OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Cliffs Natural Resources Investor Presentation January 2009 Exhibit 99(a) |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Cliffs Natural Resources Investor Presentation January 2009 Exhibit 99(a) |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 1 “Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995 This presentation includes predictive information that is intended to be made as “forward-looking” within the safe harbor protections of the Private Securities Litigation Reform Act of 1995. Although the Company believes that its forward-looking information

is based on reasonable assumptions, such information is subject to risks and uncertainties, which could cause materially different results. Important factors that could

cause actual results to differ materially from those in the forward-looking

information are set forth in the Company’s most recent Annual Report and reports on

Form 10-K and 10-Q, and news releases filed with the Securities and Exchange

Commission. All reports and news releases are available on Cliffs’ website www.cliffsnaturalresources.com. |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Cliffs Natural Resources Overview |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 3 Overview of Cliffs Natural Resources Inc. Cliffs Natural Resources (NYSE: CLF) is an international mining and natural resources company. We are the largest producer of iron ore pellets in North America, a major supplier of direct-shipping lump and fines iron ore out of Australia and a significant

producer of metallurgical coal. With core values of environmental and capital stewardship, our colleagues across the globe endeavor to provide all stakeholders operating and financial transparency as embodied in the Global Reporting Initiative (GRI) framework. Cliffs is executing a strategy designed to achieve scale and focused on serving the world’s

largest and fastest growing steel markets. The Company boasts a conservatively managed balance sheet with low debt and strong liquidity. |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 4 Cliffs’ Strategic Imperatives Scale Through Diversification Shareholder Returns Global Execution Operational Excellence Building Scale Through Diversification Multiple Revenue Streams Product Diversification Geographic Presence Operational Excellence Safety Technical Competencies Operating Efficiencies Global Execution Competencies of the Firm Outlook of Personnel Global Scalability Shareholder Returns Shareholder Value Risk Management “Earning the Right to Grow” |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 5 Cliffs’ Strategy: Geographic and Mineral Diversification GEOGRAPHIES MINERALS • MANGANESE • MOLYBDENUM • FERRO CHROME OTHER LATIN AMERICAN COUNTRIES NORTH AMERICA ASIA-PACIFIC (AUSTRALIA) LATIN AMERICA (BRAZIL) NORTH AMERICAN MET COAL SEABORNE IRON ORE IRON ORE SEABORNE MET COAL |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 6 Cliffs’ Strategy Maintain the core: North American Iron Ore Expand globally and diversify products - North American Coal - Cliffs Asia-Pacific Business Unit - Cliffs Latin American Business Unit Consistently exhibit leadership in sustainable development best practices Capitalize on Company’s unique technological expertise - Concentrating and processing lower-grade ores into high-quality products - Partnering with Kobe Steel to use its ITmk3 technology |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Cliffs Natural Resources Business Segments and Other Ventures |

