEL

IMPROVEMENTS

IMPROVEMENTS TO

TRAIN UNLOADING

CROSS

CONVEYORS

•

Physically tie the two dock

operations together

•

Feed both docks with

product from either stockyard

•

Improvement of operations

and maintenance practices

•

Total unloading time has been

reduced by an average of

4 hours per train

•

Use of two transhippers to

load concentrate into larger

vessels at anchor in the bay

•

Dock reinforcement of 30

OVER LAST 6 WEEKS, VESSEL TURN TIME AVERAGE DOWN TO 4.5 VS. 9-10 DAYS WITH

ORIGINAL

LOGISTICS

–

POSITIONING

MINE

FOR

EXECUTION

OF

GROWTH

PLANS

43 |

2012 Analyst & Investor Day

LEARNING FROM PHASE I DESIGNED INTO PHASE II

44

Improved Safety Design

Hydrosizer Startup and Test Work

Spiral Control and Optimization

Mill Liner Design

Mine Ore Control Plan

Crusher Design

Mill Cube Control |

2012 Analyst & Investor Day

APPROXIMATELY $1,400 MILLION IN CAPITAL TO SPEND THROUGH 2013

45

•

Tailings management solution for future growth

•

Cross-conveyors upgrades at the port

•

Additions to mobile fleet, shovels and drills

CAPITAL SPEND TIMELINE

(IN

MILLIONS)

