UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN

PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. ___)

| | | | | | | | | | | | | | |

| x | Filed by the Registrant | | o | Filed by a Party other than the Registrant |

| | | | | |

| Check the appropriate box: |

| o | Preliminary Proxy Statement |

| o | Confidential, For Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| o | Definitive Additional Materials |

| o | Soliciting Material Pursuant to §240.14a-12 |

CLEVELAND-CLIFFS INC.

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

| | | | | |

| Payment of Filing Fee (Check the appropriate box): |

| x | No fee required. |

| o | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) Title of each class of securities to which transaction applies: ____________ |

| (2) Aggregate number of securities to which transaction applies: ____________ |

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11

(set forth the amount on which the filing fee is calculated and state how it was determined): ____________ |

| (4) Proposed maximum aggregate value of transaction: ____________ |

| (5) Total fee paid: ____________ |

| o | Fee paid previously with preliminary materials. |

| o | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) Amount Previously Paid: ____________ |

| (2) Form, Schedule or Registration Statement No.: ____________ |

| (3) Filing Party: ____________ |

| (4) Date Filed: ____________ |

| | |

| LETTER TO OUR SHAREHOLDERS |

|

|

March 15, 2021

Dear Fellow Cleveland-Cliffs Shareholders:

In the 173 years of our existence as a company, 2020 proved to be the most seminal year in our history. In a year that will be forever known as the year of the COVID-19 pandemic, Cleveland-Cliffs transformed itself from a mining company supplying iron ore pellets to North American steel companies into the largest flat-rolled steel producer in North America. This transformation was accomplished through the acquisitions of AK Steel and ArcelorMittal USA, allowing us to combine many of the best assets, capabilities and technology in the domestic steel industry. With our much larger operational footprint, we anticipate significant synergies from asset optimization, economies of scale and streamlining overhead.

Our competitive advantage as an integrated steel company is based on our ability to operate the entire production flow from the extraction of iron ore, to steelmaking, rolling, coating, and all the way downstream to the manufacturing of complex auto-parts and components. These resources provide us with 100% of our iron ore requirements and maximum control of our costs and over the quality of our products.

Another differentiating factor of Cleveland-Cliffs is that we prioritize value over volume and aim for Return on Invested Capital. Not tonnage sold; not market share. More than any empty speech you can find pretty much anywhere in any other company around, that is what makes us a shareholder friendly company.

Also in 2020 we completed construction and began production at our new Direct Reduction plant in Toledo, Ohio. This natural-gas-based plant is the most modern of its kind in the world, and produces high-quality hot briquetted iron (HBI) which is a more environmentally friendly alternative to scrap and imported pig iron used in the steelmaking process. Both the production and use of HBI supports our strategy to reduce greenhouse gas emissions associated with the production of steel. Moreover, with the current scarcity of domestic prime scrap in the marketplace, our timing to bring this product to market in 2021 could not be better. Very importantly, our Toledo plant is the first Direct Reduction plant that was built with the capability to utilize hydrogen as reductant, partially replacing natural gas when hydrogen becomes commercially available.

With our new leadership position in the steel industry, it is very important to acknowledge that climate change is one of the most important issues impacting our industry and our planet, and to take action to mitigate that change. In January 2021 we publicly announced our commitment to reduce greenhouse gas emissions by 25% by the year 2030. This commitment will cover both Scope 1 and Scope 2 emissions across our new, larger footprint. Although our company has transformed, we will continue to prioritize the environmentally and socially responsible operation of the Cleveland-Cliffs businesses, as we have done in the past.

As we look back on 2020, we cannot forget the challenges triggered by the COVID-19 pandemic as it had a significant impact on our business and our operations. At the start of the pandemic, we quickly developed proactive company-wide processes and protocols that protected our employees while maintaining our productivity. Our decisive action early in the pandemic was key in driving our business achievements during the balance of 2020. We experienced minimal business disruptions during the remainder of the year and actually continued to lay the groundwork for our exponential growth.

On behalf of our 25,000 employees, thank you very much for believing in manufacturing in the United States and for supporting Cleveland-Cliffs.

Sincerely,

Lourenco Goncalves

Chairman, President and Chief Executive Officer

| | |

| NOTICE OF ANNUAL MEETING OF SHAREHOLDERS |

|

|

To Be Held on April 28, 2021

11:30 a.m. EDT

Online at www.virtualshareholdermeeting.com/CLF2021

To the Shareholders of Cleveland-Cliffs Inc.:

In light of the ongoing COVID-19 pandemic and to support the health and well-being of our employees and shareholders, the 2021 Annual Meeting of Shareholders of Cleveland-Cliffs Inc. will be held in a virtual meeting format via live audio webcast on the Internet at www.virtualshareholdermeeting.com/CLF2021, at 11:30 a.m., EDT, on Wednesday, April 28, 2021 for the following purposes:

1.To elect as directors the twelve candidates nominated by the Board of Directors to act until the next Annual Meeting of Shareholders or until their respective successors are duly elected and qualified;

2.To approve an amendment to our Fourth Amended Articles of Incorporation, as amended, to increase the number of Cliffs' authorized common shares from 600,000,000 to 1,200,000,000;

3.To approve the Cleveland-Cliffs Inc. 2021 Nonemployee Directors' Compensation Plan;

4.To approve the Cleveland-Cliffs Inc. 2021 Equity and Incentive Compensation Plan;

5.To approve, on an advisory basis, our named executive officers' compensation;

6.To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to serve for the 2021 fiscal year; and

7.To transact such other business, if any, as may properly come before the 2021 Annual Meeting or any adjournment thereof.

In order to vote on the matters brought before the 2021 Annual Meeting, you may vote via the Internet, vote by telephone, complete and mail the proxy card, or vote online during the 2021 Annual Meeting, as explained on the proxy card. To participate in the 2021 Annual Meeting at www.virtualshareholdermeeting.com/CLF2021, you must enter the 16-digit control number found on your proxy card or your voting instruction form. You do not need to attend the virtual meeting in order to vote your shares.

Holders of record of our common shares at the close of business on March 1, 2021 are entitled to notice of, and to vote at, the 2021 Annual Meeting or any adjournments thereof.

By Order of the Board of Directors,

James D. Graham

Executive Vice President, Chief Legal Officer & Secretary

March 15, 2021

Cleveland, Ohio

| | | | | | | | |

YOUR VOTE IS IMPORTANT. YOU MAY VOTE BY INTERNET, BY TELEPHONE, BY MAILING THE ENCLOSED PROXY CARD, OR BY VOTING ONLINE DURING THE 2021 ANNUAL MEETING. |

The proxy statement and Cliffs’ 2020 Annual Report for the 2020 fiscal year are available at www.proxyvote.com. These materials also are available on Cliffs’ website at www.clevelandcliffs.com under "Investors" and then “Financial Information." If your shares are not registered in your own name, please follow the voting instructions from your bank, broker, nominee or other shareholder of record to vote your shares. |

| | |

| PROXY STATEMENT TABLE OF CONTENTS |

|

|

| | | | | |

| PROXY STATEMENT SUMMARY | |

QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING | |

| MEETING INFORMATION | |

| CORPORATE GOVERNANCE | |

Board Leadership Structure | |

| Board’s Role in Risk Oversight | |

| Board Meetings and Committees | |

Identification and Evaluation of Director Candidates | |

| Communications With Directors | |

| Code of Business Conduct and Ethics | |

| Independence and Related Party Transactions | |

| DIRECTOR COMPENSATION | |

Director Compensation for 2020 | |

| PROPOSAL 1 – ELECTION OF DIRECTORS | |

| Information Concerning Director Nominees | |

OWNERSHIP OF EQUITY SECURITIES OF THE COMPANY | |

| PROPOSAL 2 – APPROVAL OF AN AMENDMENT TO OUR FOURTH AMENDED ARTICLES OF INCORPORATION, AS AMENDED, TO INCREASE THE NUMBER OF AUTHORIZED COMMON SHARES | |