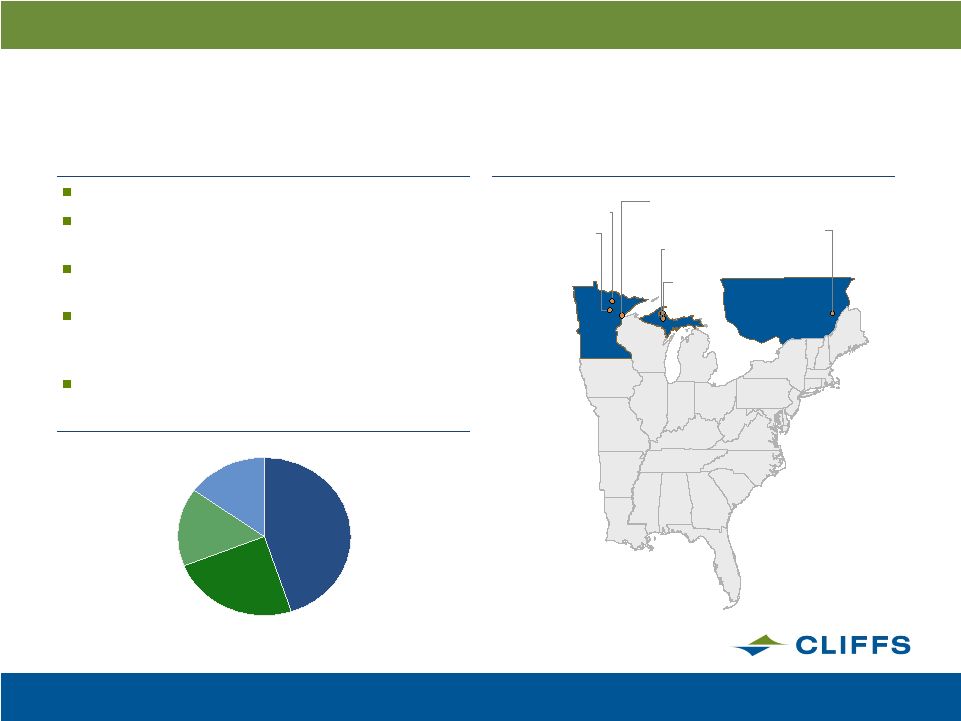

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Source: Company data 1 Ownership is composed of Quebec Catier Mining Company 11% and Minorca 4% 8 Business Overview North America’s largest supplier of iron ore pellets Virtually 100% of production is committed under long-term contracts Customer base includes nearly all U.S.-based, integrated steel producers North American Iron Ore mines managed by Cliffs currently have a rated capacity of 36.5 million tons of iron ore pellet production annually (~25 million equity tons) Over 950 million tons of proven and probable reserves North American Iron Ore Segment Cliffs Managed 45% North America Pellet Producers U.S. Steel 24% Iron Ore Company of Canada 16% Arcelor Mittal 15% Hibbing Taconite United Taconite Northshore Mining Empire Mine Tilden Mine Wabush Mine Geographic Overview 1 |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 9 North American Iron Ore Shipping Routes |

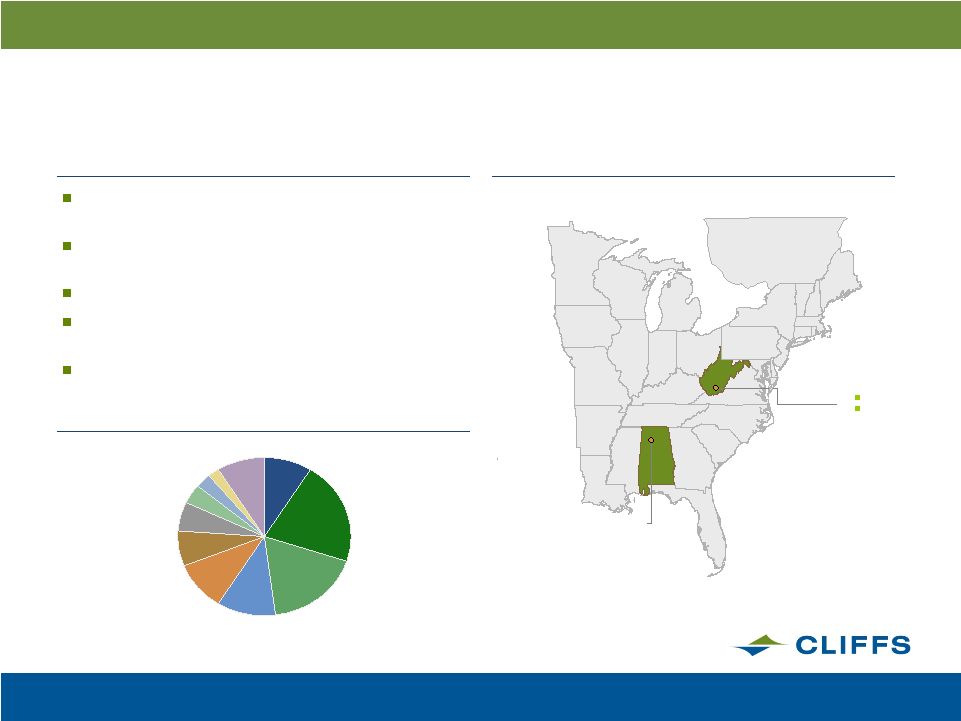

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 10 Source: Company data Business Overview Domestic producer of high-quality, low-volatility metallurgical coal with significant production sold to international markets Three underground mines: Pinnacle Complex in West Virginia, Oak Grove in Alabama Expected to produce 3.6MM short tons in 2008 Positioned near rail or barge lines providing access to international shipping ports Over 240MM tons of in-place proven and probable reserves North American Coal Segment Alpha Natural Resources 21% U.S. Metallurgical Coal Producers Geographic Overview Oak Grove Mine Pinnacle Complex Pinnacle Mine Green Ridge Mine Massey Energy 18% Walter Resources 11% Patriot Coal 10% Cliffs 9% CONSOL 7% United Coal Corp. 6% Arch Coal 4% Foundation Coal 3% Sun Coke 2% All Others 9% |