CAPITAL SPEND BREAKOUT

Concentrator

Equipment

Tailings

Mine Development

Infrastructure

Sustaining |

2012 Analyst & Investor Day

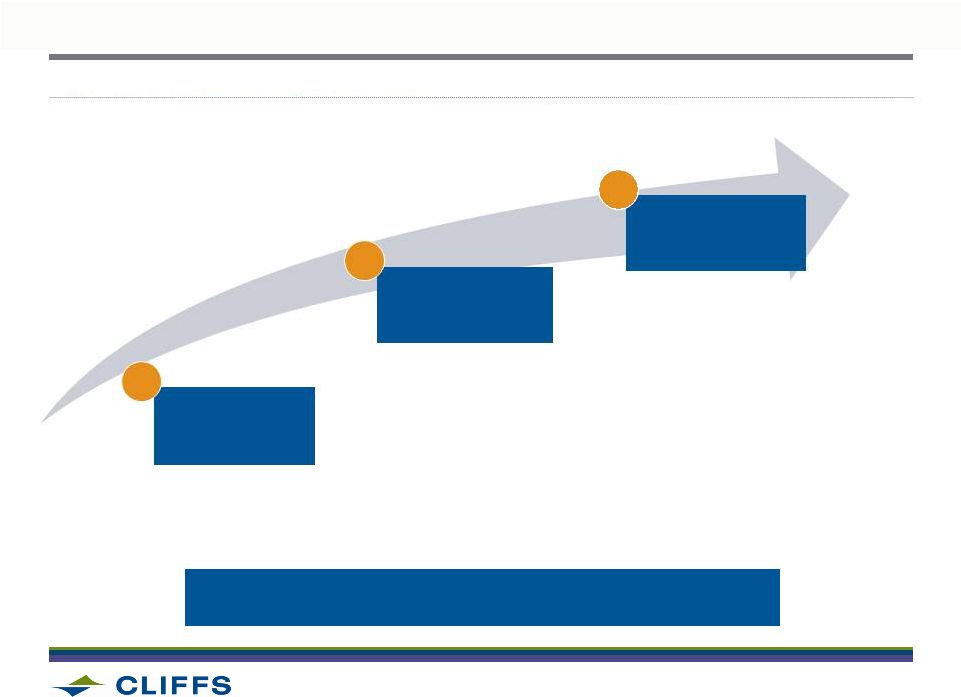

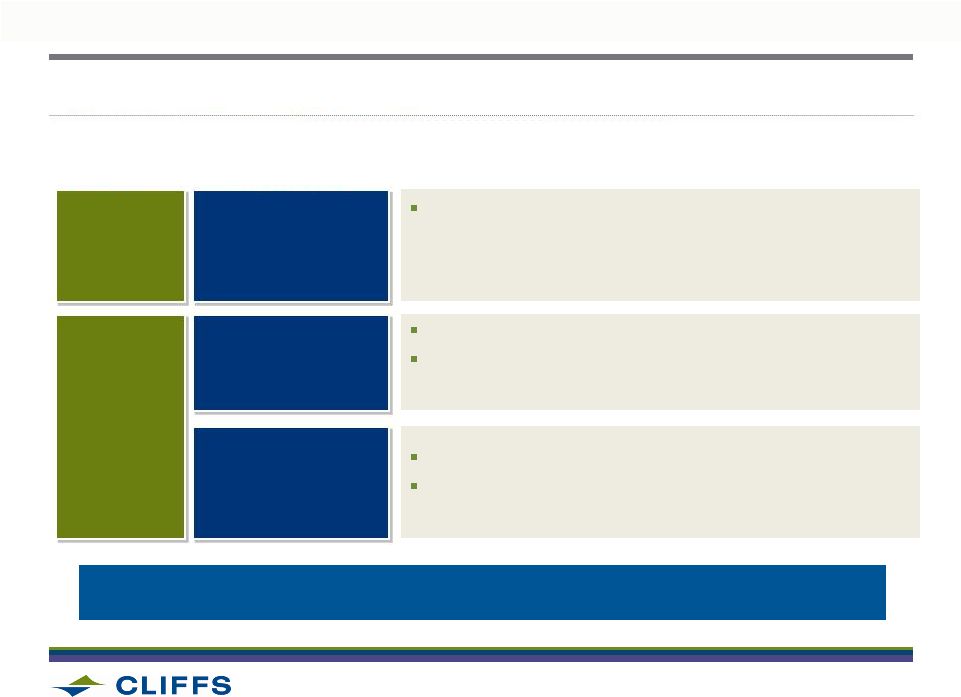

FOCUS ON FUNDAMENTALS, STABILIZE, OPTIMIZE AND DEVELOP KEY TO

REALIZING FULL POTENTIAL OF ASSETS

2012-2013

2013-2014

2015-2016

•

Permission to Operate

•

Mine Plan maturation

•

Maintenance Process

•

Phase II Startup &

Stabilization

•

Maximize Phase I

capabilities

•

Scoping study

underway for

expansion to 22 mpta

FOCUS ON FUNDAMENTALS

STABILIZE/OPTIMIZE

DEVELOP/OPTIMIZE

PHASE I

PHASE II

FUTURE EXPANSION

22 mtpa

14.5 mtpa

7.2 mtpa

46 |

2012 Analyst & Investor Day

STRATEGIC FIT

Long-term Eastern Canada strategy and project value intact

STABILIZATION OF OPERATIONS

Focus on fundamentals for long-term sustainable operations

FUTURE GROWTH

Over 80% increase in reserve base from acquisition model

IN SUMMARY

47 |

CLIFFS NATURAL RESOURCES

CLIFF SMITH |

2012 Analyst & Investor Day

CLIFFS GLOBAL EXPLORATION GROUP

•

Select

group

of

geologists

and

exploration

professionals

located

in

Cliffs’

three primary geographies (North America, South America and Australia)

•

Current emphasis on near mine, Cliffs-owned properties in Eastern

Canada, Western Australia, and Decar nickel project

•

Focus on existing pipeline of strategic partnerships (project generators)

and Cliffs controlled projects

•

Focus

on

steelmaking

raw

materials,

stable

geopolitical

regions,

and

strategic fit

49 |

2012 Analyst & Investor Day

Brazil

Canada

Australia

Mongolia

DECAR PROJECT

15,000m drilling program

Progress to Scoping Study

LABRADOR TROUGH

Bloom Lake Drilling

Hobdab target initiated

PERU

Drilling campaign

CHILE

Airborne surveys,

drilling campaigns

AUSTRALIA

Drilling campaigns in WA

and near current operations

MONGOLIA

Magnetic surveys

MEXICO

Prospect reviews

GLOBAL EXPLORATION GROUP ACTIVITIES ARE MEASURED AND FOCUSED

50

RING OF FIRE

Data compilation |

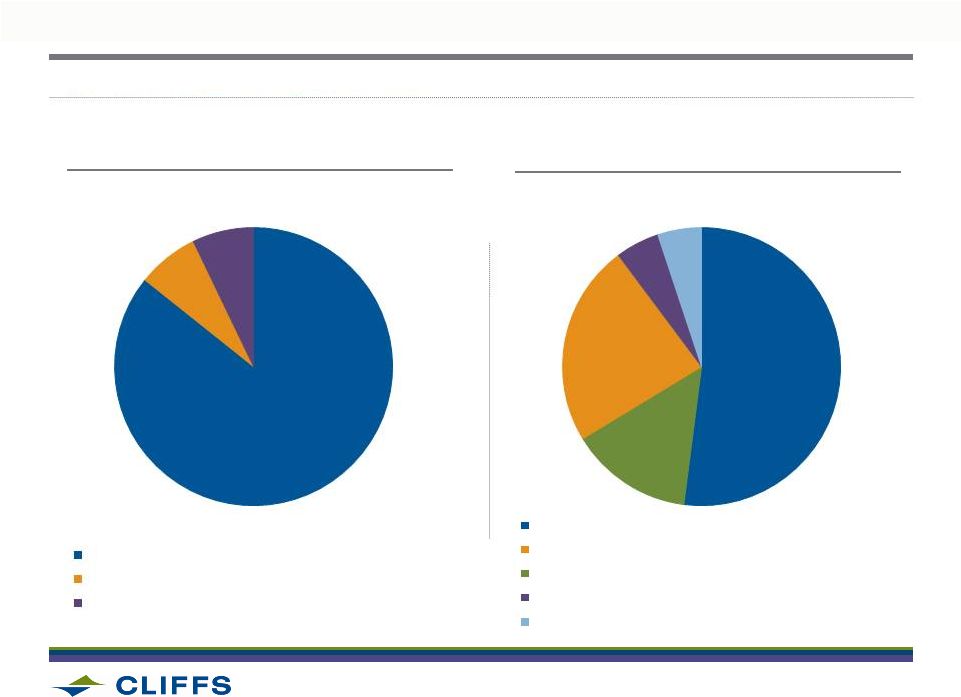

2012 Analyst & Investor Day

Met Coal (C)

WORLDWIDE EXPLORATION BUDGET IN 2012 IS $90 MILLION

51

Low Risk (Australia, Canada, Chile)

Moderate Risk (Peru, Mexico)

Moderate/Higher Risk (Mongolia)

Iron (Fe)

Nickel (Ni)

Copper/Gold (Cu-Au)

Manganese (Mn)