| PROPOSAL 3 – APPROVAL OF THE CLEVELAND-CLIFFS INC. 2021 NONEMPLOYEE DIRECTORS' COMPENSATION PLAN | |

| PROPOSAL 4 – APPROVAL OF THE CLEVELAND-CLIFFS INC. 2021 EQUITY AND INCENTIVE COMPENSATION PLAN | |

| EQUITY COMPENSATION PLAN INFORMATION | |

| |

| |

| | | | | |

| |

| COMPENSATION DISCUSSION AND ANALYSIS | |

| Executive Summary | |

Executive Compensation Philosophy and Core Principles | |

| Development and Oversight of Executive Compensation | |

| Analysis of 2020 Compensation Decisions | |

| Retirement and Deferred Compensation Benefits | |

| Supplementary Compensation Policies | |

| COMPENSATION COMMITTEE REPORT | |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | |

| COMPENSATION-RELATED RISK ASSESSMENT | |

| EXECUTIVE COMPENSATION | |

| Executive Compensation Tables and Narratives | |

| Potential Payments Upon Termination or Change in Control | |

| CEO Pay Ratio | |

| PROPOSAL 5 – APPROVAL, ON AN ADVISORY BASIS, OF OUR NAMED EXECUTIVE OFFICERS' COMPENSATION | |

| AUDIT COMMITTEE REPORT | |

| PROPOSAL 6 – RATIFICATION OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| INFORMATION ABOUT SHAREHOLDER PROPOSALS AND COMPANY DOCUMENTS | |

| OTHER INFORMATION | |

| ANNEXES | |

| ANNEX A | |

| ANNEX B | |

| ANNEX C | |

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting. Page references are supplied to help you find further information.

| | | | | | | | |

2021 ANNUAL MEETING OF SHAREHOLDERS | |

| |

DATE AND TIME: | Wednesday, April 28, 2021, at 11:30 a.m. EDT |

PLACE: | Online at www.virtualshareholdermeeting.com/CLF2021 |

RECORD DATE: | March 1, 2021 |

VOTING: | Shareholders of record are entitled to vote by Internet at www.proxyvote.com; by telephone at 1-800-690-6903; by completing and returning the enclosed proxy card by mail; or by voting online during the 2021 Annual Meeting of Shareholders (the "2021 Annual Meeting") at www.virtualshareholdermeeting.com/CLF2021 (beneficial holders must obtain a legal proxy from their broker, banker, nominee or other shareholder of record granting the right to vote). |

PROXY MATERIALS: | This proxy statement, the accompanying proxy card and our 2020 Annual Report will be made available on or about March 15, 2021 to shareholders of record as of March 1, 2021 (the "Record Date"). |

| | | | | |

ATTENDANCE AND PARTICIPATION AT THE 2021 ANNUAL MEETING | |

| |

Our virtual 2021 Annual Meeting will be conducted on the Internet via live audio webcast. Shareholders will be able to participate online and submit questions in advance of the 2021 Annual Meeting by visiting www.virtualshareholdermeeting.com/CLF2021, beginning at 11:00 a.m. EDT on April 28, 2021. Shareholders will be able to vote their shares electronically during the 2021 Annual Meeting. To participate in the 2021 Annual Meeting, you will need the 16-digit control number included on your proxy card or your voting instruction form. The 2021 Annual Meeting will begin promptly at 11:30 a.m. EDT. We encourage you to access the 2021 Annual Meeting prior to the start time. Online access will begin at 11:00 a.m. EDT. Guests may listen to a live audio webcast of the virtual 2021 Annual Meeting by visiting www.virtualshareholdermeeting.com/CLF2021 but are not entitled to participate. The virtual 2021 Annual Meeting platform is fully supported across browsers (Internet Explorer, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most updated version of applicable software and plugins. Participants should ensure they have a strong Internet connection wherever they intend to participate in the 2021 Annual Meeting. Participants should also allow plenty of time to log in and ensure that they can hear streaming audio prior to the start of the 2021 Annual Meeting. To ensure your shares are properly represented, please vote your proxy promptly even if you plan to join the 2021 Annual Meeting. QUESTIONS Lourenco Goncalves, Cliffs’ Chairman, President and Chief Executive Officer, will be available to answer questions submitted by shareholders at the conclusion of the 2021 Annual Meeting. Shareholders may submit questions for the 2021 Annual Meeting after logging in, beginning at 11:00 a.m. EDT on April 28, 2021. If you wish to submit a question, you may do so by logging into the virtual meeting platform at www.virtualshareholdermeeting.com/CLF2021, typing your question into the “Ask a Question” field, and clicking “Submit.” Please submit any questions before the start time of the 2021 Annual Meeting. Additional information regarding the ability of shareholders to ask questions during the 2021 Annual Meeting, related rules of conduct and other materials for the 2021 Annual Meeting will be available at www.virtualshareholdermeeting.com/CLF2021. TECHNICAL DIFFICULTIES Technical support, including related technical support phone numbers, will be available on the virtual meeting platform at www.virtualshareholdermeeting.com/CLF2021 beginning at 11:00 a.m. EDT on April 28, 2021 through the conclusion of the 2021 Annual Meeting. |

| | | | | | | | | | | |

VOTING MATTERS | BOARD VOTE RECOMMENDATION | PAGE REFERENCE (for more detail) |

|

| | |

Proposal 1 | Election of Directors | FOR each Director Nominee | |

Proposal 2 | Approval of an Amendment to Our Fourth Amended Articles of Incorporation, as Amended, to Increase the Number of Authorized Common Shares | FOR | |

Proposal 3 | Approval of the Cleveland-Cliffs Inc. 2021 Nonemployee Directors' Compensation Plan | FOR | |

Proposal 4 | Approval of the Cleveland-Cliffs Inc. 2021 Equity and Incentive Compensation Plan | FOR | |

Proposal 5 | Approval, on an Advisory Basis, of Our Named Executive Officers' Compensation ("Say-on-Pay") | FOR | |

Proposal 6 | Ratification of Independent Registered Public Accounting Firm | FOR | |

| | | | | | | | | | | | | | | | | |

DIRECTOR NOMINEES RECOMMENDED BY THE BOARD | |

|

| NAME | AGE | DIRECTOR SINCE | POSITION | COMMITTEE MEMBERSHIPS (1) |

| Lourenco Goncalves | 63 | 2014 | Chairman, President and Chief Executive Officer | Strategy* |

| Douglas C. Taylor | 56 | 2014 | Lead Director | Compensation*

Strategy |

| John T. Baldwin | 64 | 2014 | Director | Audit*

Compensation |

| Robert P. Fisher, Jr. | 66 | 2014 | Director | Audit

Governance |

| William K. Gerber | 67 | 2020 | Director | Audit |

| Susan M. Green (2) | 61 | 2007 | Director | Governance |

| M. Ann Harlan | 61 | 2019 | Director | Audit |

| Ralph S. Michael, III | 66 | 2020 | Director | Compensation

Governance* |

| Janet L. Miller | 67 | 2019 | Director | Audit

Governance |

| Eric M. Rychel | 47 | 2016 | Director | Audit

Compensation |

| Gabriel Stoliar | 66 | 2014 | Director | Strategy |

| Arlene M. Yocum | 63 | 2020 | Director | Strategy |

* Denotes committee chair (1)Full committee names are: Audit – Audit Committee; Compensation – Compensation and Organization Committee; Governance – Governance and Nominating Committee; and Strategy – Strategy and Sustainability Committee. (2)In October 2019, Ms. Green submitted a letter to our Board Chair and our Governance Committee Chair tendering her resignation from the Cliffs Board of Directors (the "Board") for having reached the 12-year term limit contained in our Corporate Governance Guidelines. At its October 2019 meeting and upon recommendation by the Governance Committee, the Board considered the status of Ms. Green's situation as the designee of the United Steelworkers (the "USW") to the Board. The Board determined to exercise its permitted discretion under our Corporate Governance Guidelines and unanimously voted to reject Ms. Green's resignation, with Ms. Green abstaining from the vote. See "Corporate Governance - Independence and Related Party Transactions."