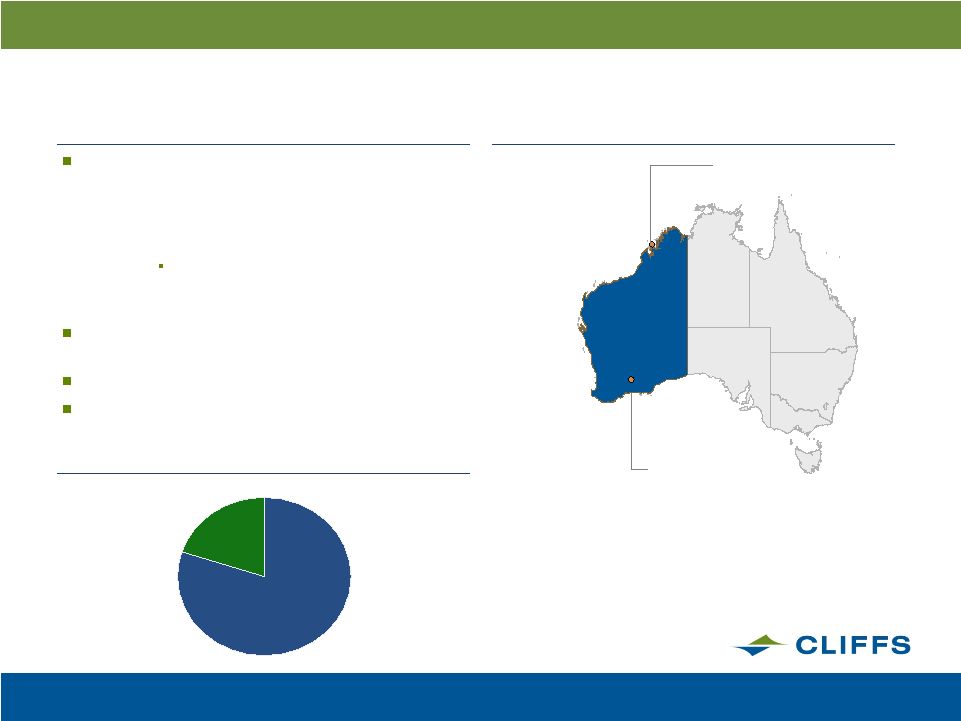

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 11 Source: Company data Business Overview Comprised of wholly owned Portman Limited, an iron ore mining company located in Western Australia: – Koolyanobbing mine (100% owned) – Cockatoo Island Joint Venture (50% owned) Construction of a new seawall expected to be completed in May 2009, extending sales through June 2011 Portman serves the Asian iron ore markets with direct- shipping fines and lump ore 2008 production: ~7.7MM tonnes Over 90MM tonnes of reserves Asia-Pacific Iron Ore Segment China 76% Customer Overview Geographic Overview Portman Cockatoo Island Portman Koolyanobbing Japan 24% |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Reserves Position Measured/Indicated 73.6 Mt Inferred

104.5 Mt Conceptual

150.0 Mt 12 Source: Company data Business Overview 30% owned by Cliffs 70% owned by Anglo-American Consists of a significant iron ore deposit, a 192-kilometer railway connecting mine to port, and 71 hectares of real estate for a loading terminal Majority of production committed under long-term supply agreement with operator of an iron oxide pelletizing plant in Bahrain Project estimated to hit 6.5MM tonnes annual run-rate in second half of 2009 Amapá Project Reserves Overview Geographic Overview Amapá Project |