BUDGET ALLOCATION

BY COUNTRY RISK

BUDGET ALLOCATION

BY COMMODITY

7%

7%

84%

5%

5%

23%

14%

51% |

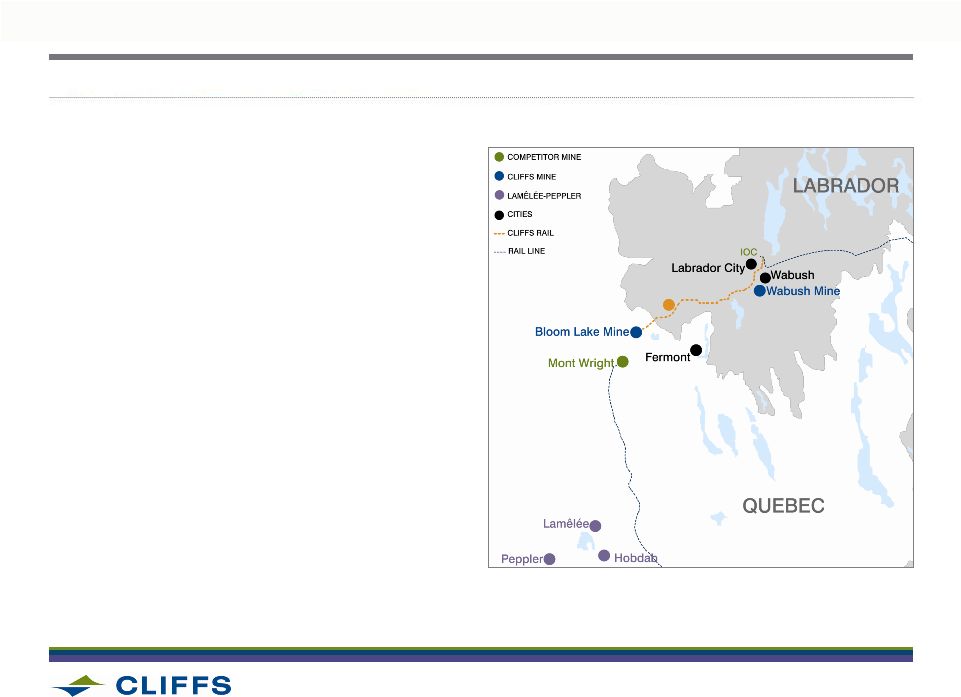

2012 Analyst & Investor Day

EXPLORATION WORK OUTSIDE OF BLOOM LAKE IN LABRADOR TROUGH

LAMELEE AND PEPPLAR LAKE

•

Located 45km south of Bloom Lake

•

Drilling program first began in 2006.

Total of 130 holes completed

•

Approximate 1 billion tonnes reported in

compliance to NI43-101 standards

•

Deposits dominated by magnetite with

lesser amounts of hematite; near surface

shallow dipping -

favorable for open pit

HOBDAB EXPLORATION TARGET

•

Exploration target located to east of

Pepplar Lake

52 |

2012 Analyst & Investor Day

DECAR PROJECT -

POTENTIAL GAME CHANGING NICKEL DEPOSIT

•

Cliffs’

51% controlled interest in North Central British Columbia nickel-iron

alloy deposit -

not a nickel laterite or sulphide deposit

•

NI

43-101

estimate

complete

-

1.2

billion

ton

inferred

resource

at

0.113

Ni

•

Mineralization makes deposit amenable to open-pit mining methods

•

Located within 5km of Canadian National active branch and 110km of

British Columbia Hydro power grid

•

High-grade concentrates produced by simple magnetic and gravity

separation, with up to 15% Ni; balance iron, silica and some chromite

53 |

2012 Analyst & Investor Day

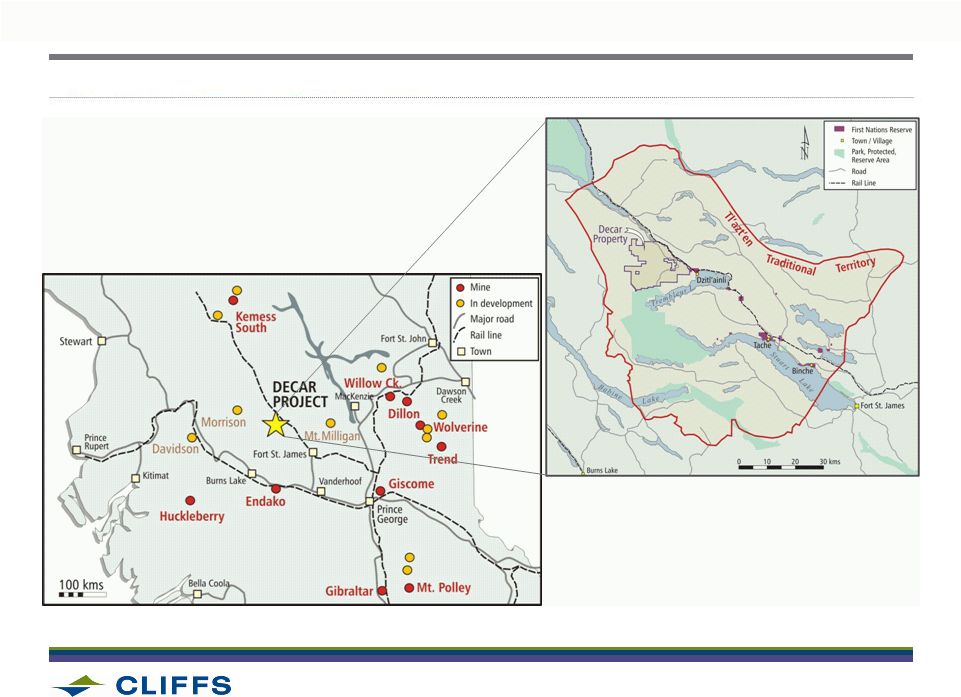

DECAR

NICKEL

PROJECT

-

NORTH

CENTRAL

BRITISH

COLUMBIA

54 |

•

Expected produced concentrates would contain no difficult impurities

•

Suitable and desirable feed into ferronickel plants with high

value-in-use properties

•

Geographic location provides access to ferronickel plants in Asia

•

Small-scale smelting tests in South Africa demonstrate performance in

conventional ferronickel smelting environment

•

Additional metallurgical testing planned for later in 2012

55

HIGH-QUALITY CONCENTRATE SUITABLE FOR MANY POTENTIAL BUYERS

2012 Analyst & Investor Day |

2012 Analyst & Investor Day

NEXT STEPS FOR DECAR NICKEL PROJECT

56

CONTINUE TO ESTABLISH

“LICENSE TO OPERATE”