|

| | | | | |

INCREASE OF NUMBER OF AUTHORIZED SHARES | |

| |

| We are seeking an amendment to our Fourth Amended Articles of Incorporation, as amended (our "Articles of Incorporation"), in order to increase the number of authorized common shares from 600,000,000 to 1,200,000,000, which will result in an increase in the total number of authorized shares from 607,000,000 to 1,207,000,000. We are seeking this increase to enhance our flexibility for possible future actions, such as financings, corporate mergers, acquisitions, stock splits, stock dividends, equity compensation awards or other general corporate purposes. |

| | | | | |

2021 NONEMPLOYEE DIRECTORS' COMPENSATION PLAN | |

| |

We are seeking your approval of the Cleveland-Cliffs Inc. 2021 Nonemployee Directors' Compensation Plan (the "2021 Directors Plan"). If approved, the 2021 Directors Plan would continue to authorize the Governance Committee to provide equity-based compensation in the form of restricted shares, restricted stock units, deferred shares, dividend equivalents and certain other awards denominated or payable in, or otherwise based on, Cliffs common shares or factors that may influence the value of our shares for the purpose of providing our nonemployee directors with incentives and rewards for service and performance that are aligned with the long-term interests of our shareholders. We are seeking approval to authorize the issuance of up to 750,000 additional common shares under the 2021 Directors Plan. |

| | | | | |

2021 EQUITY AND INCENTIVE COMPENSATION PLAN | |

| |

We are seeking your approval of the Cleveland-Cliffs Inc. 2021 Equity and Incentive Compensation Plan (the "2021 Employees Plan"). If approved, the 2021 Employees Plan would continue to authorize the Compensation Committee to provide equity-based compensation in the form of stock options, appreciation rights, restricted shares, restricted stock units, cash incentive awards, performance shares, performance units, dividend equivalents, and certain other awards denominated or payable in, or otherwise based on, Cliffs common shares or factors that may influence the value of our shares for the purpose of providing our officers and other key employees with incentives and rewards for service or performance that are aligned with the long-term interests of our shareholders. We are seeking approval to authorize the issuance of up to 26,000,000 new common shares under the 2021 Employees Plan, plus the shares remaining available under our current employee equity plan document, all as further described in the 2021 Employees Plan. |

| | | | | |

SHAREHOLDER ENGAGEMENT (summary) | |

| |

| We strive to maintain open communication with the investment community. During 2020 and early 2021, we reached out to our top 25 shareholders, representing approximately 73% of our outstanding common shares, to solicit their feedback on our compensation program, company strategy and performance, corporate governance, sustainability and other topics. See the section entitled "Shareholder Engagement" in the Compensation Discussion and Analysis ("CD&A") section for more details as to what we heard and how we responded. |

| | | | | |

EXECUTIVE COMPENSATION PHILOSOPHY AND CORE PRINCIPLES | |

| |

Our guiding executive compensation principles, as established by the Compensation Committee for 2020, were as follows: 1.Align short-term and long-term incentives with results delivered to shareholders; 2.Be transparent, ensure that executives and shareholders understand our executive compensation programs, including the objectives, mechanics, and compensation levels and opportunities provided; 3.Design an incentive plan that focuses on performance objectives tied to our business plan (including profitability-related and cost control objectives), relative performance objectives tied to market conditions (including relative total shareholder return, measured by share price appreciation plus dividends, if any) and performance against other key objectives tied to our business strategy (including safety); 4.Provide competitive fixed compensation elements over the short-term (base salary) and long-term (equity and retirement benefits) to encourage long-term retention of our key executives; and 5.Continue to structure programs as in prior years to align with corporate governance best practices (such as not providing "gross-ups" related to change in control payments, using "double-trigger" vesting in connection with a change in control for equity awards, using Share Ownership Guidelines and maintaining a clawback policy related to incentive compensation for our executive officers). |

| | | | | |

2020 EXECUTIVE COMPENSATION SUMMARY | |

| |

| The numbers in the following table showing the 2020 compensation of our named executive officers (the "NEOs") were determined in the same manner as the numbers in the corresponding columns in the 2020 Summary Compensation Table (the "SCT") (provided later in this proxy statement); however, they do not include information regarding changes in pension value and non-qualified deferred compensation earnings and information regarding all other compensation, each as required to be presented in the SCT under the rules of the U.S. Securities and Exchange Commission (the "SEC"). As such, this table should not be viewed as a substitute for the SCT: |

| | | | | | | | | | | | | | | | | | | | | | | |

| NAME | PRINCIPAL POSITION (AS OF 12/31/2020) | SALARY

($) | BONUS

($) | STOCK AWARDS

($) | OPTION AWARDS ($) | NON-EQUITY INCENTIVE PLAN COMPENSATION

($) | TOTAL

($) |

| Lourenco Goncalves | Chairman, President and Chief Executive Officer | 1,810,016 | | 3,800,000 | | 4,127,534 | | — | | 7,472,000 | | 17,209,550 | |

| Keith A. Koci | Executive Vice President, Chief Financial Officer | 489,006 | | 500,000 | | 543,095 | | — | | 500,000 | | 2,032,101 | |

| Clifford T. Smith | Executive Vice President, Chief Operating Officer | 706,218 | | 900,000 | | 1,018,304 | | — | | 1,406,940 | | 4,031,462 | |

| Terry G. Fedor | Executive Vice President, Chief Operating Officer, Steel Mills | 531,699 | | 550,000 | | 597,410 | | — | | 1,056,940 | | 2,736,049 | |

| Maurice D. Harapiak | Executive Vice President, Human Resources & Chief Administration Officer | 531,699 | | 550,000 | | 597,410 | | — | | 1,056,940 | | 2,736,049 | |

| | | | | |

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM | |

| |

| As a matter of good corporate governance, we are asking our shareholders to ratify the selection of Deloitte & Touche LLP as our independent registered public accounting firm for 2021. |

| | | | | |

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | |

| |

| This proxy statement contains statements that constitute "forward-looking statements" within the meaning of the federal securities laws. As a general matter, forward-looking statements relate to anticipated trends and expectations rather than historical matters. Forward-looking statements are subject to risks and uncertainties relating to Cliffs’ operations and business environment that are difficult to predict and may be beyond our control. Such risks and uncertainties may cause actual results to differ materially from those expressed or implied by the forward-looking statements. These risks and uncertainties include, but are not limited to, the risks and uncertainties described in Part I., Item 1A., "Risk Factors," in our Annual Report on Form 10-K for the year ended December 31, 2020, and those described from time to time in our future reports filed with the SEC. Except to the extent required by law, Cliffs does not undertake to update the forward-looking statements included in this proxy statement to reflect the impact of circumstances or events that may arise after the date the forward-looking statements were made. |

| | |

| QUESTIONS AND ANSWERS ABOUT THE MEETING AND VOTING |

|

|

1. What proposals are to be presented at the 2021 Annual Meeting?

The purpose of the 2021 Annual Meeting is to: (1) elect the twelve directors nominated by the Board in this proxy statement; (2) approve an amendment to our Articles of Incorporation to increase the number of authorized common shares; (3) approve the 2021 Directors Plan; (4) approve the 2021 Employees Plan; (5) approve, on an advisory basis, our NEOs' compensation; (6) ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to serve for the 2021 fiscal year; and (7) conduct such other business as may properly come before the 2021 Annual Meeting.

2. What is the difference between a “shareholder of record” and a “beneficial owner"?

These terms describe the manner in which your shares are held. If your shares are registered directly in your name through Broadridge, our transfer agent, you are the registered holder, or “shareholder of record." If your shares are held through a bank, broker, nominee or other registered holder, you are considered the “beneficial owner” of those shares.

3. How does the Board recommend that I vote?

The Board unanimously recommends that you vote:

•FOR ALL of the twelve individuals nominated by the Board for election as directors;

•FOR the approval of an amendment to our Articles of Incorporation to increase the number of authorized common shares;

•FOR the approval of the 2021 Directors Plan;

•FOR the approval of the 2021 Employees Plan;

•FOR the approval, on an advisory basis, of our NEOs' compensation; and

•FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to serve for the 2021 fiscal year.

4. Who is entitled to vote at the 2021 Annual Meeting?

The record date for the 2021 Annual Meeting is March 1, 2021 (the "Record Date"). On the Record Date, we had outstanding 498,906,779 common shares, $0.125 par value per share. All common shareholders of record as of the Record Date are entitled to vote at the 2021 Annual Meeting. In this proxy statement, we refer to our common shares as our "shares" and the holders of such shares as our "shareholders."

5. How do I vote?

You may vote using any of the following methods:

Shareholders of Record. If your shares are registered in your name, you may vote online during the virtual 2021 Annual Meeting at www.virtualshareholdermeeting.com/CLF2021 or you may vote by proxy. If you decide to vote by proxy, you may do so over the Internet, by telephone or by mail.

•Over the Internet. After reading the proxy materials and with your proxy card in front of you, you may use a computer to access the website www.proxyvote.com. You will be prompted to enter your control number from your proxy card. This number will identify you as a shareholder of record. Follow the simple instructions that will be given to you to record your vote.