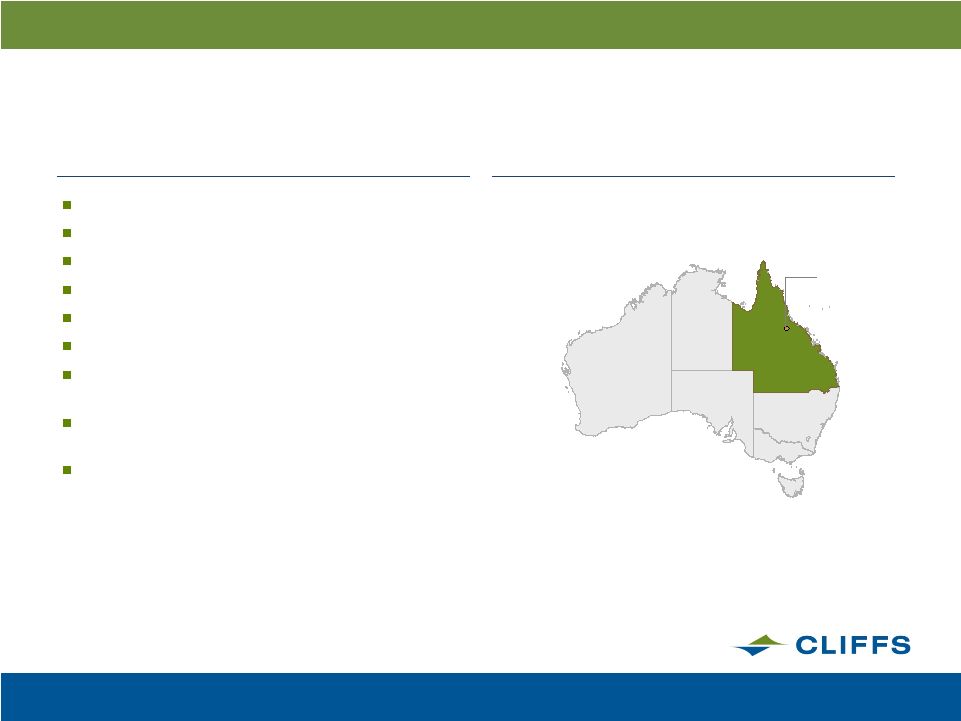

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 13 Source: Company data Business Overview 45% economic interest Located in Queensland 2008E sales volume: 2.1MM tonnes 2009E production: 3-4MM tonnes ~27 million tonnes of reserves Mix of hard coking and thermal coal Supply agreements in place with JFE, China Steel (met) and a Korean utility (thermal) Moves by rail to the Abbot Point Bulk Coal Terminal for export Cliffs’ total investment: $132MM Sonoma Project Geographic Overview Sonoma |