SCOPING STUDY UNDERWAY

DECISION ON WHETHER TO

MOVE TO PREFEASIBILITY

•

Cliffs’

CIS process

•

Additional drilling to further

define high-grade area

•

Metallurgical testing

planned for Q3/Q4

•

Scoping completion

expected in 2013

•

MOU’s already signed with

Tl’azt’en Nation in May

•

Community Kick-Off Event

held

in

June

–

over

100

attendees |

CLIFFS NATURAL RESOURCES

BILL BOOR |

2012 Analyst & Investor Day

Source: Heinz Pariser; Cliffs Analysis

CHROME ORE END MARKETS

58

CHROME ORE

6%

METALLURGICAL (FeCr)

CHARGE/HIGH CARBON (HC)

FERROCHROME

LOW CARBON (LC)

FERROCHROME

Stainless Steel (Cr Input)

Alloy Steel

Others

END USE MARKETS

Transport

Consumer

Durables

Industrial

Equipment

Refineries &

Tubing

Construction &

Decorative

Other

Nickel alloy foundries

& welding materials

Austentic

Ferritic

Other

Grades

Tool & high speed

steel

Low alloy steel

66%

13%

13%

8%

HIGH-GRADE

CHROME ORE

94%

Refractory, Foundry

Sands & Chemicals |

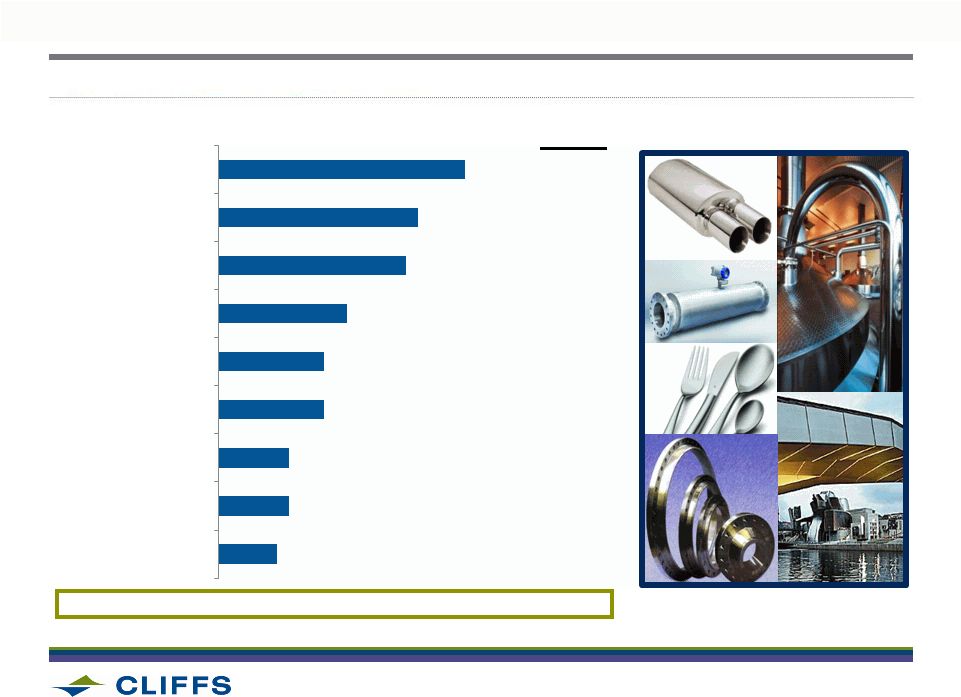

2012 Analyst & Investor Day

GLOBAL

STAINLESS

STEEL

CONSUMPTION

BY

END

USE

CATEGORY

-

2011

Source: CRU, Cliffs analysis

STAINLESS STEEL GROWTH

4.1%

5.0%

4.1%

5.3%

2.1%

1.6%

5.2%

5.7%

0.3%

4.1%

2011 -2016

CAGR

59

5%

6%

6%

9%

9%

11%

16%

17%

21%

Refineries & Tubing

Other

Transport

Motor Vehicles

Chemical Manufacturing

Other Equipment

Household Goods

Construction

Food & Beverage |

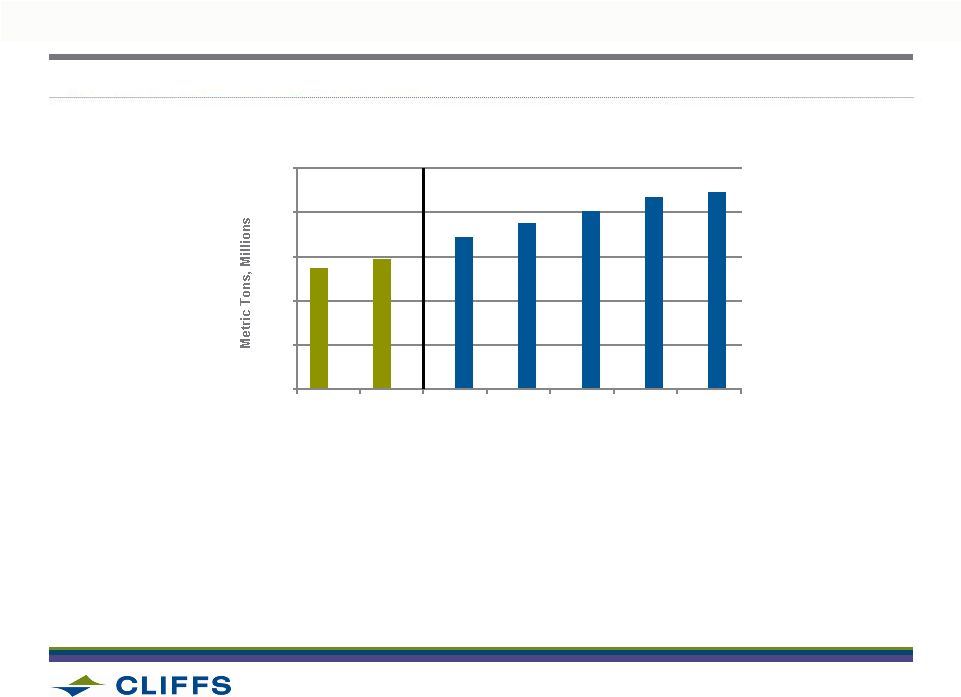

2012 Analyst & Investor Day

GLOBAL STAINLESS STEEL GROWTH

•

Total stainless steel production is expected to rise through 2016 to 42.2 million

tons from 33.6 million tons

•

Primarily driven by increasing income and economic growth in BRIC countries

Source: CRU, Cliffs analysis

60

20

25

30

35

40

45

2010

2011

2012 F

2013 F

2014 F

2015 F

2016 F

GLOBAL STAINLESS STEEL PRODUCTION

HISTORICAL

FORECAST |

2012 Analyst & Investor Day

Source: Cliffs analysis

AUSTENITIC

AUSTENITIC

•

Consists

of

Cr

(16-26%),

Ni

(5

-

22%)

and

iron

•

Recycled material provides about 40% of Cr content

•

Primary applications: food processing equipment, aeronautics, railway

equipment, industrial piping and vessels

Trend: Increasing use of scrap

AUSTENITIC AND FERRITIC STAINLESS STEEL

FERRITIC

FERRITIC

•

Primarily consists of Cr (10.5-27%) and iron; essentially nickel free

•

No recycled materials are used

Trend: Taking share from Austenitic

61

Primary

applications:

automotive,

coal

mining,

hot

water

tanks,

domestic

appliance, dishware, tubes, and conveyor chains |

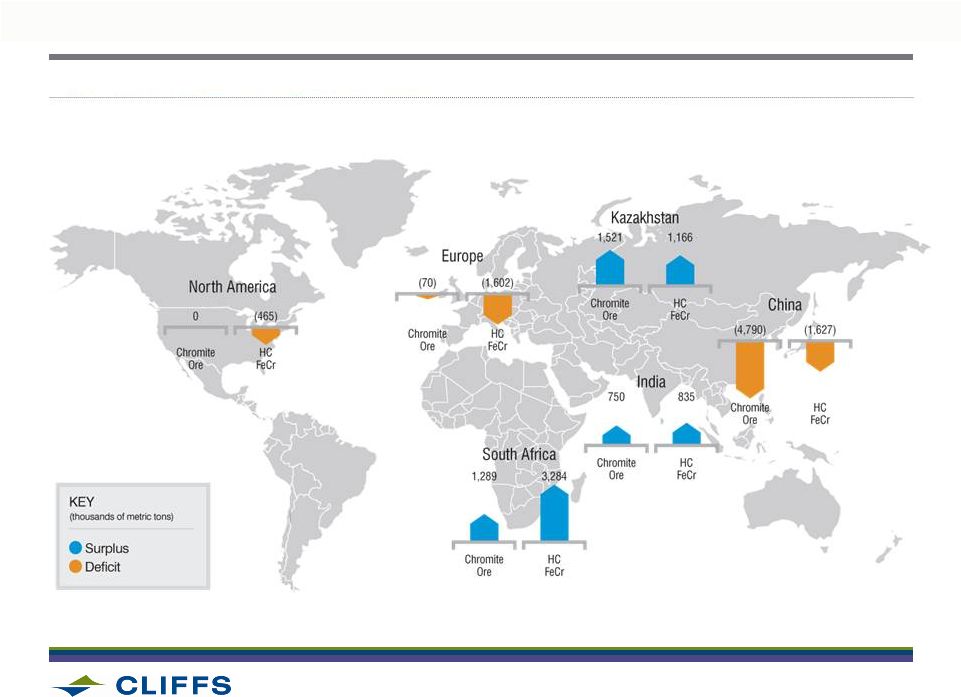

2012 Analyst & Investor Day

CHROMITE ORE AND FERROCHROME PRODUCTION AND CONSUMPTION

Note:

Map

above

excludes

production

and

consumption

from

Turkey,

Russia

and

ROW

62

Source: Metal Bulletin, Heinz Pariser

•

SIGNIFICANT

CHROMITE

ORE

AND

FERROCHROME

SUPPY

DEFICITS

EXIST

IN

NORTH

AMERICA,

EUROPE, AND CHINA |

2012 Analyst & Investor Day

SOUTH AFRICA DOMINANT GLOBAL PLAYER ACROSS VALUE CHAIN, WHILE CHINA

FERROCHROME SMELTING CAPACITY IS GROWING

1 Incl. HC/LC/MC

2 Includes UG2 ore output

3 Includes Zimbabwe which represent ~15 % of total world reserves

SOURCE: MBR; ICDA; CRU

FECR PRODUCTION

2010

MILLION

METRIC

TONNES

13%

11%

7%

21%

42%

25%

11%

9%

13%

Volume

% of total

world reserves

% of total

1%

5%

1%

21%

% of total

Volume

48%

72%

2.1

3.2

13.8

3.8

2

6.1

Other

3.70

Other

1.16

0.82

1.00

2.23

South Africa

South Africa

India

Kazakhstan

Turkey

India

China

Kazakhstan

63

CHROMITE ORE OUTPUT

2010 MILLION METRIC TONNES

1

3

3 |

2012 Analyst & Investor Day

SOUTH AFRICA COST PRESSURES ARE RESHAPING THE INDUSTRY

Local Factor

Cost

Evolution

Escalation of input costs

Electricity and labor costs eroding

competitiveness

STRUCTURAL FACTORS LIMITING SUPPLY

Regulatory

Environment

Potential government policy changes

Potential export levy on chrome could

reduce competitiveness

64 |

2012 Analyst & Investor Day

SOUTH AFRICAN INDUSTRIAL END USER TARIFF

(AVERAGE YEARLY TARIFF)