•By telephone. After reading the proxy materials and with your proxy card in front of you, you may call the toll-free number appearing on the proxy card, using a touch-tone telephone. You will be prompted to enter your control number from your proxy card. This number will identify you as a shareholder of record. Follow the simple instructions that will be given to you to record your vote.

•By mail. If you received a paper copy of the proxy card by mail, after reading the proxy materials, you may mark, sign and date your proxy card and return it in the prepaid and addressed envelope provided.

The Internet and telephone voting procedures have been set up for your convenience and have been designed to authenticate your identity, allow you to submit voting instructions and confirm that those instructions have been recorded properly.

Shares Held by Bank or Broker. If your shares are held by a bank, broker, nominee or other shareholder of record, that entity will provide you with separate voting instructions. All nominee share interests may view the proxy materials using the link www.proxyvote.com.

If your shares are held in the name of a brokerage firm, your shares may be voted even if you do not provide the brokerage firm with voting instructions. Brokerage firms have the authority under applicable rules to vote shares for which their customers do not provide voting instructions on certain “routine” matters. When a proposal is not a routine matter and the brokerage firm has not received voting instructions from the beneficial owner of the shares with respect to that proposal, the brokerage firm cannot vote the shares on that proposal. This is referred to as a “broker non-vote.” The amendment to our Articles of Incorporation to increase the number of authorized common shares and the ratification of Deloitte & Touche LLP as our registered independent public accounting firm are considered routine matters for which a brokerage firm that holds your shares may vote your shares without your instructions. The election of directors, the approval of the 2021 Directors Plan, the approval of the 2021 Employees Plan and the approval, on an advisory basis, of our NEOs' compensation are not considered routine matters, and, therefore, a brokerage firm that holds your shares may not vote your shares for such proposals without your instructions.

6. What can I do if I change my mind after I vote?

You may revoke your proxy at any time before the polls are closed for voting at the 2021 Annual Meeting by (i) executing and submitting a revised proxy bearing a later date; (ii) providing a written revocation to the Secretary of Cliffs; or (iii) voting online during the virtual 2021 Annual Meeting at www.virtualshareholdermeeting.com/CLF2021. If you do not hold your shares directly, you should follow the instructions provided by your bank, broker, nominee or other shareholder of record to revoke your previously voted proxy.

7. What vote is required to approve each proposal?

With respect to Proposal 1, the nominees receiving a plurality vote of the shares will be elected. However, under our majority voting policy (adopted by the Board) in an uncontested election, any director-nominee that is elected by a plurality vote but fails to receive a majority of votes cast (which excludes abstentions and broker non-votes) is expected to tender his or her resignation, which resignation will be considered by the Governance Committee and the Board.

With respect to Proposal 2, the proposed amendment to our Articles of Incorporation to increase the number of authorized common shares will pass with the affirmative vote of the holders of a majority of our outstanding common shares.

With respect to Proposal 3, approval of the 2021 Directors Plan requires the affirmative vote of a majority of the shares present, in person or represented by proxy, at the 2021 Annual Meeting and entitled to vote on the proposal.

With respect to Proposal 4, approval of the 2021 Employees Plan requires the affirmative vote of a majority of the shares present, in person or represented by proxy, at the 2021 Annual Meeting and entitled to vote on the proposal.

With respect to Proposal 5, approval, on an advisory basis, of our NEOs' compensation requires the affirmative vote of a majority of the shares present, in person or represented by proxy, at the 2021 Annual Meeting and entitled to vote on the proposal.

With respect to Proposal 6, the ratification of Deloitte & Touche LLP as our independent registered public accounting firm for the 2021 fiscal year will pass with the affirmative vote of a majority of the shares present, in person or represented by proxy, at the 2021 Annual Meeting and entitled to vote on the proposal.

8. Can I attend the 2021 Annual Meeting in person?

To support the health and well-being of our employees and shareholders, the 2021 Annual Meeting will be held exclusively online, with no option to attend in person. If you plan to attend the 2021 Annual Meeting virtually, you will need to visit www.virtualshareholdermeeting.com/CLF2021 and use your 16-digit control number to log into the meeting. If you do not have a 16-digit control number, you may still attend the virtual 2021 Annual Meeting as a guest in listen-only mode. We encourage shareholders to log in to the website and access the webcast early, beginning approximately 30 minutes before the 11:30 a.m. start time. If you experience technical difficulties, please contact the technical support telephone number posted on www.virtualshareholdermeeting.com/CLF2021.

The accompanying proxy is solicited by the Board for use at the 2021 Annual Meeting and any adjournments or postponements thereof. This proxy statement, the accompanying proxy card, and our 2020 Annual Report will be made available on or about March 15, 2021 to our shareholders of record as of the Record Date.

PROXY MATERIALS

Notice of Internet Availability of Proxy Materials

In accordance with rules adopted by the SEC, we are using the Internet as our primary means of furnishing proxy materials to our shareholders. Accordingly, most shareholders will not receive paper copies of our proxy materials.

We will instead send our shareholders a Notice of Internet Availability of Proxy Materials with instructions for accessing the proxy materials and voting electronically over the Internet or by telephone, also known as Notice and Access. The notice also provides information on how shareholders may request paper copies of our proxy materials. We believe electronic delivery of our proxy materials will help us reduce the environmental impact and costs of printing and distributing paper copies and improve the speed and efficiency by which our shareholders can access these materials.

On or about March 15, 2021, we will mail to each shareholder of record as of the Record Date (other than those shareholders who previously had requested paper delivery of proxy materials) a Notice of Internet Availability of Proxy Materials containing instructions on how to access and review the proxy materials, including this proxy statement and the 2020 Annual Report, on the Internet and how to access a proxy card to vote via the Internet or by telephone.

The close of business on March 1, 2021 has been fixed as the Record Date for the 2021 Annual Meeting, and only shareholders of record at that time will be entitled to vote.

The Notice of Internet Availability of Proxy Materials will contain a 16-digit control number that shareholders will need to access the proxy materials, to request paper or email copies of the proxy materials, and to vote their shares via the Internet or by telephone.

Householding

We are permitted to send a single copy of the Notice of Internet Availability of Proxy Materials or set of proxy materials (if paper delivery was previously requested) to shareholders who share the same last name and address. This procedure is called “householding” and is designed to reduce our printing and postage costs and reduce our environmental impact by printing fewer paper copies. If you are the beneficial owner, but not the record holder, of Cliffs shares, your bank, broker, nominee or other shareholder of record may only deliver one copy of the Notice of Internet Availability of Proxy Materials or set of proxy materials and, as applicable, any other proxy materials that are made available until such time as you or other shareholders sharing your address notify your nominee that you want to receive separate copies. Beneficial owners sharing an address who are receiving multiple copies of the Notice of Internet Availability of Proxy Materials or sets of proxy materials and who wish to receive a single copy or set in the future will need to contact their bank, broker, nominee or other shareholder of record. A shareholder of record who wishes to receive a separate copy of the Notice of Internet Availability of Proxy Materials or set of proxy materials, or shareholders who share the same address that are currently receiving multiple copies of the Notice of Internet Availability of Proxy Materials or sets of proxy materials and who wish to receive a single copy or set, either now or in the future, may submit this request by writing to our Secretary at Cleveland-Cliffs Inc., 200 Public Square, Suite 3300, Cleveland, Ohio 44114, or by calling our Investor Relations department at (800) 214-0739, and it will be delivered promptly.

Proxy Solicitation

We will bear the cost of solicitation of proxies. We have engaged Okapi Partners LLC to assist in the solicitation of proxies for fees and disbursements not expected to exceed approximately $30,000 in the aggregate. In addition, employees and representatives of the Company may solicit proxies, and we will request that banks and brokers or other similar agents or fiduciaries transmit the proxy materials to beneficial owners for their voting instructions, and we will reimburse them for their expenses in so doing.

Voting Rights

Shareholders of record on the Record Date are entitled to vote at the 2021 Annual Meeting. On the Record Date, there were outstanding 498,906,779 common shares entitled to vote at the 2021 Annual Meeting. A majority of the common shares entitled to vote must be represented at the 2021 Annual Meeting, in person or by proxy, to constitute a quorum and to transact business. Each outstanding share is

entitled to one vote in connection with each item to be acted upon at the 2021 Annual Meeting. You may submit a proxy by electronic transmission via the Internet, by telephone or by mail, as explained on your proxy card.