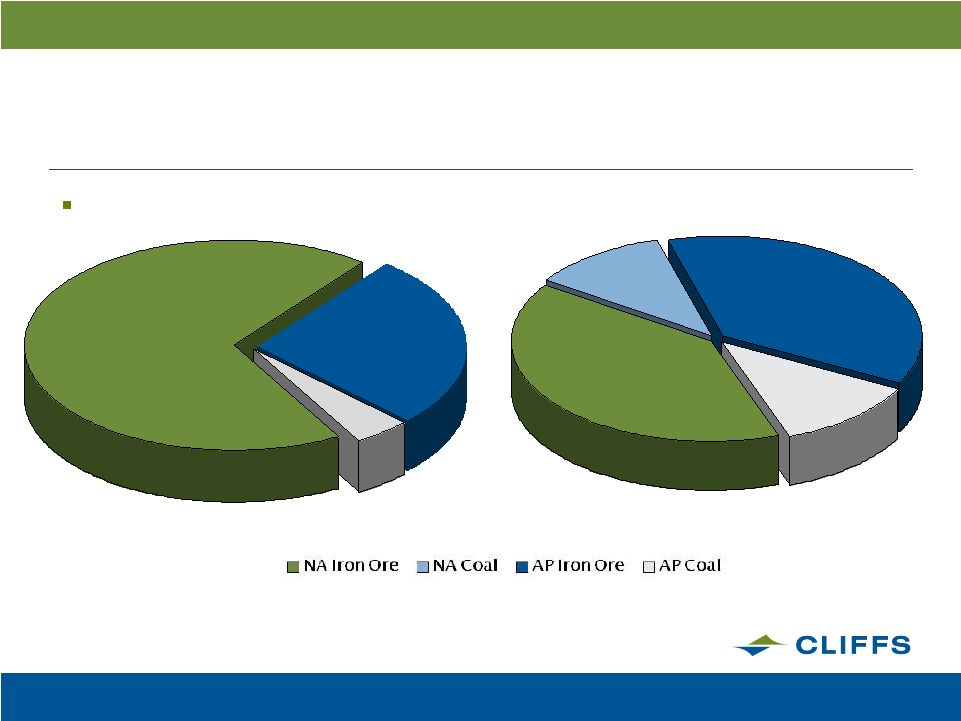

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Sales Margin by Business Segment 2008 Estimate* 69% 26% 5% 2009 Estimate* 40% 11% 37% 12% 14 *2008 Sales Margin Estimate for NA Coal is a Loss Transition demonstrates decision to pursue scale is the right strategy particularly in the current

environment |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Cliffs Natural Resources Strong Long-Term Steel Fundamentals |

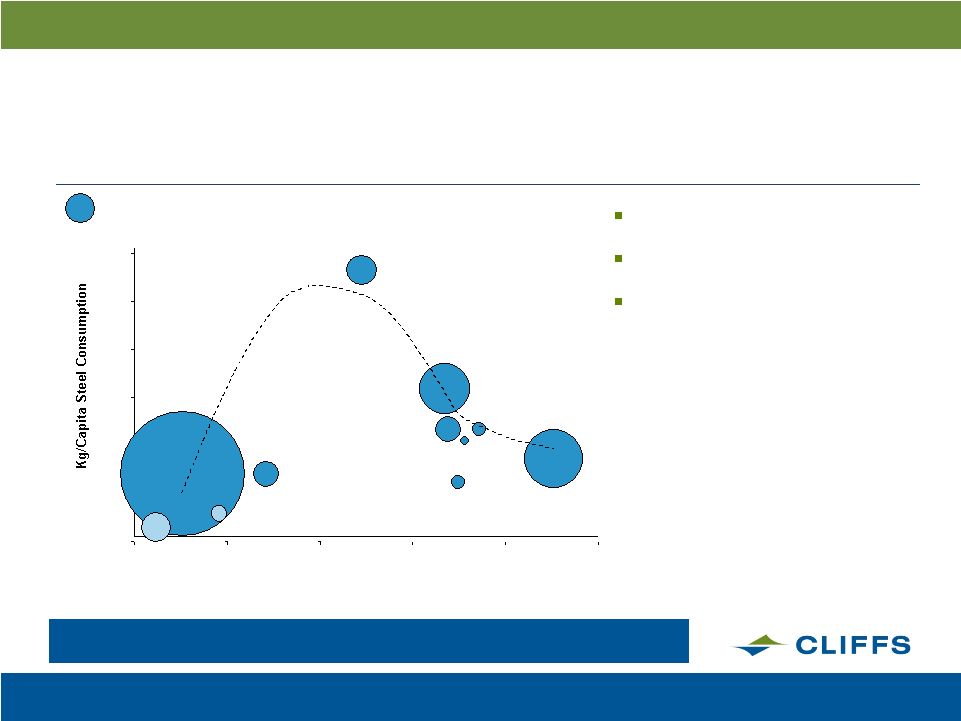

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 16 Steel Is a Large and Vital Global Business UK 1200 1000 800 600 400 200 0 Purchasing Power Parity GDP/Capita 0 10 20 30 40 50 Germany Canada U.S . Australia Japan Korea Russia China Overall, China’s steel consumption is three times that of the U.S. On a per-capita basis, however, China consumes only half as much as the U.S. The U.S. remains a net importer of steel Approx. 50mm tonnes Note: Size of bubbles represents size of absolute steel consumption 2007 in each