Real 2012 USDc per kWh

SOURCE: IRP (March 2011 version); EIU Inflation; Cliffs analysis

+76%

Low case scenario

Likely scenario

High case scenario

SOUTH

AFRICA

COST

ESCALATION

–

ELECTRICITY

PRICES

TO

INCREASE

BY

~75

%

OVER NEXT DECADE BEFORE STABILIZING IN 2020

KEY FACTORS AFFECTING

ELECTRICITY PRICES

Capacity gap in

electricity supply

Seasonal variations in

price tariffs

Variation in price tariffs

between customer segments

Potential introduction of

carbon taxes

Note: 1 USD = 7.8 ZAR

65 |

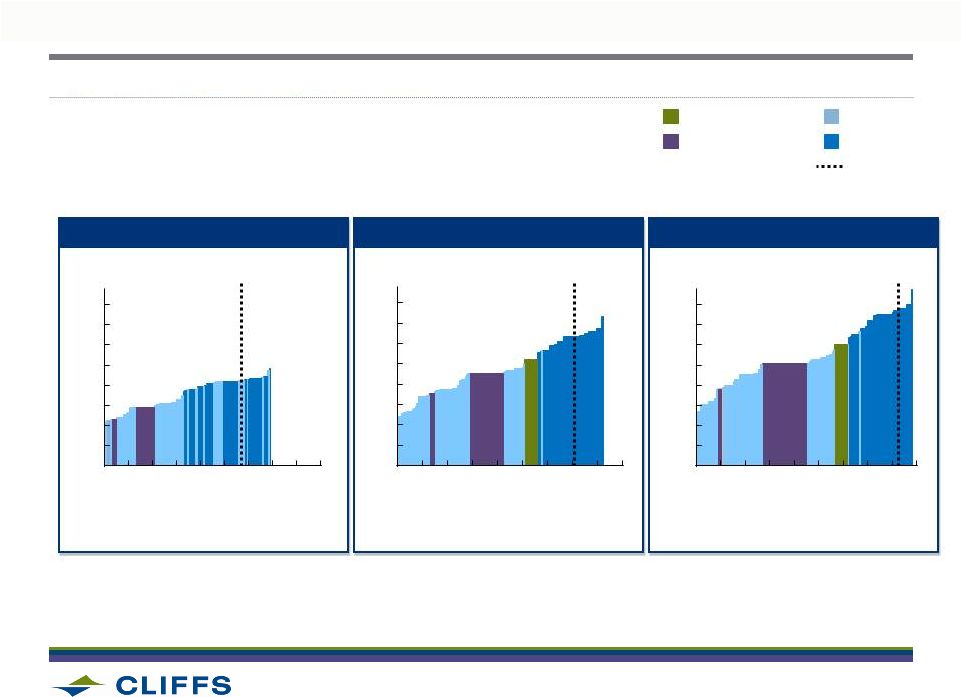

2012 Analyst & Investor Day

2012

2.50

2.00

1.00

0.50

0

16

14

12

1.50

10

8

6

4

2

2017

2022

2.50

2.00

1.50

1.00

0.50

0

16

14

12

10

8

6

4

2

CLIFFS FERROCHROME PRODUCT COMPETITIVE IN THE US MARKET…

SOURCE: McKinsey chromite ore cost model, Cliffs analysis

10.0 Mt

12.3 Mt

Operating capacity

2

Million metric tonnes

Operating capacity

2

Million metric tonnes

Operating capacity

2

Million metric tonnes

2

2.50

2.00

1.50

1.00

0.50

0

16

14

12

10

8

6

4

0

15.2 Mt

Demand

Other

South Africa

Cliffs

CIF US cost

1

Nominal USD/lb Cr contained

1 Cr ore at cost

2

Operating capacity calculated as 90% of nameplate capacity

3 SA high cost players at 70% utilization and non-winter tariff

Note: Raw material (chromite ore) costs assumed to be at cost for integrated

players and at market price for standalone ferrochrome players 66

|

2012 Analyst & Investor Day

CIF

China

cost

1

Nominal USD/lb Cr contained

Operating

capacity

1

Million metric tonnes

Operating

capacity

1

Million metric tonnes

Operating

capacity

1

Million metric tonnes

2

6

4

14

8

12

10

16

0.50

0

1.00

2.00

1.50

... AND COMPETITIVE IN DISTANT MARKETS

SOURCE: McKinsey chromite ore cost model, Cliffs analysis

4

2

6

10

8

0

12

16

14

0.50

1.50

1.00

2.00

2.00

1.50

1.00

0.50

4

2

0

6

16

8

14

10

12

Other

Cliffs

South Africa

10.0 Mt

12.3 Mt

15.2 Mt

1 Chrome ore at cost

2

Operating capacity calculated as 90% of nameplate capacity

3 SA high cost players at 70% utilization and non-winter tariff

Note: Raw material (chromite ore) costs assumed to be at cost for integrated