Voting of Proxies

The common shares represented by properly authorized proxies will be voted as specified. It is intended that the shares represented by properly authorized proxies on which no specification has been made will be voted: (1) FOR ALL of the twelve nominees for director named herein or such substitute nominees as the Board may designate; (2) FOR the approval of an amendment to our Articles of Incorporation to increase the number of authorized common shares; (3) FOR the approval of the 2021 Directors Plan; (4) FOR the approval of the 2021 Employees Plan; (5) FOR the approval, on an advisory basis, of our NEOs' compensation; (6) FOR the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm to serve for the 2021 fiscal year; and (7) at the discretion of the persons named as proxies on all other matters that may properly come before the 2021 Annual Meeting.

Cumulative Voting for Election of Directors

If notice in writing shall be given by any shareholder to the President, an Executive Vice President or the Secretary of the Company, not less than 48 hours before the time fixed for the holding of the 2021 Annual Meeting, that such shareholder desires that the voting for the election of directors shall be cumulative, and if an announcement of the giving of such notice is made upon the convening of the 2021 Annual Meeting by the Chairman or Secretary or by or on behalf of the shareholder giving such notice, each shareholder shall have the right to cumulate such voting power as such shareholder possesses at such election. Under cumulative voting, a shareholder may cast for any one nominee as many votes as shall equal the number of directors to be elected, multiplied by the number of such shareholder's shares. All such votes may be cast for a single nominee or may be distributed among any two or more nominees as such shareholder may desire. If cumulative voting is invoked, and unless contrary instructions are given by a shareholder who signs a proxy, all votes represented by such proxy will be cast in such manner and in accordance with the discretion of the person acting as proxy as will result in the election of as many of our Board’s nominees as is possible.

Counting Votes

The results of shareholder voting will be tabulated by the inspector of elections appointed for the 2021 Annual Meeting. We intend to treat properly authorized proxies as “present” for purposes of determining whether a quorum has been achieved at the 2021 Annual Meeting. Abstentions and broker non-votes will also be counted for purposes of determining whether a quorum is present.

Abstentions and broker non-votes will have no effect with respect to the election of directors.

Abstentions will have the effect of votes against, and broker non-votes will have no effect with respect to, the vote to adopt the 2021 Directors Plan, the vote to adopt the 2021 Employees Plan and the advisory vote regarding the compensation of our NEOs.

Abstentions will have the effect of votes against the vote to approve the proposed amendment to our Articles of Incorporation to increase the number of authorized common shares and the ratification of Deloitte & Touche LLP as our independent registered public accounting firm. The vote to adopt an amendment to our Articles of Incorporation to increase the number of authorized common shares and the ratification of Deloitte & Touche LLP as our independent registered public accounting firm are considered routine matters and, as a result, we do not expect to have broker non-votes with respect to these proposals.

BOARD LEADERSHIP STRUCTURE

The Chairman of the Board is Lourenco Goncalves, who is also our President and Chief Executive Officer ("CEO"). Pursuant to our Corporate Governance Guidelines, when the positions of Chairman and CEO are held by one individual or if the Chairman is a Cliffs executive, then the Governance Committee recommends to the Board a Lead Director. Douglas C. Taylor currently serves as our Lead Director. The Board believes that this leadership structure is the optimal structure to guide our Company and to maintain the focus to achieve our business goals and represents our shareholders' interests.

Under this leadership structure, Mr. Goncalves, as Chairman, is responsible for overseeing and facilitating communications between our management and the Board, for setting the meeting schedules and agendas, and leading Board discussions during Board meetings. In his combined role, Mr. Goncalves has the benefit of Cliffs personnel to help with extensive meeting preparation, responsibility for the process of recordkeeping of all Board deliberations, and the benefit of direct daily contact with management and the internal audit department. The Chairman works closely with the Lead Director in setting meeting agendas and in ensuring that essential information is communicated effectively to the Board.

The Lead Director’s responsibilities include: chairing executive session meetings of the independent directors; leading the Board’s processes for evaluating the CEO; presiding at all meetings of the Board at which the Chairman is not present; serving as a liaison between the Chairman and the independent directors; and meeting separately at least annually with each director.

This leadership structure provides our Chairman with the readily available resources to manage the affairs of the Board while allowing our Lead Director to provide effective and timely advice and guidance. Our governance process is based on our Corporate Governance Guidelines, which are available on our website at www.clevelandcliffs.com under "Investors" then "Corporate Governance".

In accordance with the corporate governance listing standards of the New York Stock Exchange (the "NYSE"), our non-management directors meet at regularly scheduled executive sessions without management present. These meetings take place at least quarterly.

BOARD'S ROLE IN RISK OVERSIGHT

The Board as a whole oversees our enterprise risk management ("ERM") process. The Board executes its risk oversight role in a variety of ways. The full Board regularly discusses the key strategic risks facing Cliffs.

The Board delegates oversight responsibility for certain areas of risk to its committees. Generally, each committee oversees risks that are associated with the purpose of and responsibilities delegated to that committee. For example, the Audit Committee oversees risks related to accounting and financial reporting. In addition, pursuant to its charter, the Audit Committee periodically reviews our ERM process. The Compensation Committee monitors risks related to development and succession planning for the CEO and executive officers, as well as compensation and related policies and programs for executive and non-executive officers and management. The Governance Committee handles risks with respect to board composition, membership and structure, and corporate governance matters. The Strategy Committee oversees our strategic plan and annual management objectives and oversees, advises on and monitors opportunities and risks relating to our strategic plan and our sustainability goals and initiatives. As appropriate, the respective committees’ Chairpersons provide reports to the full Board.

Management is responsible for the day-to-day management of our risks. The ERM process includes the involvement of management in the identification, assessment, mitigation and monitoring of a wide array of potential risks, from strategic to operational to compliance-related risks throughout the Company. Executive management regularly reports to the Board or relevant committees regarding Cliffs’ key risks and the actions being taken to manage these risks.

The Company believes that its leadership structure supports the risk oversight function of the Board. Except for the Strategy Committee, independent directors chair our committees, which are each involved with risk oversight, and all directors actively participate in the Board’s risk oversight function.

BOARD MEETINGS AND COMMITTEES

Our directors discharge their responsibilities in a variety of ways, including reviewing reports to directors, visiting our facilities, corresponding with the CEO, and conducting telephone conferences with the CEO and other directors regarding matters of interest and concern to Cliffs. In addition, our directors have regular access to our senior management. All committees regularly report their activities, actions and recommendations to the full Board.

During 2020, our Board held thirteen meetings. Each director attended, either in person or by telephone conference, at least 95% of the Board and committee meetings held while serving as a director or committee member in 2020. Pursuant to Board policy, all serving directors are expected to attend all Board and committee meetings, as well as our annual meeting of shareholders. All of our then-serving directors who were standing for re-election attended the 2020 Annual Meeting.

The Board currently has four standing committees: the Audit Committee, the Compensation Committee, the Governance Committee and the Strategy Committee. Each of these four committees has a charter that can be found on our website at www.clevelandcliffs.com under "Investors," then “Corporate Governance” and then “Committees.” A biographical overview of the members of our committees can be found beginning on page 17.