respective country BRIC economic growth is substantial and appears

inevitable Brazil India Steel consumption potential (2007) |

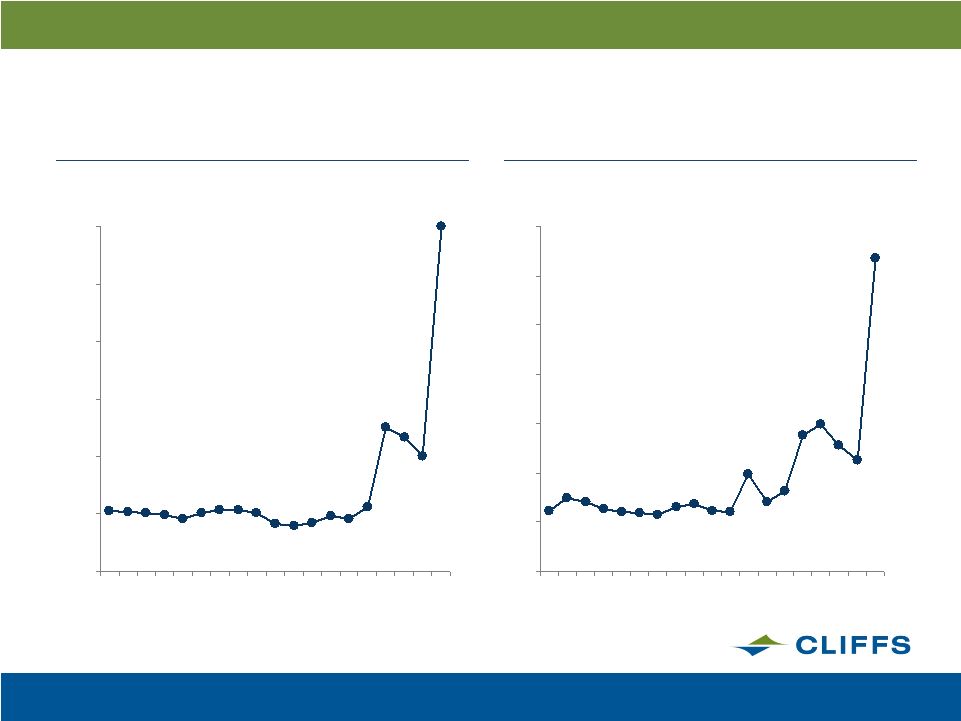

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 17 Strong Coal Pricing Trends 0 20 40 60 80 100 120 140 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008E Note: CAPP steam coal index – CSX, 12,500 Btu, 1# Rail Source: Bloomberg, Platts Met coal prices ($/tonne)

Steam coal prices ($/ton) 0 50 100 150 200 250 300 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008E Source: Metal Strategies, equity research |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 18 Iron Ore Trends Recently Strong, Though Expected to Be Pressured in 2009 0 25 50 75 100 125 150 1990 1992 1994 1996 1998 2000 2002 2004 2006 2008 Pellets Lump Fines Iron ore prices ($/tonne based on 64% Iron Content) Source: Cliffs and Tex Reports $141 $129 $93 86% -3% 5.8% 86.6% 71% 19% 9.5% 96.5% 71% 19% 9.5% 79.9% |