players and at market price for standalone ferrochrome players Demand

67

2012

2017

2022 |

2012 Analyst & Investor Day

2012

2017

2022

400

350

300

250

200

150

100

50

0

45

40

35

30

25

20

15

10

5

400

350

300

250

200

150

100

50

0

45

40

35

30

25

20

15

10

5

400

350

300

250

200

150

100

50

0

45

40

35

30

25

20

15

10

5

28.6 Mt

35.0 Mt

Operating capacity¹

Million metric tonnes

Operating capacity¹

Million metric tonnes

Operating capacity¹

Million metric tonnes

CLIFFS CONCENTRATE WILL BE COST COMPETITIVE

42.8 Mt

South Africa

Other

UG2 (Pt byproduct)

Cliffs

Demand

SOURCE: McKinsey chromite ore cost model

CIF China cost for 42% standard grade

chromite ore

Nominal USD per metric tonne

Note: Scenario assumes that SA will impose export levy on chromite ore of ~50

USD/tonne 1 Operating capacity calculated as 90% of nameplate capacity

68 |

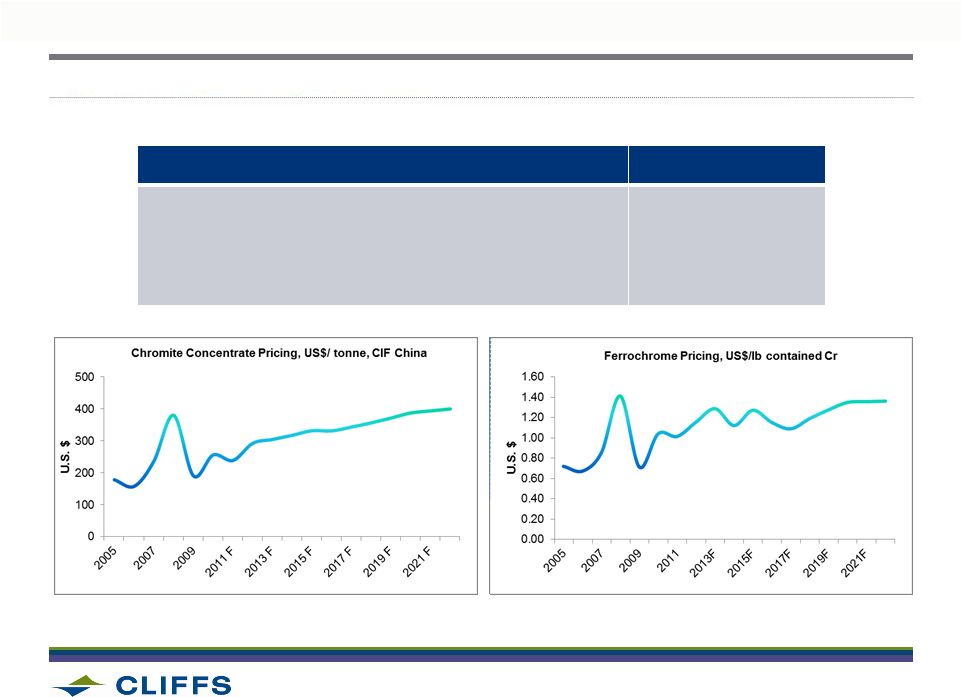

2012 Analyst & Investor Day

LIFE OF MINE

Concentrate ($/ tonne)

Concentrate grade

Ferrochrome ($/ lb cr content)

FeCr grade

$390

43%

$1.40

58%

COST CURVE TRENDS WILL DRIVE HIGHER INDUSTRY PRICING

REALIZED PRICING ASSUMPTIONS

Note: Price outlook excludes impact of proposed South Africa export duties

69

Source: Concentrate Pricing – McKinsey, FeCr Pricing – Heinz H. Pariser/Cliffs |

2012 Analyst & Investor Day

RESOURCE ESTIMATES HAVE EXCEEDED ACQUISITION BASIS BY 96%

CLIFFS PROJECT BASED ON THE BLACK THOR DEPOSIT

•

Measured and indicated resources now stand at 102 Mt

•

Remains open at depth

RESOURCE CATEGORY

(Tons in Millions)

ACQUISITION

Q1 / 10

CURRENT

Q1 / 12

MEASURED & INDICATED

102

INFERRED

69

33

TOTAL

69

135 [+96%]

70

OPPORTUNITY EXISTS TO FURTHER INCREASE RESOURCE FROM BLACK THOR AND

INCORPORATE POTENTIAL FROM BIG DADDY AND BLACK LABEL

|

2012 Analyst & Investor Day

SUCCESSFUL TESTS IN SOUTH AFRICA AND ONTARIO HAVE REDUCED

TECHNICAL RISK

MINERAL PROCESSING

•

Metallurgical testing completed at Mintek (South

Africa) confirmed the process flowsheet and

material balance

FERROCHROME PRODUCTION

•

200 ton pilot furnace test at Mintek (South

Africa) and small scale test at XPS Sudbury

confirmed the following:

•

Metal recoveries were very high (> 90%)