Board Committees

| | | | | | | | |

| AUDIT COMMITTEE |

| |

| MEMBERS: 6 | INDEPENDENT: 6 | 2020 MEETINGS: 7 |

| AUDIT COMMITTEE FINANCIAL EXPERTS: The Board has determined that each of John T. Baldwin, William K. Gerber and Eric M. Rychel is an "audit committee financial expert" within the meaning of Item 407 of Regulation S-K under the federal securities laws. |

RESPONSIBILITIES: |

▪Reviews with our management, the internal auditors and the independent registered public accounting firm, the adequacy and effectiveness of our system of internal control over financial reporting ▪Reviews significant accounting matters ▪Reviews quarterly unaudited financial information prior to public release ▪Approves the audited financial statements prior to public distribution ▪Approves our assertions related to internal controls prior to public distribution ▪Reviews any significant changes in our accounting principles or financial reporting practices ▪Evaluates our independent registered public accounting firm; discusses with the independent registered public accounting firm their independence and considers the compatibility of non-audit services with such independence ▪Annually selects and retains our independent registered public accounting firm to examine our financial statements and reviews, approves and retains the services performed by our independent registered public accounting firm ▪Approves management’s appointment, termination or replacement of the head of Internal Audit ▪Conducts a legal compliance review at least annually |

| CHAIR: John T. Baldwin | MEMBERS: Robert P. Fisher, Jr., William K. Gerber, M. Ann Harlan, Janet L. Miller and Eric M. Rychel |

| | | | | | | | |

| COMPENSATION AND ORGANIZATION COMMITTEE |

| |

| MEMBERS: 4 | INDEPENDENT: 4 | 2020 MEETINGS: 6 |

RESPONSIBILITIES: |

▪Oversees development and implementation of Cliffs' compensation policies and programs for executive officers ▪Ensures that criteria for awards under incentive plans relate to Cliffs' strategic plan and operating performance objectives and approves equity-based awards ▪Reviews and evaluates CEO and executive officer performance and approves compensation (with the CEO's compensation being subject to ratification by the independent members of the Board) ▪Recommends to the Board the election of officers ▪Assists with management development and succession planning ▪Reviews employment and severance arrangements and oversees regulatory compliance regarding compensation matters and related party transactions ▪Obtains the advice of outside experts with regard to compensation matters ▪May, in its discretion, delegate all or a portion of its duties and responsibilities to a subcommittee and may delegate certain equity award grant authority to officers of Cliffs, subject to applicable law For more information about the role of executives and outside advisers in our executive compensation process, see the CD&A section of this proxy statement. |

CHAIR: Douglas C. Taylor | MEMBERS: John T. Baldwin, Ralph S. Michael, III and Eric M. Rychel |

| | | | | | | | |

| | |

| GOVERNANCE AND NOMINATING COMMITTEE |

| |

| MEMBERS: 4 | INDEPENDENT: 4 | 2020 MEETINGS: 5 |

| RESPONSIBILITIES: |

▪Oversees annual review of our Corporate Governance Guidelines and our Guidelines for Selection of Nonemployee Directors and periodic review of external developments in corporate governance matters generally ▪Periodically reviews and makes recommendations regarding the CEO's authorized levels for corporate expenditures ▪Establishes and maintains, with the Audit Committee, procedures for review of related party transactions ▪Monitors the Board governance process and provides counsel to the CEO on Board governance and other matters ▪Recommends changes in membership and responsibility of Board committees ▪Acts as the Board’s Nominating Committee and Proxy Committee in the election of directors ▪Annually reviews and administers our director compensation plans and benefits, and makes recommendations to the Board with respect to compensation plans and equity-based plans for directors ▪Other responsibilities include oversight of annual evaluation of the Board and CEO and monitoring risks associated with Board organization, membership, structure and succession planning |

CHAIR: Ralph S. Michael, III | MEMBERS: Robert P. Fisher, Jr., Susan M. Green and Janet L. Miller |

| | | | | | | | |

| STRATEGY AND SUSTAINABILITY COMMITTEE |

| |

| MEMBERS: 4 | INDEPENDENT: 3 | 2020 MEETINGS: 5 |

| RESPONSIBILITIES: |

▪Oversees Cliffs’ strategic plan and annual management objectives ▪Monitors risks relevant to Cliffs' strategy, including operational, safety, environmental, social and governance risks ▪Provides advice and assistance with developing our current and future strategy ▪Provides follow up oversight with respect to the comparison of actual results with estimates for major projects and post-acquisition integration efforts ▪Assesses Cliffs’ overall capital structure and its capital allocation priorities ▪Assists management in determining the resources necessary to implement Cliffs’ strategic and financial plans ▪Considers the merits and risks of potential acquisitions, joint ventures. emerging growth opportunities and strategic alliances ▪Acts in an advisory capacity with respect to Cliffs' sustainability strategies, its commitment to environmental stewardship, its focus on health and safety of employees and other stakeholders, and its corporate social responsibility initiatives ▪Reviews and approves any sustainability reports that may be published by Cliffs from time to time |

CHAIR: Lourenco Goncalves | MEMBERS: Gabriel Stoliar, Douglas C. Taylor and Arlene M. Yocum |

IDENTIFICATION AND EVALUATION OF DIRECTOR CANDIDATES

Shareholder Nominees

The policy of the Governance Committee is to consider properly submitted shareholder nominations for candidates for membership on the Board as described below under “Identifying and Evaluating Nominees for Directors.” In evaluating nominations, the Governance Committee seeks to achieve a balance of knowledge, experience and capability on the Board and to address the membership criteria set forth below under “Board Diversity and Director Qualifications.” Any shareholder nominations proposed for consideration by the Governance Committee should include: (i) complete information as to the identity and qualifications of the proposed nominee, including name, address, present and prior business and/or professional affiliations, education and experience, and particular fields of expertise; (ii) an indication of the nominee’s consent to serve as a director if elected; and (iii) the reasons why, in the opinion of the recommending shareholder, the proposed nominee is qualified and suited to be a director. Shareholder nominations should be addressed to Cleveland-Cliffs Inc., 200 Public Square, Suite 3300, Cleveland, Ohio 44114, Attention: Secretary. Our Regulations provide that at any meeting of shareholders at which directors are to be elected, only persons nominated as candidates will be eligible for election.

Board Diversity and Director Qualifications

The Governance Committee considers board diversity as it deems appropriate and consistent with our Corporate Governance Guidelines, the charter of the Governance Committee and other criteria established by the Board. The Governance Committee’s goal in selecting directors for nomination to the Board generally is to seek to create a well-balanced team that combines diverse experience, skill and intellect of seasoned directors in order to enable us to pursue our strategic objectives. The Governance Committee has not reduced the qualifications for service on the Board to a checklist of specific standards or minimum qualifications, skills or qualities. Rather, the Governance Committee seeks, consistent with the vacancies existing on the Board at any particular time and the interplay of a particular candidate’s experience with the experience of other directors, to select individuals whose business experience, knowledge, skills, diversity and integrity would be considered a desirable addition to the Board and any committees thereof. In addition, the Governance Committee annually conducts a review of incumbent directors in order to determine whether a director should be nominated for re-election to the Board.

Identifying and Evaluating Nominees for Directors

The Governance Committee utilizes a variety of methods for identifying and evaluating nominees for director. The Governance Committee regularly reviews the appropriate size of the Board and whether any vacancies on the Board are expected due to retirement or otherwise. In the event that vacancies are anticipated, or otherwise arise, the Governance Committee considers various potential candidates for director. Applicable considerations include: whether the current composition of the Board is consistent with the criteria described in our Corporate Governance Guidelines; whether the candidate submitted possesses the qualifications that generally are the basis for selection of candidates to the Board; and whether the candidate would be considered independent under the rules of the NYSE and our standards with respect to director independence. Candidates may come to the attention of the Governance Committee through current Board members, professional search firms, shareholders or other persons. As described above, the Governance Committee considers properly submitted shareholder nominations for candidates for the Board. Following verification of the recommending shareholder’s status, recommendations are considered by the Governance Committee at its next regularly scheduled meeting. Final approval of any candidate is determined by the full Board.

COMMUNICATIONS WITH DIRECTORS

Shareholders and interested parties may communicate with the Lead Director, our non-management directors as a group or the Board by writing to the Lead Director at Cleveland-Cliffs Inc., 200 Public Square, Suite 3300, Cleveland, Ohio 44114. As set forth in the Corporate Governance Guidelines, the Lead Director will report to the full Board any communications that are directed at all members of the Board. The Secretary routinely filters communications that are solicitations, complaints, unrelated to Cliffs or Cliffs' business or determined to pose a possible security risk to the addressee.

CODE OF BUSINESS CONDUCT AND ETHICS

We have adopted a Code of Business Conduct and Ethics (the "Ethics Code"), which applies to all of our directors, officers and employees. The Ethics Code is available on our website at www.clevelandcliffs.com under "Investors" then "Corporate Governance." We intend to post amendments to or waivers from our Ethics Code (to the extent applicable to our principal executive officer, principal financial officer or principal accounting officer) on our website. References to our website and the contents thereof do not constitute incorporation by reference of the information contained on our website, and such information is not part of this proxy statement.

INDEPENDENCE AND RELATED PARTY TRANSACTIONS

Of our current directors, the Board has determined that each of Messrs. Baldwin, Fisher, Gerber, Michael, Rychel, Stoliar and Taylor and Mses. Green, Harlan, Miller and Yocum has no material relationship with us (either directly or as a partner, shareholder or officer of an organization that has a relationship with us) and is independent within the NYSE director independence standards. Mr. Goncalves is our Chairman, President and CEO, and, as such, is not considered independent.