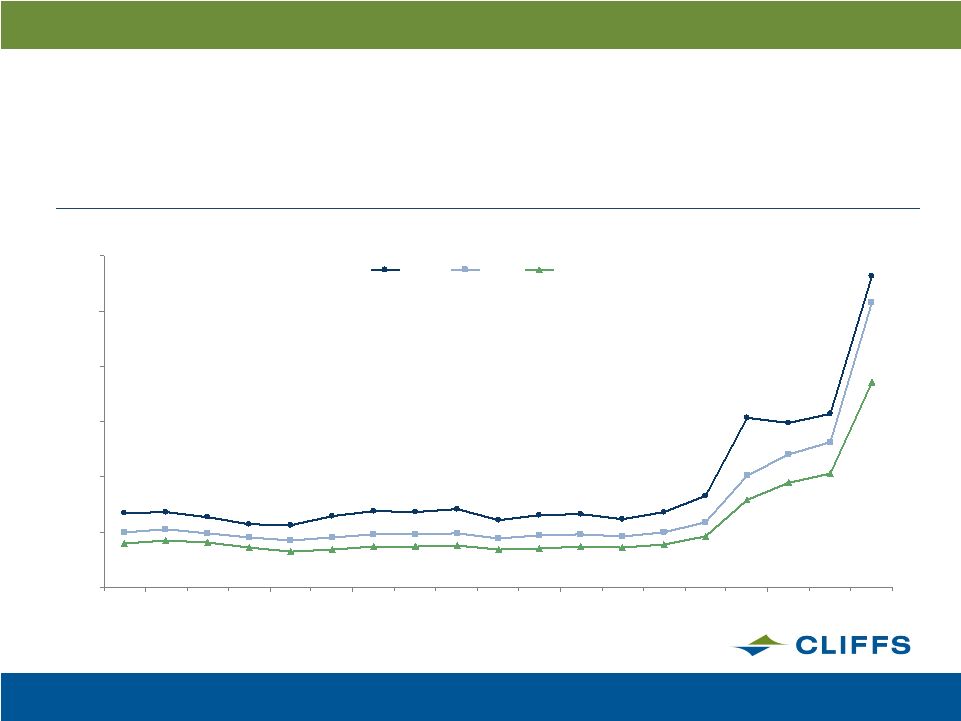

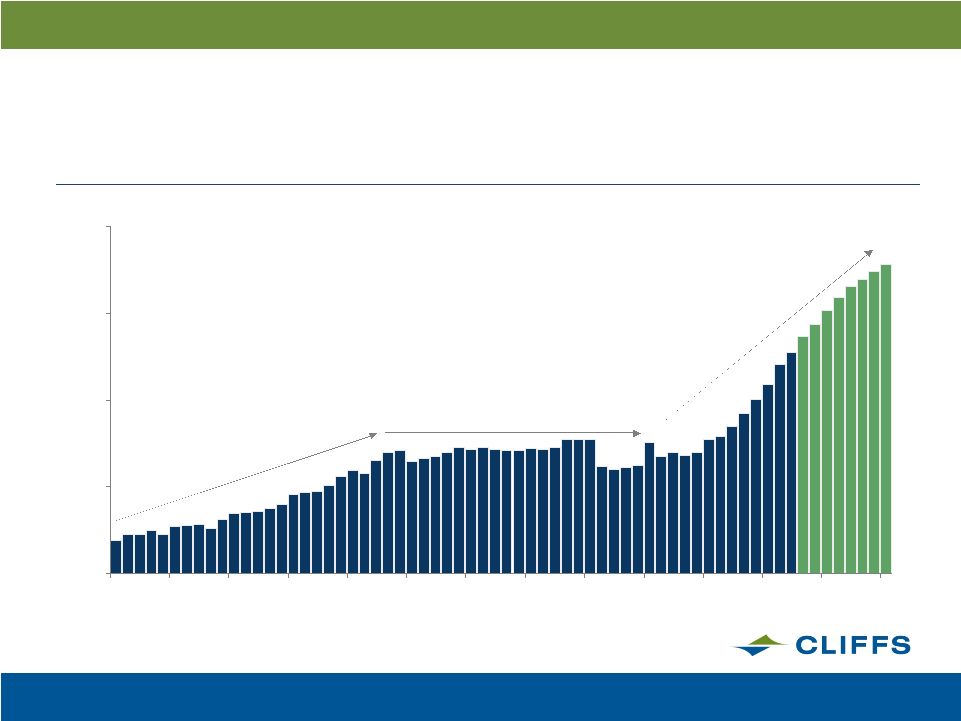

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 19 Long-Term Steel Demand Will Drive Our Business Global steel demand (millions of tonnes) 0 500 1,000 1,500 2,000 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 2010E 2015E Post-World War II reconstruction and Japanese industrialization CAGR 1950-1973: 5.9% Post-oil crisis slowdown CAGR 1973-1995: 0.4% BRIC cycle CAGR 1995-2015: 4.4% Source: IISI, Metal Strategies |