•

DC furnace technology utilizing Cliffs’

concentrate

can

produce

alloy

with

57%

-

60%

chrome within customer chemistry requirements

71 |

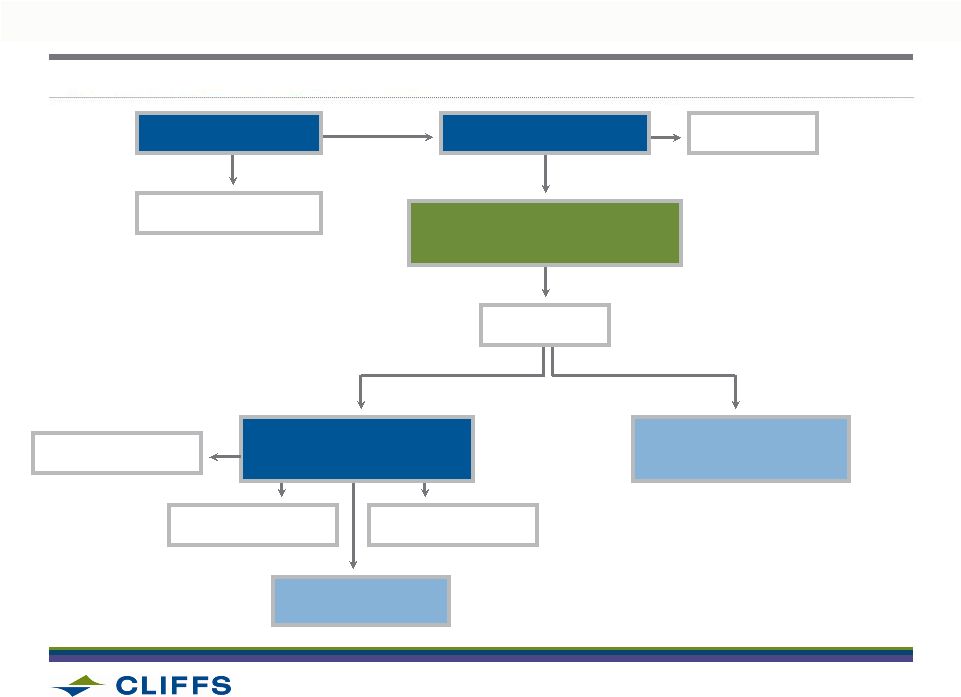

2012 Analyst & Investor Day

MINE

8:1 Strip Ratio

WASTE ROCK

33,200 KTPA

CONCENTRATOR

TAILINGS

TRANSPORATION

~100 70 ton trucks per day

334 km road

EXISTING

RAIL

CHINA ORE

MARKET

1,100 KTPA

FeCr PROCESSING FACILITY

4 DC Furnaces

60 MW each

560 KTPA

FeCR

SLAG

770KTPA

FLUX

220 KTPA

REDUCTANT

350 KTPA

1,100 KTPA

1,220 KTPA

4,150 KTPA

2,320 KTPA

PROJECT SCOPE LOCKED IN FOR FEASIBILITY

72 |

2012 Analyst & Investor Day

Concentrate

FeCr

Natural market for chromite concentrates, as majority of

future demand growth resides in China

China

Competitively low delivered cost of FeCr

Proximity and strong existing relationships

U.S.

Stable, established markets

South Africa dominates, but Cliffs will be highly

competitive on a delivered cost basis

Europe, Japan,

Korea and Taiwan

PRODUCT

MARKET FOCUS

RATIONALE

MARKETING STRATEGY BASED ON THE GEOGRAPHIES OFFERING BEST

OPPORTUNITY FOR CLIFFS

NEARLY 50% OF FECR PRODUCTION ALREADY COMMITTED THROUGH

INDICATIONS OF INTEREST

73 |

2012 Analyst & Investor Day

CLIFFS CASH COSTS IN CHROME ORE AND FERROCHROME WILL BE COMPETITIVE

TOTAL DELIVERED COST PER LB = $0.70

TOTAL DELIVERED COST PER TON = $200

OPEX BY ELEMENT

CONCENTRATE

OPEX BY ELEMENT

FECR

74 |

2012 Analyst & Investor Day

24.4mt

CONSTRUCTION

Permit

Q3 2014

2012

2015

2016

THE OVERALL TIMELINE IS DRIVEN BY PERMITTING

$2.1 –

3.0 B

FEASIBILITY

PHASE

$200 M

$400 M

EARLY

WORKS

2013

2014

•

$90M OF FEASIBILITY STUDY COSTS WILL BE EXPENSED

75

CAPITAL SPEND EXPECTATION |

2012 Analyst & Investor Day

WORLD-CLASS DEPOSIT POSITIONS THE PROJECT FOR ADVANCEMENT AND

SIGNIFICANT RETURNS

KEY ASSUMPTIONS

•

Capital Expenditures between

$2.7 -

$3.6 billion

•

Ferrochrome:

•

Volumes:

560 ktpy

•

Price**:

$1.40/lb contained Cr

•

Cost:

$0.70/lb

•

Concentrate:

•

Volumes:

1,100 ktpy

•

Price**:

$390/tonne

•

Cost:

$200/tonne

* IRR from Pre-feasibility Study

** Life-of-mine realized price

UPSIDE TO CLIFFS’

RETURNS

•

Potential JV partner

•

Pursue project financing

EXPECTED RETURNS

14% -

17%*

76 |

2012 Analyst & Investor Day

CLOSING

•

Megatrends

continue

to

underpin

Cliffs’

strategic

decisions

•

Impressive pipeline of growth and expansion projects

•

Technical competencies and experienced operators position the Company for

successful execution of large-scale projects

•

Cliffs is transitioning to a more sophisticated and methodical economic

value- based management approach including a rigorous capital

investment system •

Cliffs’

portfolio of assets, growth track record, sound financial position, and

impressive cash dividend makes the Company an attractive investment

for shareholders |

2012 Analyst & Investor Day

Q & A |