We have a written Related Party Transactions Policy (our "RPT Policy"), pursuant to which we only will enter into a related party transaction if our CEO and Chief Legal Officer determine that the transaction is comparable to those that could be obtained in arm’s-length dealings with an unrelated third party. If the transaction is approved by our CEO and Chief Legal Officer, then the transaction also must be approved by the disinterested members of our Audit Committee. Under our RPT Policy, any related party transactions are reviewed by the Audit Committee at each quarterly meeting. After review, the disinterested members of the Audit Committee either approve or disapprove the proposed transaction. Management is responsible for updating the Audit Committee at each quarterly meeting as to any material changes to those transactions that the Audit Committee has previously approved. For purposes of our RPT Policy, we define a related person as any person who is a director, executive officer, nominee for director or an immediate family member of a director, an executive officer or a nominee for director. We define a related party transaction as a transaction, agreement or relationship in which Cliffs was, is or will be a participant, the amount of the transaction exceeds $120,000, and a related person has or will have a direct or indirect material interest. However, compensation paid by Cliffs for service as a director or executive officer of the Company is not deemed to be a related party transaction, even if the aggregate amount involved exceeds $120,000.

Since January 1, 2020, there have been two transactions in which Cliffs was a participant that each exceeded $120,000, and in which a related person had or will have a direct or material interest, as described below. We recognize that transactions between us and any of our directors or executive officers can present potential or actual conflicts of interest and create the appearance that our decisions are based on considerations other than the best interests of our shareholders.

1. In September 2016, Cliffs hired Mr. Celso Goncalves, the son of our Chairman, President and CEO, as our Assistant Treasurer. Effective January 1, 2018, Mr. Celso Goncalves was promoted to Vice President, Treasurer and named an officer of Cliffs. Effective March 13, 2020, Mr. Celso Goncalves was promoted to Senior Vice President, Finance & Treasurer and continues to serve as an officer of Cliffs. With respect to fiscal year 2020, Mr. Celso Goncalves was paid a salary of $325,000, earned incentive compensation under the Management Performance Incentive Plan of $292,500, earned a discretionary bonus of $292,500 in recognition of extraordinary efforts in connection with completing two transformative acquisitions during 2020, and participated in other regular and customary employee benefit plans and programs generally available to our employees. In addition, in March 2020, Mr. Celso Goncalves was granted a Restricted Stock Unit Award of 22,437 common shares, which had a grant date value of $109,268, and a Performance Share Award of 22,437 common shares, which had a grant date value of $109,268, as well as a Performance Cash Award of $165,750. The foregoing compensation arrangement is considered a related party transaction under our RPT Policy. Mr. Celso Goncalves' compensation was reviewed and approved by our Audit Committee in accordance with our RPT Policy.

2. Our subsidiary, Cleveland-Cliffs Steel Corporation (f/k/a AK Steel Corporation) ("AK Steel Corporation"), has contracted on an arm's-length basis for work with Morgan Engineering Systems, Inc. ("Morgan Engineering"), which is a company owned by Mr. Mark Fedor. Mr. Mark Fedor is the brother of Mr. Terry Fedor, who serves as our Executive Vice President, Chief Operating Officer, Steels Mills and is an NEO. AK Steel Corporation's business relationship with Morgan Engineering existed prior to our acquisition of AK Steel Corporation on March 13, 2020, and AK Steel Corporation and our other subsidiaries may determine to continue to engage Morgan Engineering in the ordinary course of business to provide services on an arm's-length basis in future years, and such services may exceed the $120,000 annual threshold under our RPT Policy. For example, during 2020, Morgan Engineering was paid approximately $700,000 for work performed for AK Steel Corporation. Mr. Terry Fedor was not involved in the initial engagement of Morgan Engineering by AK Steel Corporation or any of our other subsidiaries and has agreed to abstain from any future actions related to Morgan Engineering. In accordance with our RPT Policy, during 2020 the CEO and the Chief Legal Officer, as well as the Audit Committee, approved and ratified transactions with Morgan Engineering.

We have entered into indemnification agreements with each current member of the Board and each of our officers. The form and execution of the indemnification agreements were approved and adopted by the Board on April 24, 2019. The indemnification agreements essentially provide that, to the fullest extent permitted or required by Ohio law and as the law may change to increase the scope of indemnification, we will indemnify the indemnitee against all expenses, costs, liabilities and losses (including attorneys’ fees, judgments, fines or settlements) incurred or suffered by the indemnitee in connection with any suit in which the indemnitee is a party or otherwise involved as a result of his or her service as a member of the Board or as an officer of the Company. Under these agreements, to the extent that the indemnification is unavailable, we shall contribute to the payment of any and all indemnifiable claims or losses in an amount that is fair and reasonable under the circumstances. In connection with the indemnification agreements with each current member of the Board, we have a trust agreement with KeyBank National Association pursuant to which the parties to the indemnification agreements may be reimbursed with respect to enforcing their respective rights under the indemnification agreements.

In 2004, we reached an agreement with the USW pursuant to which the USW may designate a member to the Board provided that the individual is acceptable to the Chairman, is recommended by the Board Affairs Committee (now known as the Governance Committee), and is then approved by the full Board to be considered a director nominee. In 2007, Susan Green was first proposed by the USW, elected to the Board by Cliffs’ shareholders in July 2007, and re-elected in each of the years 2008 through 2013. As a result of the proxy contest in 2014, Ms. Green was not re-elected but was asked by the reconstituted Board to re-join the Board and was subsequently appointed on October 15, 2014 and re-elected each year since 2015. In October 2019, Ms. Green submitted a letter to our Board Chair and our Governance Committee Chair tendering her resignation from the Board for having reached the 12-year term limit contained in our Corporate Governance Guidelines. At its October 2019 meeting and upon recommendation by the Governance Committee, the Board considered the status of Ms. Green's situation as the USW's designee to the Board. The Board determined to exercise its permitted discretion under our Corporate Governance Guidelines and unanimously voted to reject Ms. Green's resignation, with Ms. Green abstaining from the vote.

Our Amended and Restated 2014 Nonemployee Directors' Compensation Plan (the "Directors' Plan"), which is further described below, allows for a combination of cash and equity compensation for our nonemployee directors.

Cash Compensation

For 2020, each nonemployee director received the following cash payments, paid in equal quarterly amounts, for his or her Board retainer and committee assignments.

| | | | | |

| BOARD FORM OF CASH COMPENSATION | 2020 ($) |

| Annual Retainer | 120,000 |

| Lead Director Annual Retainer | 48,000 |

| Audit Committee Chair Annual Retainer | 24,000 |

| Compensation Committee Chair Annual Retainer | 15,000 |

| Governance Committee Chair Annual Retainer | 12,000 |

In addition, customary expenses for attending Board and committee meetings are reimbursed. Employee directors receive no additional cash compensation for their service as directors. We do not fund any type of retirement or pension plan for nonemployee directors.

Retainer Share Election Program

Starting in 2015, the Governance Committee recommended and the Board adopted a Nonemployee Director Retainer Share Election Program pursuant to which nonemployee directors may elect to receive in Cliffs common shares all or certain portions of their annual retainer and any other fees earned in cash. Election is voluntary and irrevocable for the applicable election period, and shares issued under this program must be held for six months from the issuance date. The number of shares received each quarter is calculated by dividing the value of the applicable quarterly cash retainer amount by the closing market price of our common shares on the date of payment.

Equity Grants

During 2020, our nonemployee directors received restricted share awards under the Directors’ Plan. For 2020, nonemployee directors were granted a number of restricted shares, with a value equal to $100,000, based on the closing price of the Company’s common shares on the NYSE on April 22, 2020, the date of our annual meeting of shareholders in 2020. The restricted share awards issued under the Directors' Plan generally vest twelve months from the grant date. These grants were subject to any deferral election and made pursuant to the terms of the Directors’ Plan and an award agreement, effective on April 22, 2020.

Directors receive dividends, if any, on their restricted share awards and may elect to reinvest all cash dividends in additional common shares. Those additional common shares are subject to the same restrictions as the underlying award. Cash dividends not subject to a deferral election are paid to the director without restriction.