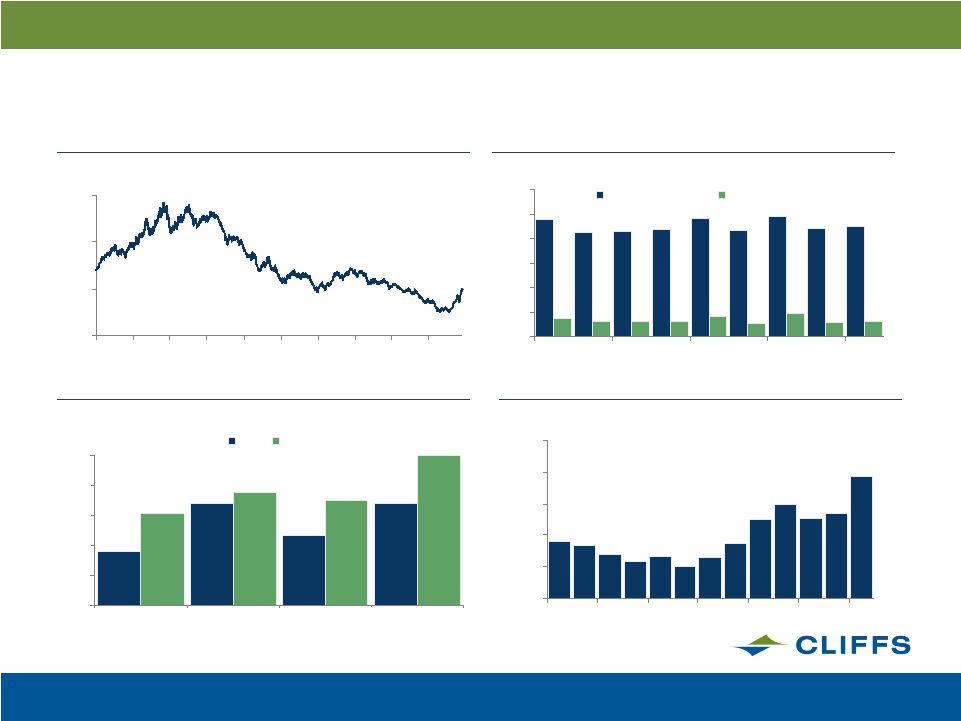

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 20 U.S. Steel Industry Is Particularly Well-Positioned Source: FactSet, Metal Strategies, AME Dollar vs. Euro ($/€) Market share of top 3 U.S. producers (%)

0.50 0.75 1.00 1.25 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 U.S. steel consumption (millions of tonnes) 0 25 50 75 100 125 150 2000 2002 2004 2006 2008E US steel consumption US steel imports HRC prices ($/tonne)

0 200 400 600 800 1,000 1996 2000 2004 2008E 0% 20% 40% 60% 80% 100% HRC Plate CRC Tin Mill 2000 2006 • Mitigates imports and strengthens exports • U.S. is a net importer • U.S. is becoming a low-cost producer • U.S. steel industry continues to consolidate and attract foreign investment |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Production Cuts Announced by Global Steel Firms 21 Output Cuts Are Faster and Deeper Versus Prior Cycles Jan. 09 Dec. 08 Nov. 08 Oct. 08 ArcelorMittal Cutting liquid steel production by 7.7% Cutting output by 30% AK Steel Idled operations in Ohio and Kentucky Baosteel Cut output by delaying the reopening of blast furnace China Steel (Taiwan) Plans to reduce output by 10% in 2009 Corus Production cuts of 30% into second-quarter 2009 JFE Steel Revises production cut to 26% in second half of 2009 Cutting production by 9.6% in second half of 2009 Nippon Steel Cutting 2009 output by 4- 4.5 million tonnes Novolipetsk Idling two blast furnaces POSCO Extended first-ever output cut through first quarter of 2009 Will cut steel production by 200,000 tonnes in Dec. and 370,000 tonnes in Jan. Severstal Idled a blast furnace, cutting output by 1.1 million tonnes Cut Oct. production by 25%-30% in Italy, Russia, and U.S. Shougang Group, Hebei Iron & Steel, Anyang Iron & Steel, and Shandong Iron & Steel All announce output cuts ranging between 0% and 20% United States Steel Idled three plants to lower production |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP 22 Current Business Segment Production¹ Current Annualized Business Run Rate North American Iron Ore 22MM total long tons 15MM equity tons North American Coal 3.5MM short tons Asia-Pacific Iron Ore 7.5MM tonnes Sonoma Project 3MM to 4MM total tonnes 1.4MM to 1.8MM equity tonnes 1 Company estimates |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Cliffs’ Strengthening Liquidity Position 23 Dec. 31, 2008¹ Dec. 31, 2007 Cash and Cash Equivalents $180.0 $157.1 Borrowing Capacity Under Existing Revolving Credit Facility $600.0 $343.8 Total Available Liquidity $780.0 $500.9 Cash From Operations (TTM) $700-$750 $288.9 Debt Obligations $525.0 $641.9 Shareholders’ Equity $1,700.0 $1,163.7 (Dollars in Millions) ¹Company estimates |

OPERATIONAL EXCELLENCE | A WORLD LEADER | STEWARDSHIP Cliffs Natural Resources Investor Presentation January 2009 |