Share Ownership Guidelines

We have established Share Ownership Guidelines for our nonemployee directors and assess each director’s compliance with the guidelines on a quarterly basis. The Share Ownership Guidelines provide that each director hold or acquire common shares of the Company having a market value equal to at least 3.5x the current annual retainer within five years of becoming a director. As of December 31, 2020, all directors were in compliance with the guidelines.

Deferrals

Our Directors’ Plan gives nonemployee directors the opportunity to defer all or a portion of their awards that are denominated or payable solely in shares. Deferred share accounts earn dividend equivalents at the end of each quarter based on any cash dividends we pay during the quarter, which dividend equivalents are credited to the accounts in the form of additional deferred shares. The amounts in the director’s deferral account will be paid to the director in the form elected after such director’s termination of service, death or a change in control of Cliffs.

DIRECTOR COMPENSATION FOR 2020

The following table, supported by the accompanying footnotes and the narrative above, sets forth for fiscal year 2020 all compensation earned by the individuals who served as our nonemployee directors at any time during 2020.

| | | | | | | | | | | | | | |

| NAME | FEES EARNED OR PAID IN CASH ($)(1) | STOCK AWARDS ($)(2) | ALL OTHER COMPENSATION ($) | TOTAL ($) |

| J.T. Baldwin | 144,000 | 99,999 | — | 243,999 |

| R.P. Fisher, Jr. | 120,000 | 99,999 | — | 219,999 |

| W.K. Gerber (3) | 96,264 | 111,745 | — | 208,009 |

| S.M. Green | 120,000 | 99,999 | — | 219,999 |

| M.A. Harlan | 120,000 | 99,999 | — | 219,999 |

| R.S. Michael, III (4) | 105,890 | 111,745 | — | 217,635 |

| J.L. Miller | 120,000 | 99,999 | — | 219,999 |

| J.A. Rutkowski, Jr. (5) | 33,000 | — | — | 33,000 |

| E.M. Rychel | 120,000 | 99,999 | — | 219,999 |

| M.D. Siegal (6) | 30,000 | — | — | 30,000 |

| G. Stoliar | 120,000 | 99,999 | — | 219,999 |

| D.C. Taylor | 183,000 | 99,999 | — | 282,999 |

| A.M. Yocum (7) | 96,264 | 111,745 | — | 208,009 |

(1)The amounts listed in this column reflect the aggregate cash dollar value of all earnings in 2020 for annual retainer fees and chair retainers.

(2)The amounts reported in this column reflect the aggregate grant date fair value computed in accordance with Financial Accounting Standards Board ("FASB") Accounting Standards Codification ("ASC") Topic 718 for the nonemployee directors’ restricted share awards granted during 2020, which awards are further described above, and whether or not deferred by the director. The grant date fair value of the nonemployee directors’ prorated 2019 restricted share award of 2,412 shares to each of Messrs. Gerber and Michael and Ms. Yocum on March 13, 2020 was $4.87 per share ($11,748.63). The grant date fair value of the nonemployee directors’ restricted share award of 27,397 shares on April 22, 2020 was $3.65 per share (approximately $100,000). Messrs. Baldwin and Rychel elected to defer all of their 2020 restricted share award under the Directors' Plan. As of December 31, 2020, the aggregate number of restricted shares subject to forfeiture held by each nonemployee director was as follows: Mr. Fisher - 27,397; Mr. Gerber -29,809; Ms. Green - 27,397; Ms. Harlan - 27,397; Mr. Michael - 29,809; Ms. Miller - 27,397; Mr. Stoliar - 27,397; Mr. Taylor - 27,397; and Ms. Yocum - 29,809. As of December 31, 2020, the aggregate number of deferred share units allocated to the deferred share accounts of Messrs. Baldwin and Rychel under the Directors' Plan were 38,406.954 and 67,551.971, respectively.

(3)Mr. Gerber was elected as a director on March 13, 2020 and received a prorated 2019 restricted share award in addition to his 2020 restricted share award received on April 22, 2020.

(4)Mr. Michael was elected as a director on March 13, 2020 and received a prorated 2019 restricted share award in addition to his 2020 restricted share award received on April 22, 2020.

(5)Mr. Rutkowski resigned as a director on March 13, 2020.

(6)Mr. Siegal resigned as a director on March 13, 2020.

(7)Ms. Yocum was elected as a director on March 13, 2020 and received a prorated 2019 restricted share award in addition to her 2020 restricted share award received on April 22, 2020.

| | | | | | | | |

| PROPOSAL 1 | ELECTION OF DIRECTORS |

| | |

| | |

The Board has nominated the following individuals to serve until the next Annual Meeting of Shareholders or until their successors shall be elected: John T. Baldwin; Robert P. Fisher, Jr.; William K. Gerber; Lourenco Goncalves; Susan M. Green; M. Ann Harlan; Ralph S. Michael, III; Janet L. Miller; Eric M. Rychel; Gabriel Stoliar; Douglas C. Taylor; and Arlene M. Yocum. All of the director nominees named herein are independent under the NYSE director independence standards, except for Mr. Goncalves. All of the nominees were elected by the shareholders at the Annual Meeting of Shareholders held on April 22, 2020.

Each of the director nominees has consented to his or her name being submitted by Cliffs as a nominee for election as a member of the Board. Each such nominee has further consented to serve as a member of the Board if elected. Should any nominee decline or be unable to accept such nomination to serve as a director, an event that we currently do not anticipate, the persons named as proxies reserve the right, in their discretion, to vote for a lesser number of nominees or for substitute nominees designated by the directors, to the extent consistent with our Regulations.

The nominees for election to the Board have diversified professional experience in general management, steel manufacturing and processing, mining, metallurgical engineering, operations, finance, investment banking, labor, law and other fields. There is no family relationship among any of our nominees and executive officers. The average age of the nominees currently serving on the Board is 63, ranging from ages 47 to 67. The average years of service of the nominees currently serving on the Board is 4.8 years, ranging from one year to over 13 years of service.

In the election of directors, the nominees receiving a plurality vote of the shares will be elected. However, under our majority voting policy (adopted by the Board), in an uncontested election, any director nominee that is elected by a plurality vote but fails to receive a majority of votes cast (which excludes abstentions and broker non-votes) is expected to tender his or her resignation, which resignation will be considered by the Governance Committee and the Board.

Under Ohio law, shareholders have the right to exercise cumulative voting in the election of directors as described under “Cumulative Voting for Election of Directors” on page 8. If cumulative voting rights are in effect for the election of directors, which we currently do not anticipate to be the case, you may allocate among the director nominees, as you see fit, the total number of votes equal to the number of director positions to be filled multiplied by the number of shares you hold.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Nominee Highlights (including our CEO) |

| | | | | | | | |

| | | | | | | | |

Average tenure of 4.8 years | | Four Women (33%) | | 92% Independent |

| |

| | | | | | | |

Average age of Directors is 63 | | Highly qualified Directors

with a diversity of skills and experiences that aligns with our long-term strategy | |

| |

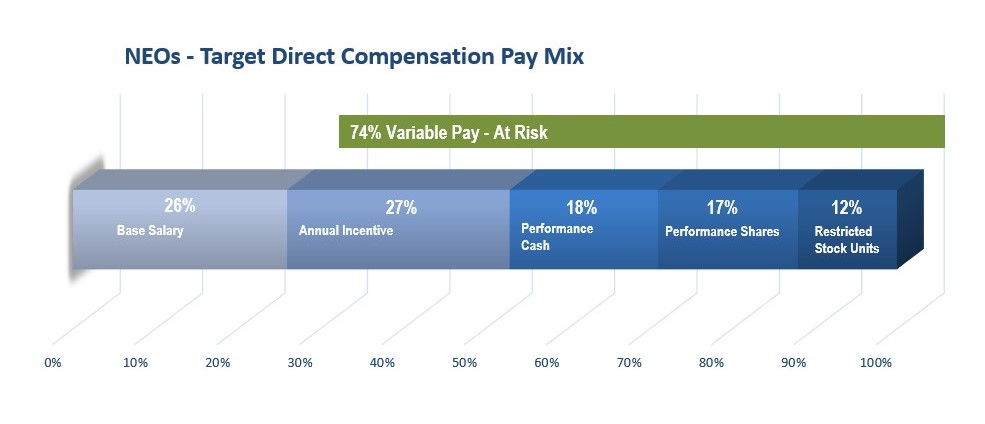

| | | | | | | |